Q3 Banking Trends: Lower Net Income, Higher Loan Balances, Increased Security Values

The FDIC plays a crucial role in the American banking system by protecting deposits from bank failure and supervising member financial institutions. Part of their supervisory role includes sharing information about the health of the banking sector through the Quarterly Banking Profile.

This report contains important information that business leaders need to understand to assess the safety of their cash. However, the report is vast and time consuming to review. We have summarized the most important changes from this report to save you time.

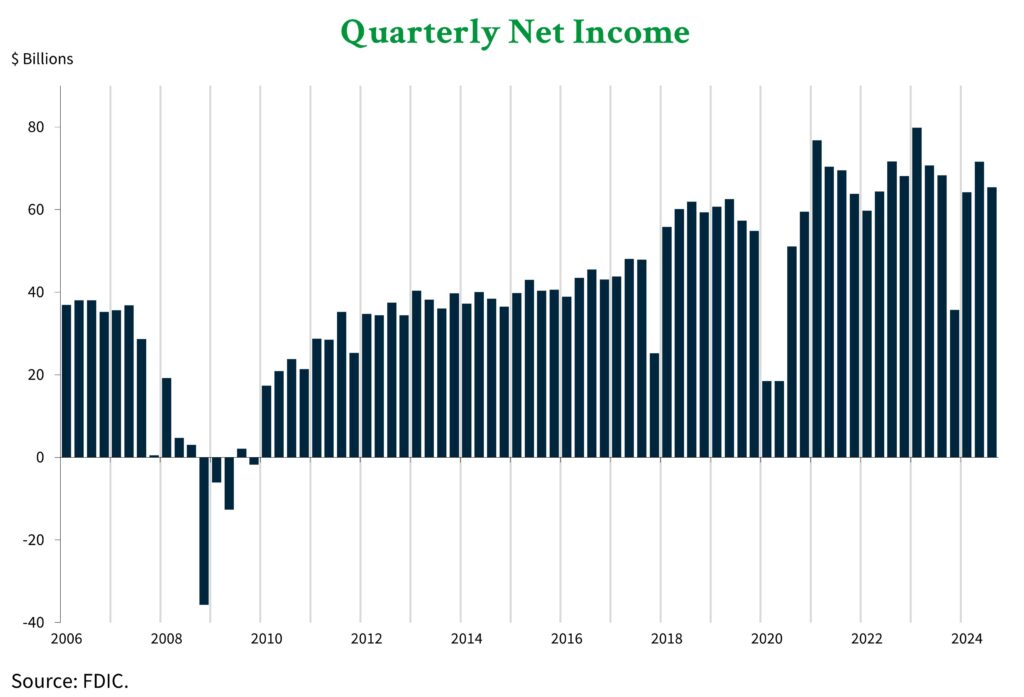

Bank Net Income Declined in Q3 2024

Bank net income declined by 8.6% from the second to the third quarter. The majority of this change is attributable to about $10 billion in gains from equity security transactions that bolstered net income in the second quarter but did not recur in the third quarter.

The change in net income was also reflected in the aggregate return-on-assets ratio. It fell by 0.11 percentage points to 1.09% or about 0.08 percentage points lower than the level one year ago.

Net income for U.S. banks was supported by higher net interest income and a 0.07 percentage point rise in the Net Interest Margin [NIM]. This measures the difference between the amount of interest banks generate and distribute to depositors. In fact, the growth in asset yields exceeded the growth in funding costs for the first time since the second quarter of 2023. Lower net income demonstrates a slight weakening in the banking industry for the quarter. However, bank income was still elevated by historical standards as shown by the chart below.

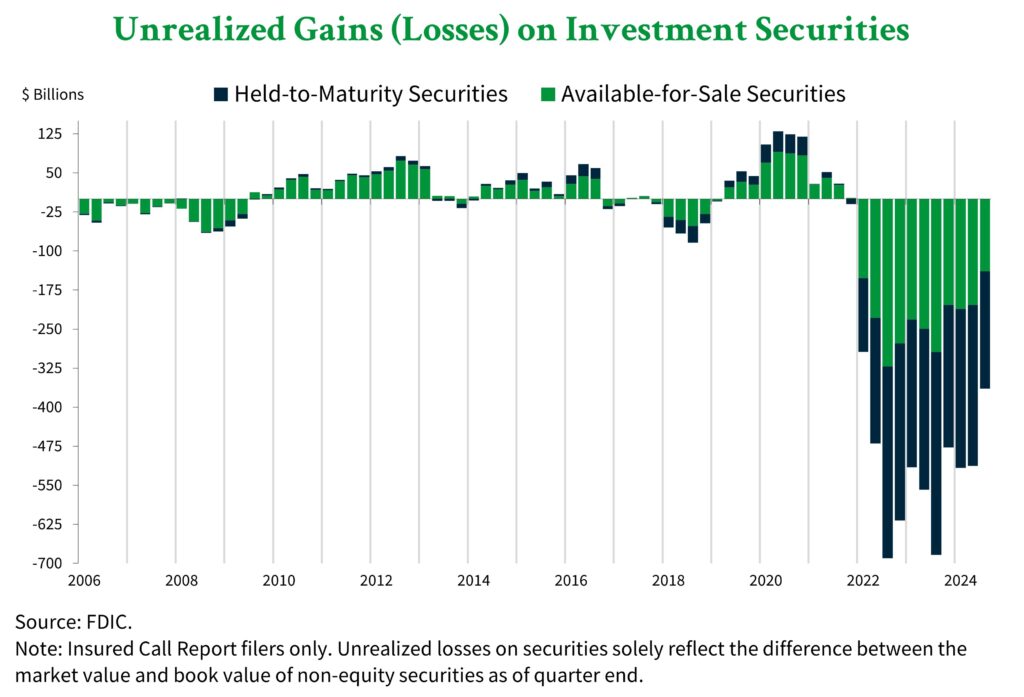

Unrealized Losses on Bank Securities Fell in Q3

Many bank portfolios are supplemented by securities such as bonds. These securities became less valuable as interest rates rose over the past few years and those losses are even credited with contributing to some of the notable bank failures last year.

As long-term interest rates declined last quarter, the securities in bank portfolios became more valuable – erasing some of those losses. In fact, unrealized losses declined by $148.9 billion or 29% from the previous quarter.

Despite the quarterly improvement, unrealized losses in bank portfolios are still substantial compared to previous periods. Total losses were $364 billion in the third quarter – or about eight times higher than the level in Q4 2019.

Higher securities values are seen as a positive sign for banks because they could raise more capital on short notice if needed. Lower unrealized losses across the industry further reduce the risk of another bout of bank failures.

The chart below summarizes unrealized losses in bank portfolios since 2006.

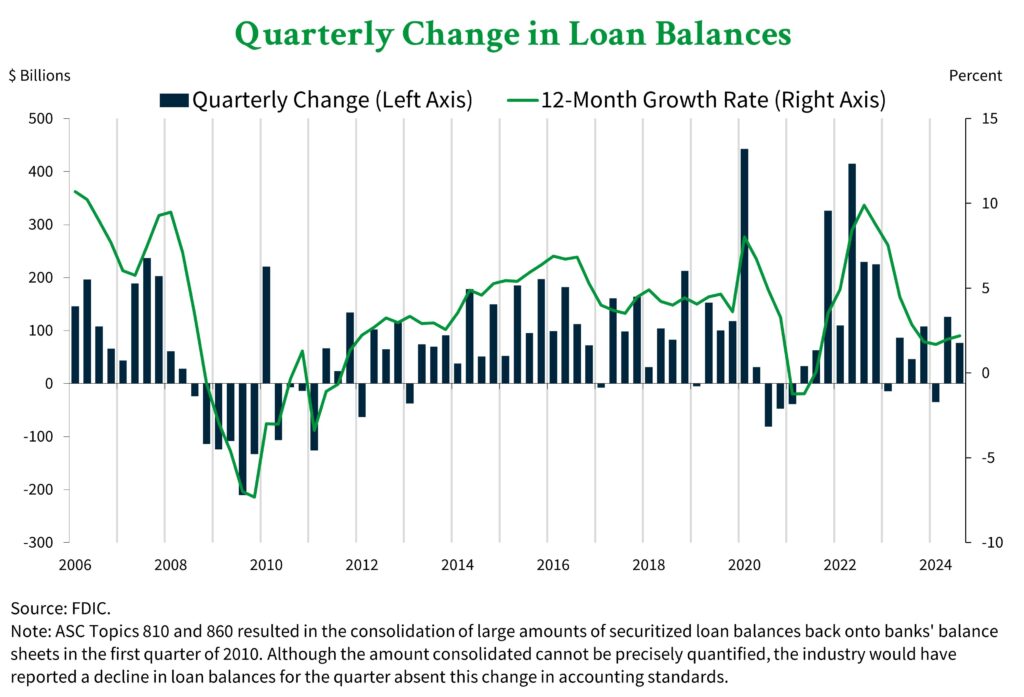

Bank Loan Balances Rose in Q3

Bank loan balances rose by $76.9 billion, or 0.6%, from the second to the third quarter. Loan growth was widespread with 68.2% of banks reporting quarterly improvement. The growth occurred in all major loan categories except Construction and Development and Commercial and Industrial loans.

While banks issued more loans, they also reported slightly higher past-due balances. The past-due and nonaccrual [PNDA] loan ratio rose by 0.6 percentage points to 1.54%. This rate is 0.18 percentage points higher than one year ago but still well below the pre-pandemic average.

Quarterly loan growth is a positive indicator for banks, particularly given the high interest rates currently weighing on lending markets. Additionally, the FDIC described asset quality as stable, despite the slight rise in past due balances. This further adds to a positive image of the current state of the banking industry.

See the chart below for an overview of how loan balances have changed over time.

The FDIC Remains Well Equipped to Protect Depositors

The FDIC guarantees deposits at member banks in the event of bank failure. They do this by facilitating the transfer of funds to a solvent bank or reimbursing them from the Deposit Insurance Fund [DIF].

The balance of the DIF increased by $3.9 billion to $133.1 billion in the third quarter. With this change, the reserve ratio increased by 0.04 percentage points to 1.25%.

A healthy balance in the DIF is vital to ensuring that the FDIC can carry out their mission of protecting deposits. Fortunately, the FDIC remains well positioned to protect deposits if the state of the banking industry should weaken.

Valuable Insights Delivered to Your Inbox

At American Deposit Management, we keep our finger on the pulse of new developments in the business and banking industries. We share the latest information through weekly articles that provide actionable insights.

Catch up on past articles on our Insights page and subscribe to our mailing list to have our latest articles delivered straight to your inbox. Also, don’t forget to follow us on Facebook, Twitter, and LinkedIn so you never miss an update.

Banking Brief: Q4 2025

Q4 began with a government shutdown, featured two rate cuts, included notable mergers, and ended with record bank stock valuations.

The Role of Cash Reserves in Economic Downturns

Robust cash reserves are the tool that allows businesses to not only survive economic downturns but thrive during them.

How The Glass-Steagall Act Shaped Modern Banking

The Glass-Steagall Act of 1933 redefined the function and oversight of the nation’s banks, and its impact continues today.