Economic Challenges for Business Could Persist into 2023

Businesses were forced to adapt to dramatic economic shifts in 2022 – interest rates rose, prices skyrocketed, and geopolitical tensions threatened already constrained supply chains. This year, many of those pressures are expected to persist, so business leaders should continue to adjust their course to match the evolving economic conditions.

Inflation and Interest Rates Continue to Present Challenges in 2023

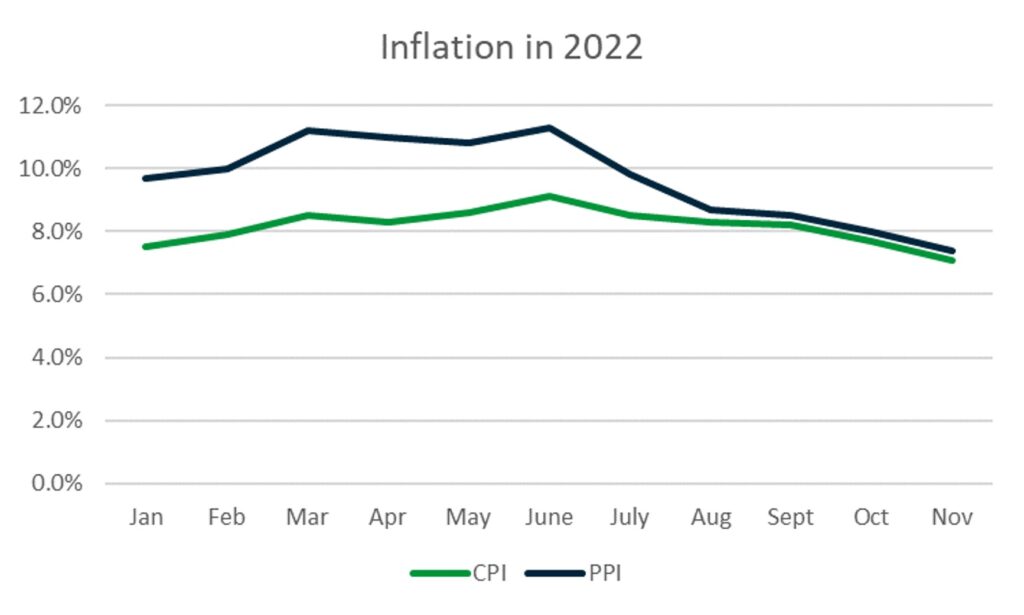

One of the biggest headlines in 2022 was inflation. In June, both the Consumer Price Index and Producer Price Index peaked at multi-decade highs – 9.1% and 11.3%, respectively. Toward the end of the year, inflation slowed moderately but remains far above the Fed’s target of 2%.

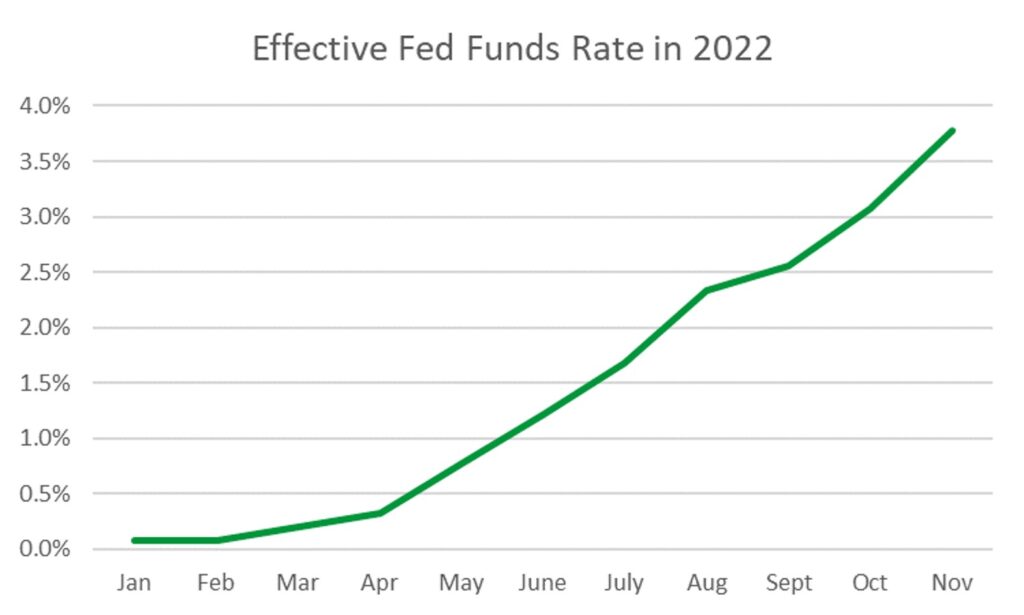

As inflation battered business and consumer budgets, the Fed acted aggressively to tame it. At the beginning of 2022, the Fed funds rate was effectively zero. By the end of the year, the target range reached 4.25% – 4.50%.

With inflation persisting despite the Fed’s efforts, further interest rate hikes are likely. In fact, the FOMC predicts the Fed funds rate will reach 5.1% by the end of the year. However, forecasts indicate that interest rate hikes will be effective in curtailing price increases and PCE inflation will fall to 3.1% by the end of 2023.

War in Ukraine Could Continue to Disrupt the Global Economy in 2023

Last February, Russia invaded Ukraine, a move that the U.S. and allies condemned. In response, the U.S. government implemented a lengthy list of sanctions and over 1,000 U.S. companies limited or completely stopped operations in Russia.

More than 30 countries joined the U.S. in employing sanctions. These restrictions have hindered Russia’s ability to participate in global trade and estimates show that the Russian economy contracted by 3% in 2022.

While sanctions have been effective in disrupting the Russian economy, they’ve also had adverse impacts on the United States. Russia has been responsible for less than 3% of U.S. exports and imports since World War II, so the impact of sanctions has been tempered domestically. However, businesses that traded with, operated in, or sourced materials from Russia were affected more significantly. These disruptions further exacerbated inflation and supply chain constraints already facing U.S. businesses.

The effects of sanctions were even more substantial in Europe, where Russia was a significant supplier of food and energy products. While food is exempt from U.S. and EU sanctions, fuel is not. Sanctions have caused energy prices to rise across the globe and the expansion of oil restrictions in December could further destabilize global energy markets in the coming year.

As Russian materials, energy, and customers have been removed from the global trade equation, prices have risen. With no clear resolution in sight, the war in Ukraine could continue to impact the global economy this year – particularly in energy markets.

Supply Chain Constraints Continue to Impact Businesses in 2023

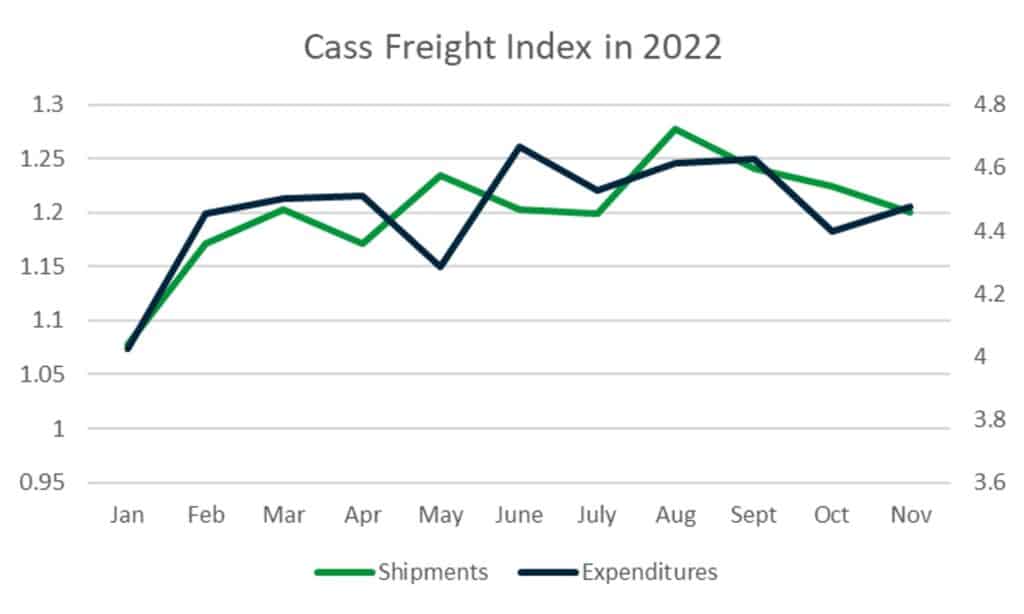

In early 2022, supply chains were still experiencing the impacts of the COVID-19 pandemic – particularly in the shipping of raw materials and finished goods. In addition to the war between Russia and Ukraine, COVID-19 shutdowns in China continued to hinder supply chains.

Freight costs escalated through the first half of 2022 as shipments increased from pandemic lows and infrastructure struggled to keep pace. In the latter half of the year, costs remained elevated, as did shipments, but both showed signs of moderation.

Political unrest and rising costs are expected to continue to weigh on supply chains this year. In fact, half of business leaders expect reduced availability of raw materials in 2023.

How Businesses Are Responding to These Challenges

Last year, firms adapted to inflation, interest rates, geopolitics, and supply chain challenges in a variety of ways. In the coming year, more adjustments could be necessary to adapt to the rapidly changing economic landscape.

Inflation and Interest Rates

As prices have continued to escalate, businesses have taken steps to preserve their profitability. Some of the most common ways companies have adapted to inflation are raising prices, increasing automation, and trimming other expenses. Higher rates have also presented challenges and businesses have responded by decreasing reliance on variable rate loans and reducing costs in other areas to offset the effects of higher loan payments.

This year, businesses are once again including higher borrowing and input costs in their forecasts and preparing to make adjustments to pricing and sourcing strategies. One commonly overlooked way that firms can respond to higher rates and costs is increasing cash on hand. While it may take some creative thinking to accomplish, sufficient reserves can improve resiliency by allowing firms to absorb higher costs without making drastic changes to their business model or pricing. In addition, firms could see higher returns on their cash as rates rise. This additional interest can help mitigate some of the impacts of inflation and even add to profits.

War In Ukraine

Some companies that limited or stopped their operations in Russia realized significant losses. However, for most firms, the worst of the losses were confined to the first few months of the war. After that, companies worked to replace the business they lost in Russia by seeking alternative customers and supply lines in other markets. With no immediate resolution in sight for the Russia-Ukraine conflict, companies will continue relying on materials and buyers outside of Russia for the foreseeable future.

Rising energy prices are another important consideration resulting from the Russia-Ukraine conflict. In Europe, energy price caps are working to keep prices below the market extremes for consumers and businesses. Across the Atlantic, energy volatility will likely continue to impact the U.S. economy and its businesses throughout 2023. Firms can respond to these challenges by including higher energy costs in their forecasts. As with general inflation, additional cash reserves can help businesses mitigate these challenges.

Supply Chain Constraints

While supply chain issues have moderated since the early days of the COVID-19 pandemic, they continue to persist in many industries. To accommodate these challenges, further adjustments could be necessary this year.

In response to supply chain disruptions, organizations are implementing various changes. According to a study by SAP SE, an international software company focused on business process management, businesses plan to:

- Adopt new technology (74%).

- Implement additional contingency measures (67%).

- Prioritize U.S.-based supply chain solutions (60%).

- Move from just-in-time to just-in-case manufacturing (64%).

Not only can these strategies help businesses adapt to current supply chain challenges, but they can also increase supply-chain resiliency in the long run.

Business escrow is another way companies can reduce risk and improve supplier relationships in the current environment of supply chain uncertainty. An escrow agent acts as a neutral third party in complex, lengthy, or risky transactions and ensures that both parties meet their contractual obligations. This service complements risk management programs and can be instrumental when working with new vendors.

The year ahead could be challenging for the business community with inflation persisting, interest rates rising, geopolitical tensions continuing, and supply chain constraints lingering. However, resiliency is a hallmark of American business. Firms have overcome many hurdles since the pandemic began and continue to meet the challenges facing them through innovation and creativity. With such widespread economic uncertainty at play, the winners in 2023 likely won’t be determined based on which firms face the fewest obstacles, but which companies find the right solutions.

Follow ADM for More Valuable Insights

At the American Deposit Management Co. [ADM], we keep our finger on the pulse of new developments in the business and banking industries, so sign up for our mailing list to receive our weekly insights. Also, follow us on Twitter, Facebook, and LinkedIn to keep up with our latest updates.

Q4 Banking Trends: Strong Net Income, Rising Deposits, Lower Unrealized Losses

American banks reported strong net income and lower unrealized losses alongside higher loan balances and deposit levels in Q4 2025.

How Did the Gramm-Leach-Bliley Act Facilitate Bank Consolidation?

The Gramm-Leach-Bliley Act passed in 1999 and ushered in a new era of consolidated, one-stop shop banking that perseveres today.

An Overview of Regulations Governing the Management of Public Funds

Public entities like school districts and municipalities are held to specific regulations that govern the ways funds are invested.