Q4 Banking Trends: Loan Growth, Improved Net Income, Higher Unrealized Losses

In addition to protecting deposits, the FDIC is tasked with examining and supervising member banks. They release some of the data they collect while fulfilling these directives each quarter in the Quarterly Banking Profile.

FDIC data helps business leaders evaluate the safety of their cash and the security of the financial system. However, the report is vast and time consuming to review. Fortunately, we have summarized the key points below.

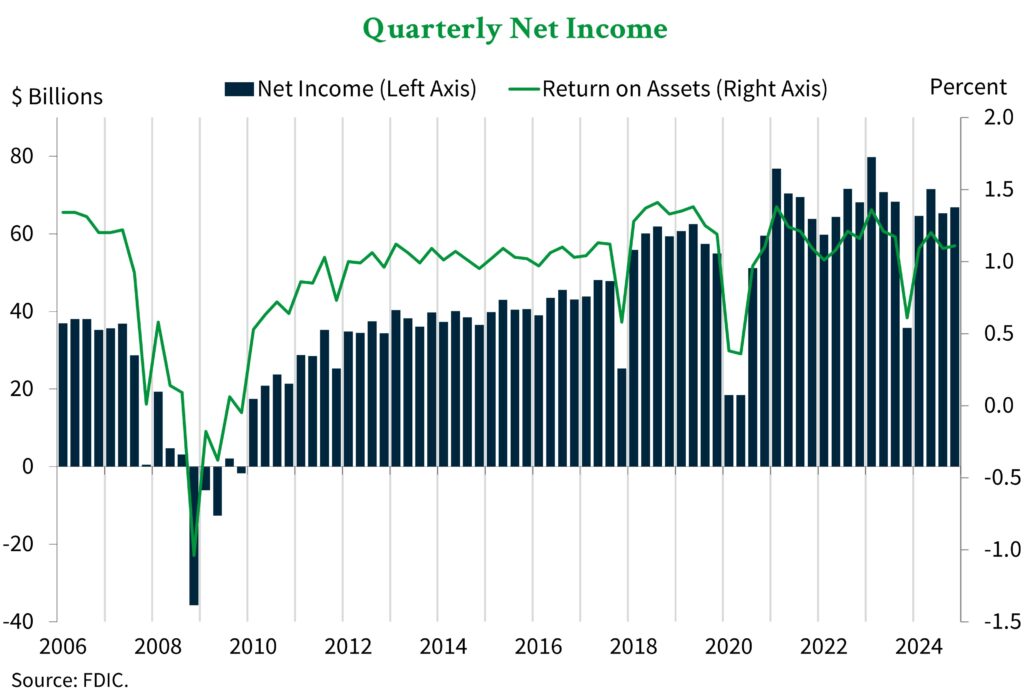

Bank Net Income Improved in Q4

Bank net income tumbled by 8.6% in the third quarter, and the most recent data shows that some of those losses were recovered in the final quarter of the year. As the chart below shows, net income improved by 2.3% in the fourth quarter but remains below the annual high achieved in the second quarter.

Interest rate cuts drove interest expense and interest income down for the quarter. However, interest expense fell more rapidly than interest income – which led to the quarterly rise in net income. This dynamic contributed to a 0.2 percentage point rise in the ROA ratio, bringing it to 1.11%.

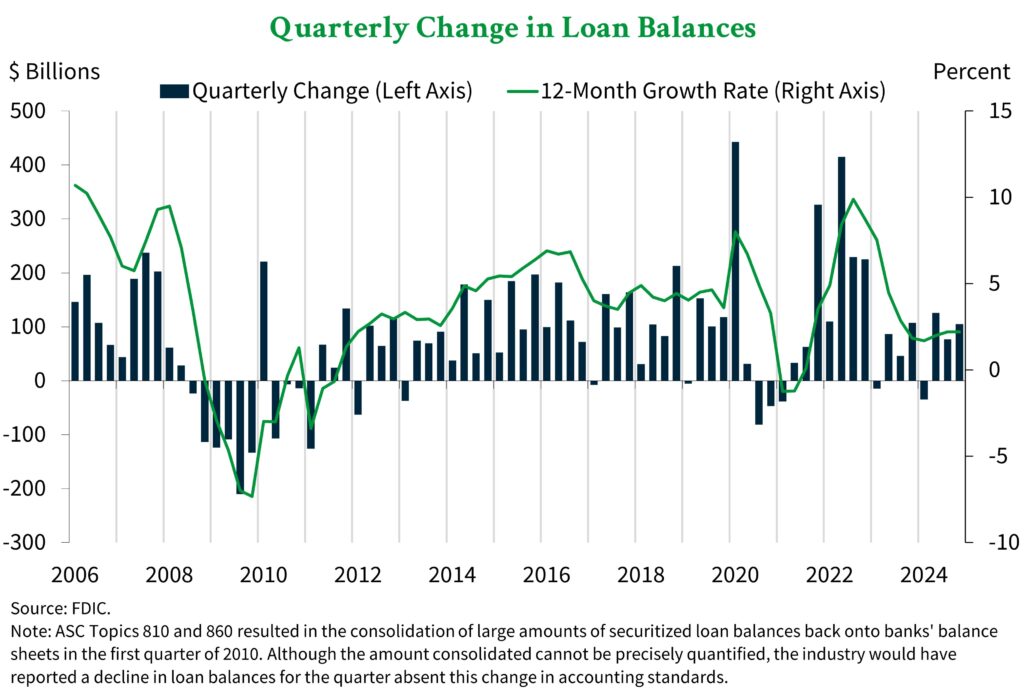

Bank Loan Balances Grew in Q4

Total loan balances for FDIC member banks grew by $105.2 billion – or 0.8% – from the third quarter to the fourth quarter. The chart below shows that even with this quarterly improvement, loan growth slowed throughout 2023 and 2024 from the massive spike in 2022.

The “all other” loans category experienced the most growth last quarter due to reclassifications of some loan products. Credit card balances and loans to non-depository financial institutions also grew considerably for the quarter.

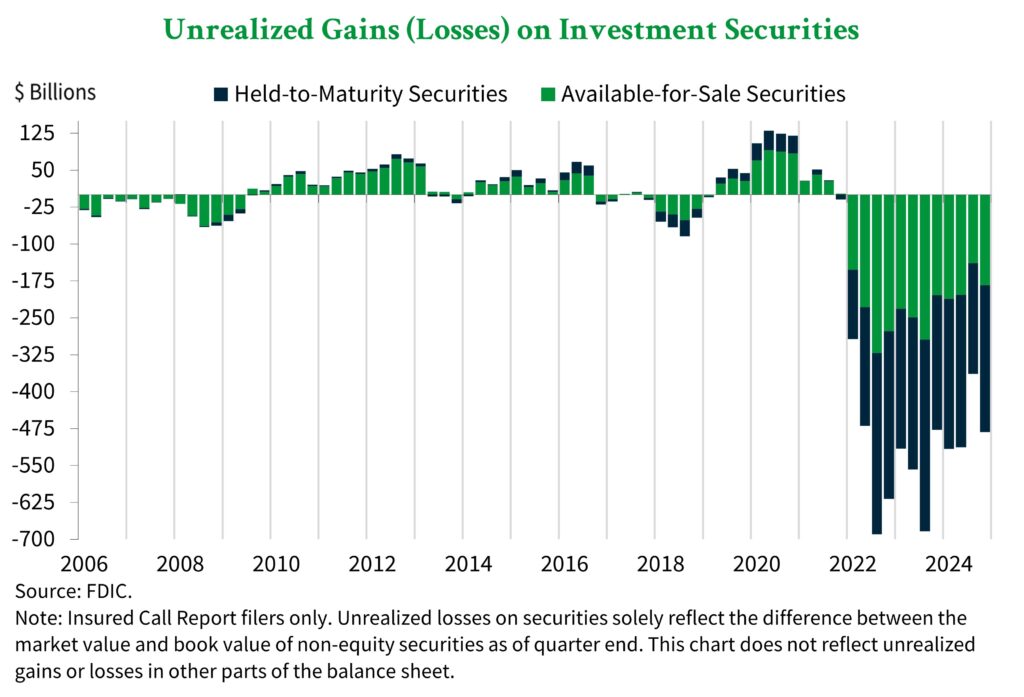

Unrealized Losses on Investment Securities Grew in Q4

Unrealized losses for investment securities are a factor that is closely watched by depositors and bank investors, since it is one indicator of risk. The total unrealized losses for held-to-maturity and available-for-sale securities at FDIC member banks grew by $118.4 billion – or 32.5% – from the previous quarter.

Increases in long-term interest rates devalued securities, which drove the increase in unrealized losses. The chart below shows that the quarterly change was significant, but total unrealized losses have declined from their peak in 2023.

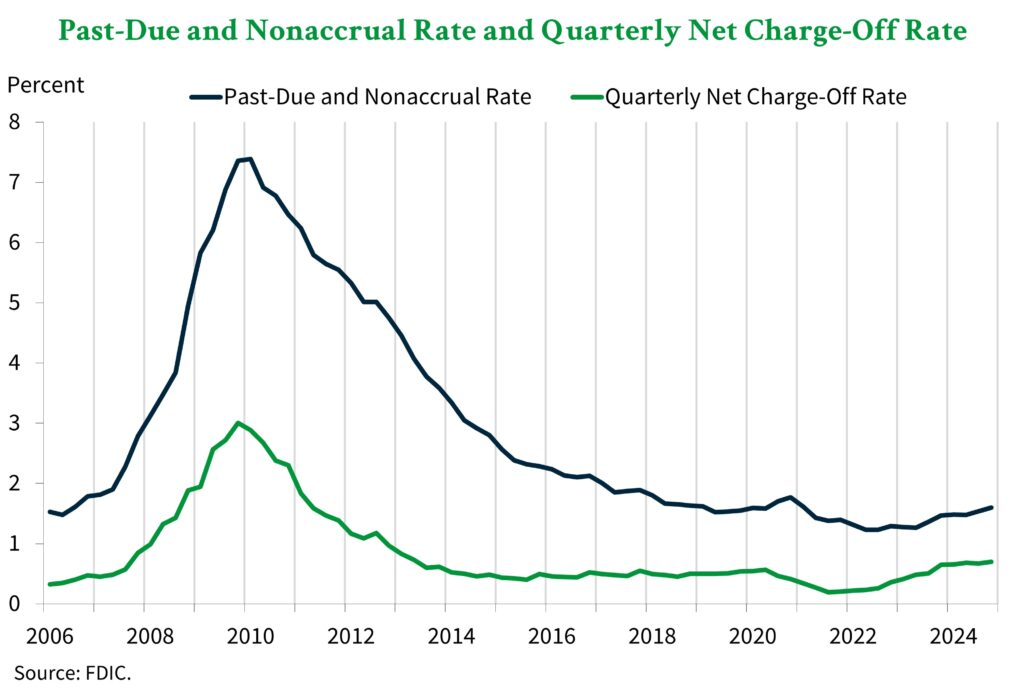

Loan Quality Metrics Worsened Slightly in Q4

The total quality of loan products worsened slightly in the fourth quarter. The past-due and nonaccrual [PDNA] rate for all loans increased by 0.06 percentage points to 1.60%. PDNA for 1 to 4 family loans increased by 0.14 percentage points while the rate for multifamily loans jumped by 0.38 percentage points. Auto loan PDNA also rose by 0.20 percentage points.

Non-owner-occupied property loans continued to report elevated PDNA rates. The PDNA rate for these loans fell from 4.99% in the third quarter to 4.75% in the fourth quarter. However, the rate is still substantially higher than the pre-pandemic average of 0.59%.

The largest banks – those with assets over $250 billion – reported the largest share of high-PDNA non-owner-occupied property loans. These banks typically have a lower concentration of these loans relative to their portfolios, which helps to mitigate the associated risk.

Net charge-off rates also increased – rising by 0.03 percentage points for the quarter and 0.19 percentage points from one year ago. This change brought the net charge-off rate to 0.22 percentage points higher than the pre-pandemic average.

As the graph below shows, PDNA and net charge-off rates have been slowly but steadily rising since their trough in 2022. However, they remain below the short-term peak witnessed during the pandemic.

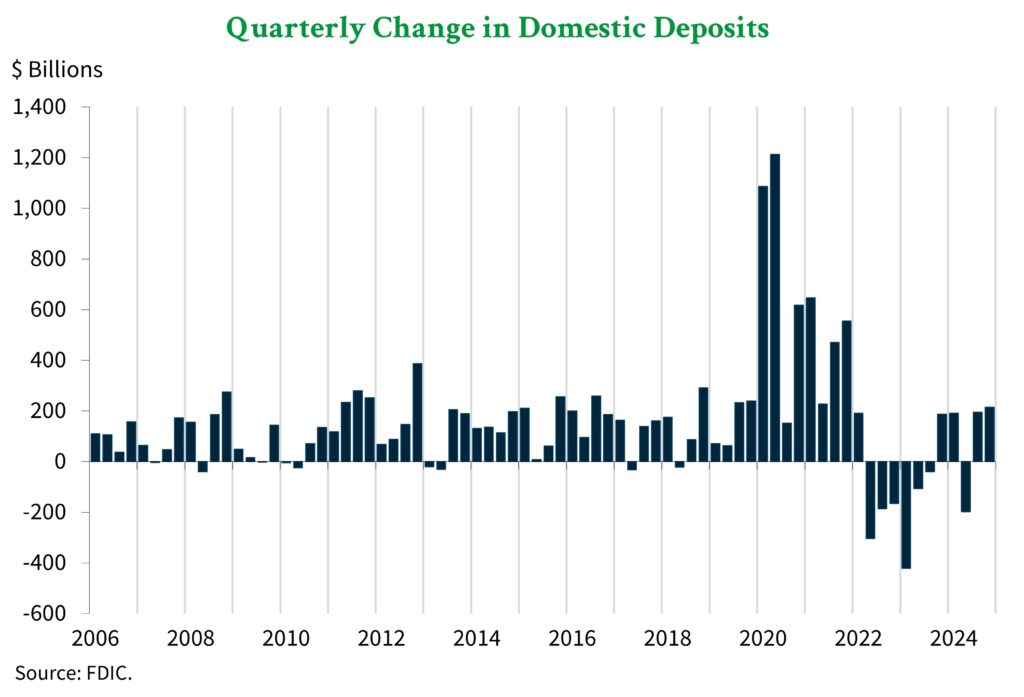

Bank Deposits Increased in Q4

Total deposits at FDIC member banks increased by $214.4 billion – or 1.2% – from the third quarter to the fourth quarter. This change followed steady growth in the third quarter, as shown by the chart below.

Insured deposits – those under the FDIC limit – rose by $39.1 billion or 0.4%. Uninsured deposit growth far outpaced this rate and grew by $218.5 billion or 3.0%. These deposits are considered riskier than insured deposits because they are not protected by the FDIC, and banks with a high concentration of uninsured deposits are at a greater risk of a bank run.

The FDIC Remains Well Positioned to Protect Deposits

To uphold their mission to insure deposits, the FDIC’s stores assets that can be used to reimburse deposits in the Deposit Insurance Fund [DIF]. The DIF balance was $137.1 billion at the end of the fourth quarter – up by $4.0 billion from the previous quarter.

Assessment income continued to drive DIF growth and contributed $3.2 billion to the DIF balance. Interest earned on investment securities, negative provisions for insurance losses, and unrealized gains on securities added another $1.5 billion to the fund. These gains were partially offset by $666 million in operating expenses.

Growth in the DIF balance increased the reserve ratio by 0.03 percentage points to 1.28%. This ratio is on track to meet the 1.35% statutory minimum by September 30, 2028.

Along with a higher DIF balance, the number of banks on the “Problem Bank List” declined by 2 to 66 banks. With this change, problem banks represent 1.5% of total banks – which is within the normal range for a noncrisis period.

A manageable number of problem banks and a healthy DIF balance are crucial to the FDIC’s ability to protect deposits. Improvements in both areas make the case that the FDIC remains well positioned to fulfill their mission should the industry experience a crisis.

Even More Valuable Insights Delivered Directly to Your Inbox

At American Deposit Management, our weekly articles cover important developments in the business and banking industries. Subscribe to our newsletter to have our valuable insights delivered straight to your inbox. If you are looking for more information today, review all our articles on the Insights page.

We also offer modern cash solutions that provide access to full government protection from the FDIC or NCUA, nationally competitive returns, and liquidity to match your needs. Contact a member of our team today to learn more about how our services can improve cash management for your business.

An Overview of Regulations Governing the Management of Public Funds

Public entities like school districts and municipalities are held to specific regulations that govern the ways funds are invested.

Business Escrow in 2026

Business escrow services are not a new concept, but modern solutions should offer far more than companies could expect in the past.

FOMC Meets in January Amid Continued Inflation and Softening Employment

The FOMC met for the first time in 2026 on January 27th and 28th. At that meeting, they voted to hold the Fed Funds Rate steady.