A Modern Solution for Extended Deposit Insurance

AMMA™ Exchange allows you to attract high-value depositors with additional deposit insurance while maintaining current liquidity ratios – all with one point of contact.

Why AMMA™ Exchange?

ADM recognizes the need for financial institutions to offer extended deposit insurance to their members and clients. Fund security is essential to maintaining trust and retaining high-value deposits, and without access to full FDIC/NCUA insurance, financial institutions risk losing deposits to competitors.

AMMA™ Exchange empowers institutions to bridge this gap by providing seamless access to extended deposit insurance, ensuring that both individuals and businesses can confidently safeguard their funds.

Beyond security, AMMA™ Exchange fosters stronger member relationships and opens new avenues for revenue growth, positioning your institution as a trusted financial partner.

LIVE WEBINAR

Deep dive into our AMMA™ Exchange webinar to learn how the flow of funds works and benefits of this solution for your Financial Institution.

IMPLEMENTATION IN 3 EASY STEPS

Experience dedicated support with a single point of contact at ADM, ensuring seamless funds exchange.

Execute Agreements

Solidify partnership with ADM, your financial institution, and your depositor.

Set up Accounts

Open an ADM account at your financial institution. ADM opens an account for your depositor.

Fund Account

Funds exchange takes place through your one partnership with ADM. Your liquidity does not change.

Benefits for Financial Institutions

By leveraging our extensive deposit network, financial institutions can attract and retain high-value depositors while maintaining their current liquidity ratios. This proactive solution allows financial institutions to compete effectively against banks offering extended government insurance for larger deposits.

ATTRACT & RETAIN HIGH-VALUE INDIVIDUAL AND BUSINESS DEPOSITS

EXPAND & STRENGTHEN MEMBER/CLIENT RELATIONSHIPS

MAINTAIN CURRENT LIQUIDITY RATIOS & BALANCE SHEET STABILITY

FAQS

You’ll probably have questions. We’ve answered a few of them below, but you’re always welcome to pick up the phone and have a chat with us.

How will client funds be insured?

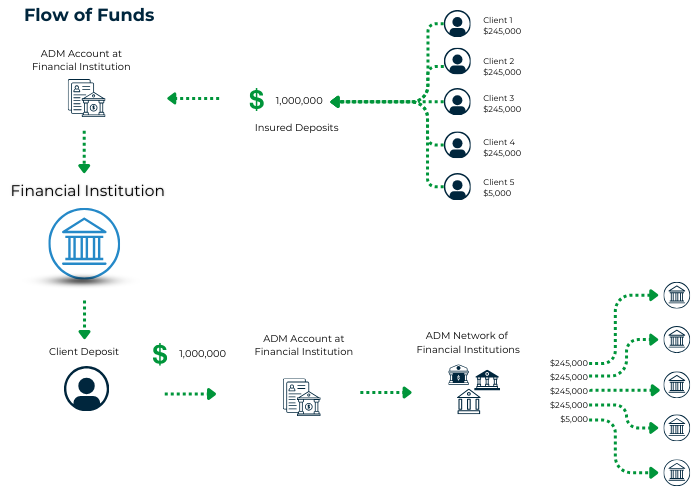

ADM will establish an account within our system for each depositor and strategically distribute their funds across our network of partner financial institutions. This ensures that all balances within the program have access to full FDIC/NCUA insurance.

Will our liquidity ratios change by sending depositor funds to ADM?

No, ADM will open a deposit account with your institution, allowing us to return fully insured deposits on a 1:1 basis, aligned with the funds deposited with ADM.

How are client interest rates set?

Interest rates will be established through a mutual agreement at each client account opening.

Will ADM work directly with my depositors?

ADM will work directly with the financial institution, collecting only the necessary account information to establish an account in our system. However, we will have no direct communication with your depositors.

What is the cost of the program?

ADM can either invoice our fee or apply a spread to our account to cover the fee.

Will depositors be able to view account information?

ADM offers flexible information-sharing options. We can provide depositors with view-only access to our portal, share files with your institution for data import, or integrate systems via API, enabling seamless information display on the end user’s account.

How will fund transfers be executed?

All deposit and withdrawal requests for the AMMA Exchange program will be coordinated between the depositor and the financial institution. This can easily be done through one of the integration methods mentioned above.

How quickly will depositors have access to their funds?

Accounts will have next-day liquidity as long as funds are requested by 1:00 PM ET the day before.

Interested in learning more about AMMA™ Exchange? Contact our team today for additional information and to implement into your Financial Institution. Get in touch here.