FOMC Meeting and Projections Summary for December 2023

The FOMC met on December 12th and 13th to determine the future of monetary policy and update their economic forecasts. Their decision to keep rates steady aligned with analyst expectations, and this allowed the projections for 2024 to take center stage.

FOMC Held Interest Rates Steady in December

FOMC members voted to hold the Fed Funds Rate steady at a target range of 5.25 – 5.50%. This decision did not come as a surprise, as more than 97% of analysts predicted it prior to the meeting.

For the first time in the current tightening cycle, Fed Chair Jerome Powell said that the current Fed Funds Rate is “likely at or near its peak.” However, he went on to say that the FOMC is “prepared to tighten policy further” if higher interest rates are needed to combat inflation.

Strong Economic Data Influenced the Interest Rate Decision

The possibility of peaking interest rates came after several reports showed continued progress toward the Fed’s goals. One of the key economic data points Chair Powell noted was Gross Domestic Product [GDP], which he said is on track to grow by about 2.5% for the year. This level of growth is a significant feat during a tightening cycle.

Chairman Powell also mentioned continued resilience in the labor market. The most recent data shows the unemployment rate at just 3.7%, despite notable growth in the labor force participation rate.

According to Chair Powell, the most recent inflation data was both positive and negative. The Fed estimates that PCE inflation rose by 2.6% for the year ending in November, showing additional progress toward the Fed’s 2% goal. However, there is still progress that needs to be made to return inflation to the target level.

While there were several positive economic outcomes since the last FOMC meeting, Chair Powell also said the U.S. has seen some less desirable side effects of tighter monetary policy. These included stagnation in the housing market and slower business fixed investment.

Projections for The Future of Monetary Policy and the Economy

In addition to the interest rate decision, the most recent economic data influenced FOMC projections for the future of interest rates and the economy. The committee releases these forecasts four times per year with the last being released in September. This month’s updated projections provide valuable insights about this year and the year to come.

Final Estimates in 2023

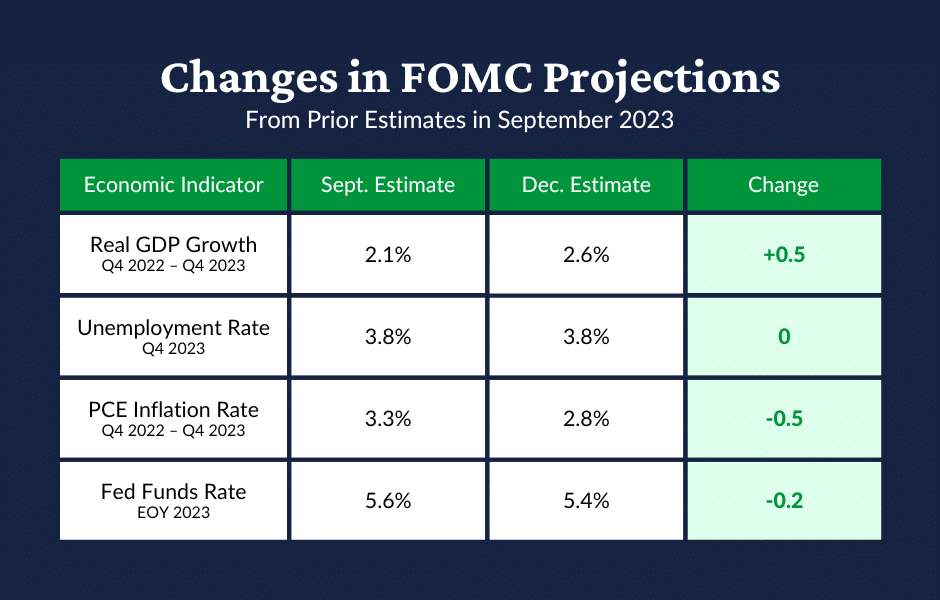

The FOMC now predicts stronger economic growth and lower inflation in 2023 compared to their previous projections. Additionally, members adjusted their forecasts for the end-of-year Fed Funds Rate to reflect the most recent decision to maintain the current target range of 5.25 – 5.50%.

See the chart below for an overview of the changes to their projections.

Economic Projections for 2024 and Beyond

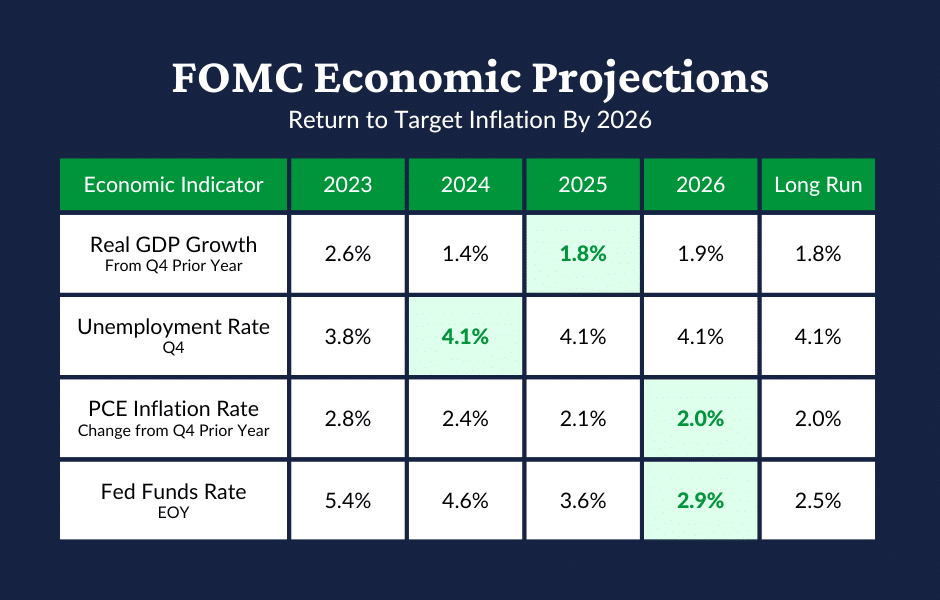

FOMC members made small adjustments to their projections for GDP, unemployment, and inflation over the next several years, but the projected path of the economy remained virtually the same.

Major economic signals are projected to return to the long-run averages by 2026 – though several factors are expected to reach equilibrium even earlier. The unemployment rate is projected to be the first economic indicator to return to the Fed’s target. It is forecasted to rise to 4.1% next year and remain at that level for the foreseeable future.

Economic growth is also expected to normalize in the coming years. GDP is forecasted to decline significantly next year – to just 1.4% – before rising to the long-run estimate of 1.8% in 2025.

The inflation rate is projected to take slightly longer than other indicators to normalize. Further, the PCE inflation rate is expected to gradually decline over the next three years and reach the Fed’s target of 2.0% in 2026.

Lower Interest Rates Projected for 2024

While FOMC projections for the economy in 2024 saw only mild changes, their forecasts for the Fed Funds Rate changed dramatically. The September estimate showed an end-of-year Fed Funds Rate of 5.1% in 2024 – signaling one interest rate reduction from the current level. This week, members reduced their estimate to 4.6% – suggesting three interest rate reductions next year.

As soon as the Fed released the latest forecasts, analysts began updating their own projections. By the close of business, 11.4% of analysts were betting on a rate reduction at the next FOMC meeting in January. Nearly three-quarters of these analysts predict falling interest rates by the following meeting in March.

Economists have often scoffed at the idea of a “soft landing” but the latest projections from the FOMC are challenging this view. If the next few years unfold as the Fed predicts, the U.S. economy could escape the worst inflationary period since the 1980s without a significant recession.

Follow ADM For More Valuable Insights

At ADM, we monitor pressing economic and business changes and keep you informed. Join our mailing list to have a summary of every FOMC meeting delivered straight to your inbox. Additionally, our weekly articles highlight important changes and key tips for success in the business and banking industries.

Be sure to check out our Insights page to catch up on valuable knowledge, and follow us on LinkedIn, Twitter, and Facebook.

The One Account Advantage for Business Cash Management

Fragmented cash management creates unnecessary complexity, but a consolidated platform can fundamentally reshape your results.

Q4 Banking Trends: Strong Net Income, Rising Deposits, Lower Unrealized Losses

American banks reported strong net income and lower unrealized losses alongside higher loan balances and deposit levels in Q4 2025.

How Did the Gramm-Leach-Bliley Act Facilitate Bank Consolidation?

The Gramm-Leach-Bliley Act passed in 1999 and ushered in a new era of consolidated, one-stop shop banking that perseveres today.