December 2022 FOMC Meeting Summary

At this week’s meeting, the FOMC once again raised interest rates and updated their projections for the future of the economy. This continues the committee’s aggressive work toward combatting inflation by raising rates and unwinding the quantitative easing program implemented during the COVID-19 pandemic.

The FOMC Raised Rates at December’s Meeting

The FOMC raised the Fed funds rate by 50 basis points to a target range of 4.25% – 4.50% at this week’s meeting. In the statement announcing the increase, committee members noted that while inflation continues to be a significant concern, other aspects of the economy remain relatively unaffected by tighter policy.

Inflation Has Slowed Moderately

Recent data suggests that inflation has moderated slightly from the multi-decade highs seen earlier in the year. The Consumer Price Index rose at an annual rate of 7.1% in November while the Producer Price Index rose 7.4%. Both peaked in June at 9.1% and 11.3%, respectively. Despite this slower pace, inflation remains significantly higher than the Fed’s target of 2%, which was noted as contributing factor to the committee’s decision to raise rates.

The Labor Market Remains Tight, GDP Expanding

Often, the Fed must sacrifice employment and economic output to achieve stable prices. So far, both the labor market and GDP have remained strong despite the rate hikes this year. Since March, the unemployment rate has remained in a narrow band between 3.5% and 3.7% – near historic lows and the pre-pandemic level. Additionally, The latest estimate shows that real GDP grew at an annualized rate of 2.9% in the third quarter.

With more work to be done to control inflation, and other aspects of the economy showing signs of strength, the FOMC anticipates further rate hikes in the future. The pace of these rate increases will depend on the state of the economy, the cumulative impact of past rate increases, and the lag between monetary policy and noticeable outcomes.

Updated Economic Projections

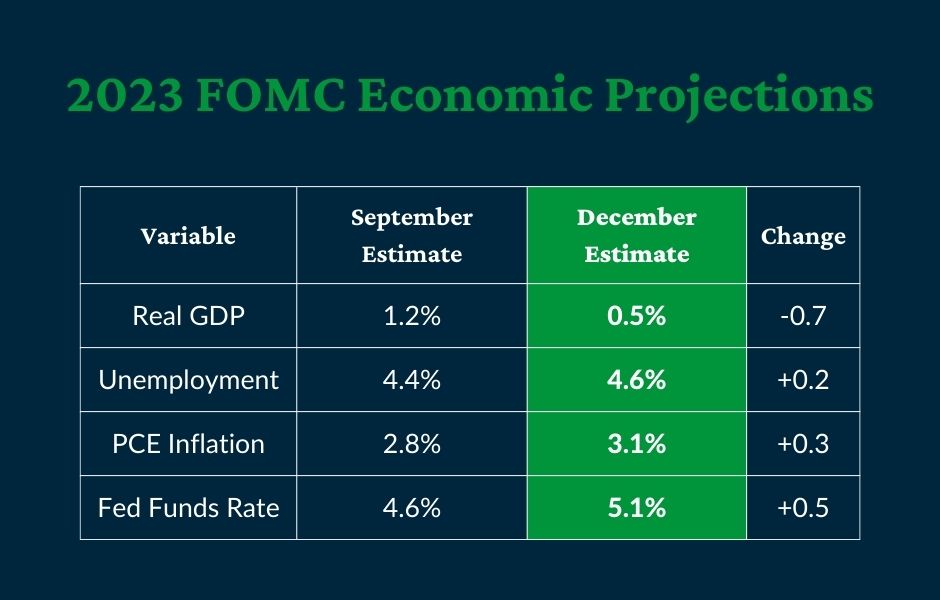

FOMC members updated their economic projections for the fourth time this year. The latest estimates reflect the FOMC’s firm stance on inflation and their plan for controlling it. Unfortunately, curtailing inflation is expected to have some negative impacts on other aspects of the economy.

2023 Economic Projections

The latest economic projections paint a more subdued picture for the economy in 2023. From September’s estimate, GDP growth was revised down to 0.5% and the anticipated inflation rate was increased to 5.6%. With the higher inflation projection, the anticipated Fed funds rate was raised to 5.1%. Unemployment is expected to grow from its current level to 4.6% by the end of 2023, an increase of 0.2 percentage points from the previous estimate.

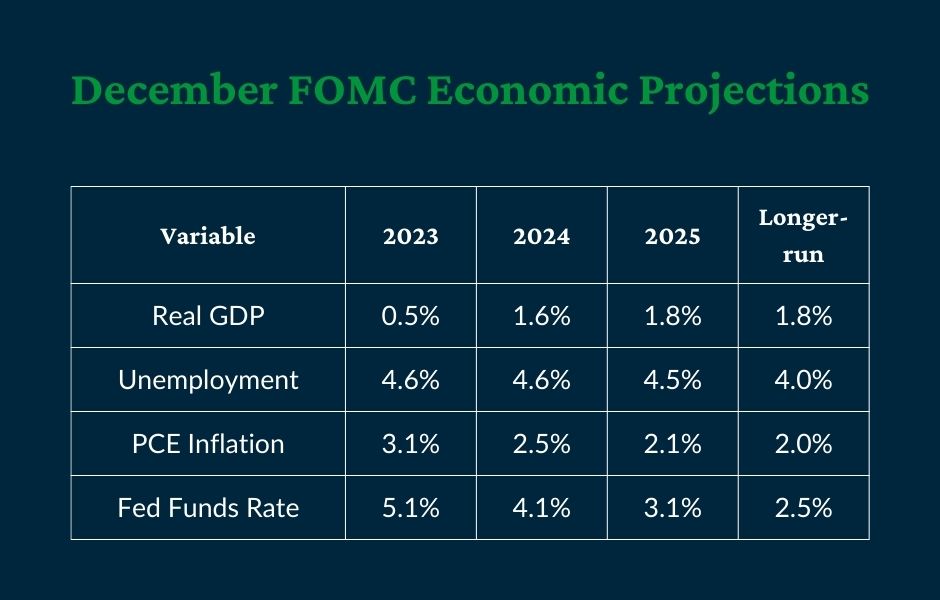

Economic Projections for 2024 and Beyond

While next year’s economic projections were significantly changed from the previous estimate, long-term expectations were less altered.

GDP

GDP is expected to increase by 1.6% in 2024 then expand by 1.8% in 2025. These estimates were little changed from September’s projections.

Unemployment

The unemployment rate is expected to hold steady at 4.6% in 2024 before falling to 4.5% in 2025. These estimates were slightly increased from the previous projections.

Inflation

Inflation is estimated to fall to 2.5% in 2024 and further decrease to 2.1% in 2025. These projections were slightly higher than the prior estimates.

Interest Rates

The Fed funds rate is expected to decrease to 4.1% in 2024 and fall further to 3.1% in 2025. These estimates were increased from 3.9% and 2.9% in September’s projections.

In the long term, all aspects of the economy are expected to return to equilibrium. GDP is anticipated to grow at 1.8% per year, unemployment is expected to settle near 4.0%, inflation is projected at an annual rate of 2.0%, and the Fed funds rate is estimated to hover near 2.5%. None of the Fed’s long-term projections were updated from September’s estimates.

In future meetings, further rate hikes are likely, and those could negatively impact the economy. However, the benefits of stable prices are expected to outweigh any temporary economic pain.

Don’t miss our interest rate and Federal Reserve updates.

At the American Deposit Management Co. [ADM], we provide valuable insights through our weekly articles and analysis of FOMC meetings. These insights can help businesses adapt quickly to changing market conditions.

To stay abreast of developments in monetary policy, the business landscape, and the economy, sign up for our mailing list to receive our weekly article and follow us on Twitter, Facebook, and LinkedIn.

How Are Money Market Account Yields Determined?

Yields for money market accounts can vary widely between banks based on business needs, regulatory changes, and competition.

FDIC Insurance Limits in 2026

The Federal Deposit Insurance Corporation guarantees the safety of business deposits at member banks up to a certain limit.

Banking Brief: Q4 2025

Q4 began with a government shutdown, featured two rate cuts, included notable mergers, and ended with record bank stock valuations.