FOMC Holds Interest Rates Steady at September Meeting

The FOMC met on September 19th and 20th to discuss the state of the economy and determine the future of monetary policy. At the meeting, committee members reiterated the need to return inflation to 2% while promoting maximum employment, and they voted to keep the Fed funds rate steady for now. They also released updated projections for the future of the economy and interest rates.

Factors That Influenced the Interest Rate Decision

FOMC members voted to keep the Fed funds rate at a target range of 5.25 – 5.50%. In the statement announcing this decision, the committee noted three factors that contributed to their decision – economic growth, a strong labor market, and elevated inflation.

Economic Growth

Economic expansion is typically measured by the change in Gross Domestic Product [GDP]. The most recent estimate from the Bureau of Economic Analysis shows that Real GDP rose by an annualized rate of 2.0% in the first quarter and 2.1% in the second quarter. These figures were roughly in line with the historical average, suggesting that the economy is expanding at a moderate pace.

Strong Labor Market

The FOMC noted that hiring has recently slowed, but the unemployment rate remains low. The latest information from the Bureau of Labor Statistics showed the unemployment rate at 3.8% in August – only 0.1 percentage points higher than one year ago. Additionally, the U.S. added 187,000 jobs for the month. While this figure is impressive, it is far below the 12-month average of 271,000 new jobs per month.

Elevated Inflation

Inflation remains a top priority for the Fed. While the inflation rate has moderated from the highs seen last summer, prices continue to rise more quickly than the Fed’s target of 2%. The Bureau of Economic Analysis reported that PCE inflation – the Fed’s preferred gauge – rose by 3.3% from July 2022 to July 2023.

The FOMC also noted that tighter credit conditions are likely to continue weighing on these three factors in the coming months. Tighter credit is the expected result of past rate increases coupled with turmoil in the banking sector. As these effects unfold, the Fed will continue to monitor the economy, labor market, and inflation to inform future interest rate decisions.

Fed Releases Updated Economic Outlook

In addition to their interest rate decision, FOMC members delivered updated economic projections. These estimates are released four times per year, with the most recent projections published in June.

Significant Updates to 2023 Projections

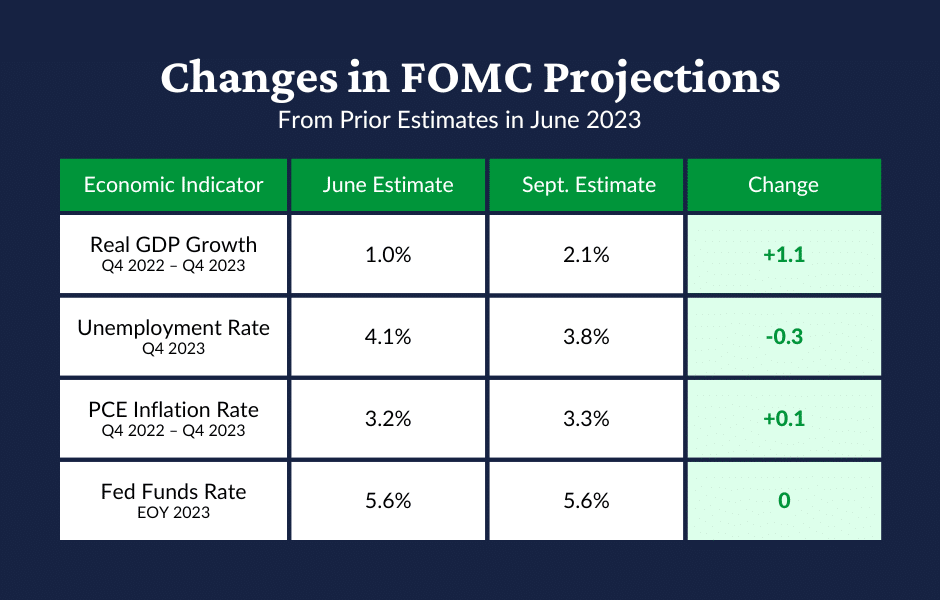

The latest economic projections released by the FOMC show a more positive outlook for the remainder of 2023. The forecast for Real GDP growth rose to 2.1% – more than double the June projection of 1.0%. Additionally, projected unemployment was lowered to 3.8% from the prior estimate of 4.1%.

While the economic outlook was improved in the latest forecast, expectations for inflation and interest rates were mostly flat. The FOMC raised their inflation projection to 3.3% from the prior forecast of 3.2%, while their end-of-year Fed funds rate estimate was unchanged at 5.6%. Given the current Fed funds rate, this projection equates to one additional interest rate hike at some point this year. The chart below summarizes the changes to the FOMC’s economic projections for 2023.

Return to Targets Over the Next 3 Years

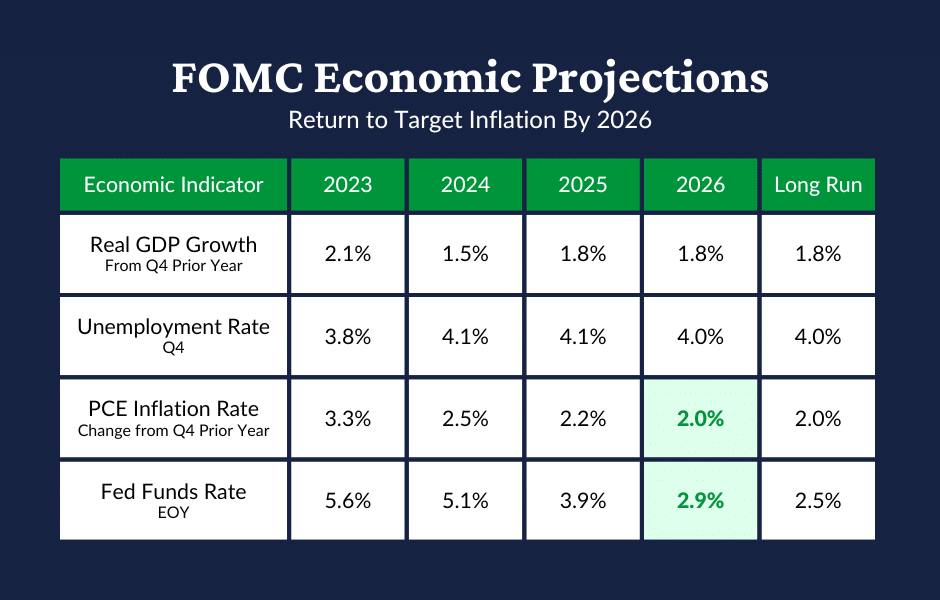

According to the latest projections, economic conditions are expected to slightly deteriorate in 2024 before returning to long-term targets set by the FOMC. Inflation, unemployment, and Real GDP growth are projected to normalize by 2026. The FOMC also expects the Fed funds rate to fall below 3% in 2026 before returning to the Fed’s target in the long run.

The chart below summarizes the Fed’s economic and monetary policy outlook.

How Economic Projections Are Expected to Impact Interest Rates

If the economy follows the latest projections, the Fed expects one additional rate increase in 2023 and elevated interest rates for the next several years. However, markets are more optimistic about the short-term path of interest rates. A majority of futures traders predict that the FOMC will hold the Fed funds rate steady at both the November and December meetings.

As Fed Chair Jerome Powell noted in his press conference, the current level of interest rates has been restrictive – putting downward pressure on the economy, labor market, and inflation. Chair Powell also noted that “the full effects of [the FOMC’s] tightening have yet to be felt.” He went on to say that the Fed would continue to monitor the cumulative effects of past interest rate increases as well as incoming economic data before determining next steps.

Don’t miss our Federal Reserve updates.

At the American Deposit Management Co. [ADM], we help companies keep a finger on the pulse of developments in interest rates, business, and banking. For more valuable information, check out our insights page.

Never miss our weekly article by subscribing to our mailing list. Also, don’t forget to follow us on LinkedIn, Twitter, and Facebook.

*American Deposit Management is not an FDIC/NCUA-insured institution. FDIC/NCUA deposit coverage only protects against the failure of an FDIC/NCUA-insured depository institution.

FOMC Lowers Interest Rates at Final 2024 Meeting

At the last FOMC meeting of 2024, committee members voted to reduce the Fed Funds Rate and released updated economic projections.

History of Economic Turmoil in the U.S. Part 2 of 3 – Mid-20th Century

Part two of this three-part series explores the catalysts and resolutions of the worst recessions in the mid-20th century.

A Brief History of U.S. Bank Failures

Devastating bank failures occur frequently in U.S. history, but government action has significantly reduced the risk of losses.