FOMC Raises Rates at May Meeting

FOMC members met on May 2nd and 3rd to discuss the future of monetary policy. At the meeting, committee members renewed their commitment to taming inflation through higher interest rates.

Another Interest Rate Hike

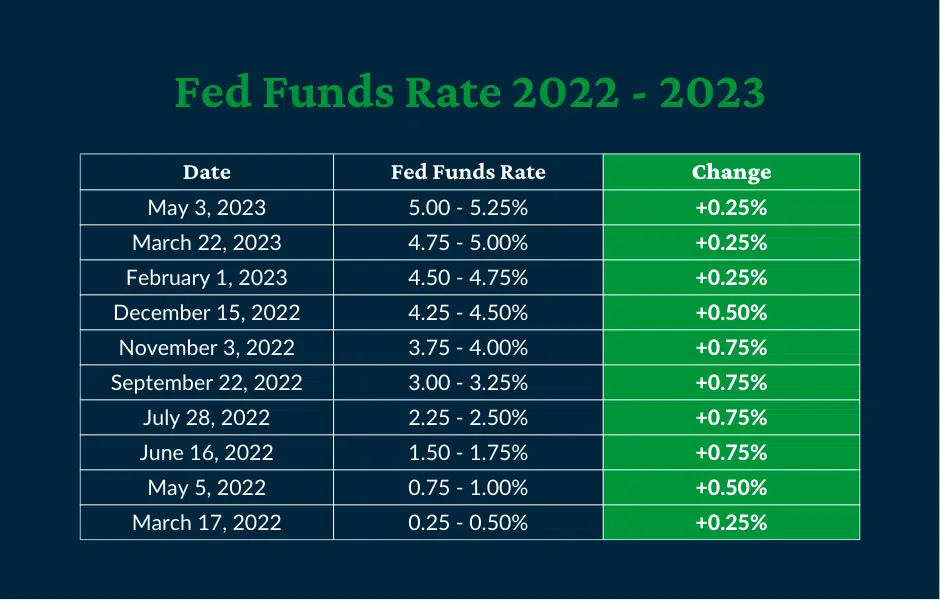

The FOMC raised the Fed funds rate by 0.25%, bringing the target range to 5.00% – 5.25%. This is the 10th consecutive meeting with a rate hike. Overall, the Fed has raised rates by a total of 5.00% since March 2022.

In addition to higher rates, the Fed will continue to reduce the size of its balance sheet. The current quantitative tightening program was announced in May 2022 and began the following month. Since that time, the Fed has steadily reduced Treasury, agency, and mortgage-backed securities holdings.

The Current State of the Economy

In the statement accompanying the monetary policy decision, FOMC members noted several economic factors that influenced their decision. These included modest economic growth, job gains, elevated inflation, and tighter credit conditions resulting from turmoil in the banking sector.

GDP Slowed in The First Quarter

The latest data from the Bureau of Economic Analysis showed that first quarter real Gross Domestic Product [GDP] rose by 1.1%. This reading represented a significant deceleration from the prior quarter’s growth of 2.6%.

Unemployment Rate Remains Low

According to the most recent data from the Bureau of Labor Statistics, the U.S. added 236,000 jobs in March and the unemployment rate was 3.5%. In the press conference following the interest rate announcement, Fed Chair Jerome Powell noted that the unemployment rate remained very low but that the labor force participation rate has increased recently. He also stated that nominal wage growth has slowed. Despite these signs of a weakening labor market, Powell said, “overall, labor demand still substantially exceeds the supply of available workers.”

Inflation Remains Elevated

The March Consumer Price Index [CPI] rose at an annual rate of 5.0% and PCE inflation – the Fed’s preferred gauge – rose by 4.2%. While these readings are well below the peak inflation rate seen last summer, they remain elevated by historical standards.

Banking Turmoil Continues to Tighten Credit Markets

The recent failures of Silicon Valley Bank, Signature Bank, and First Republic Bank have further tightened credit conditions. At the previous FOMC meeting, Chair Powell described these bank failures as producing similar results to a rate hike.

The effects of tighter credit – influenced by interest rate policy and recent bank failures – are expected to be felt in the coming months. In the statement accompanying the interest rate decision, the FOMC said, “Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation.”

The Future of Interest Rates

The FOMC did not directly indicate that this rate hike will be the last in the current tightening cycle. However, the language used in the latest statement was softer than previous meetings. The May statement did not include the sentence “the Committee anticipates that some additional policy firming may be appropriate,” which appeared in March’s statement.

The Fed’s softer language is in-line with market expectations of a rate pause in June. Regarding a pause, Chair Powell did not comment directly, but reiterated that the committee will continue to monitor economic events and make data-driven decisions.

Don’t miss our interest rate and Federal Reserve updates.

At the American Deposit Management Co. [ADM], we help businesses react quickly to changing market conditions through our weekly articles. These publications provide valuable insights to help companies adapt to changes in monetary policy, banking, and business.

To stay up to date on interest rate policy and economic developments, sign up for our mailing list. Also, don’t forget to follow us on Twitter, Facebook, and LinkedIn.

*American Deposit Management is not an FDIC/NCUA-insured institution. FDIC/NCUA deposit coverage only protects against the failure of an FDIC/NCUA-insured depository institution.

FOMC Maintains Interest Rates Amid Increasing Economic Uncertainty

The FOMC cited increasing economic uncertainty as a factor in their vote to hold the Fed Funds Rate steady at the May meeting.

Common Business Cash Investments That Are Excluded from FDIC Insurance

These cash investments are common choices for cash managers but use caution because they are excluded from FDIC insurance.

A Guide to Cash Management for Public Organizations

This guide covers the crucial factors public organizations need to consider when creating an effective cash management plan.