Q1 Banking Trends: Higher Net Income, Increased Loan Balances, Rising Deposits

Business leaders across the country are grappling with economic uncertainty in many aspects of their business, and their investments are no exception. Stock markets, bond markets, and even commodities have been influenced by tariff talks and uncertainty about the future of trade – but how are banks faring?

The FDIC recently released the Q1 Quarterly Banking Profile which details the profitability and safety of insured banks across the country. This report is dense and can be tedious to interpret. That’s why we have summarized the key points to give leaders in the business and banking industries the information they need without the hassle.

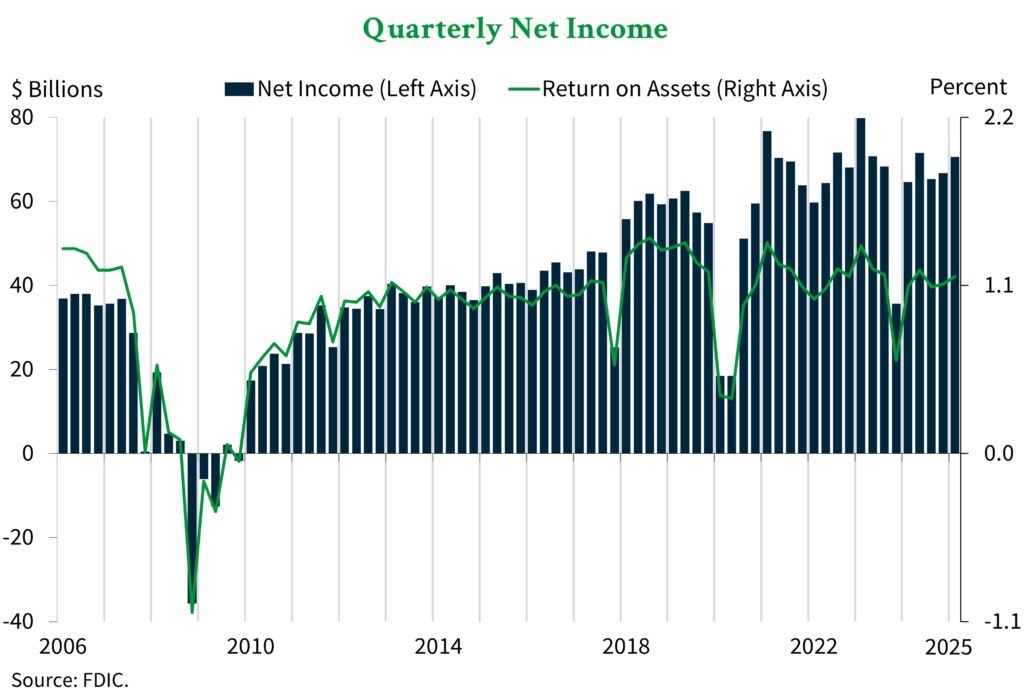

FDIC Member Banks Reported Higher Net Income

Net income for all FDIC member banks was $70.6 billion in the first quarter – an increase of 5.8% from the previous quarter. The chart below shows that the latest quarter marked the third consecutive rise in net income.

Higher non-interest income was a key driver of this increase last quarter. Further, gains on securities and a reduction in non-interest expenses contributed to net income growth. On the other hand, these factors were partially offset by a 0.2% decline in net interest income and an 18.3% increase in applicable income taxes.

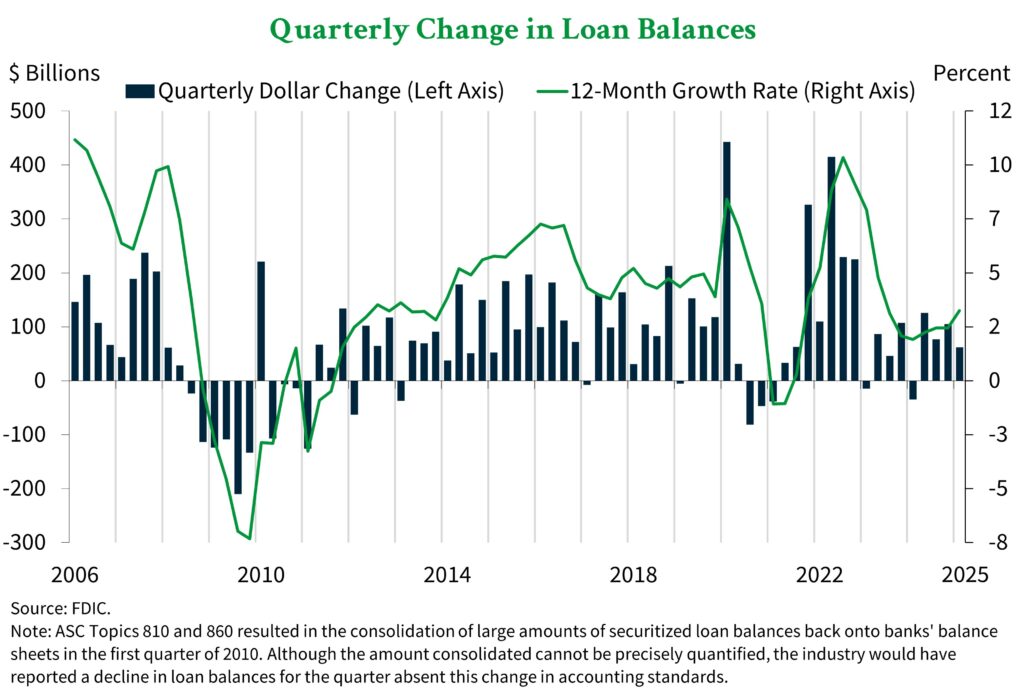

Loan Balances Rose at a Slower Pace in Q1

The first quarter marked the fourth consecutive quarter of increasing loan balances for FDIC member banks. This growth was driven by reclassifications of loans to non-depository financial institutions – also known as NDFIs. Increases in Commercial & Industrial and Multifamily CRE loans also contributed to the rise.

While the total balance of loans grew, the chart below shows that the pace slowed to 0.5% from the fourth quarter when loan growth was 0.8%. Additionally, loan growth was just 3.0% on an annualized basis – well below the pre-pandemic average of 4.9% growth per year.

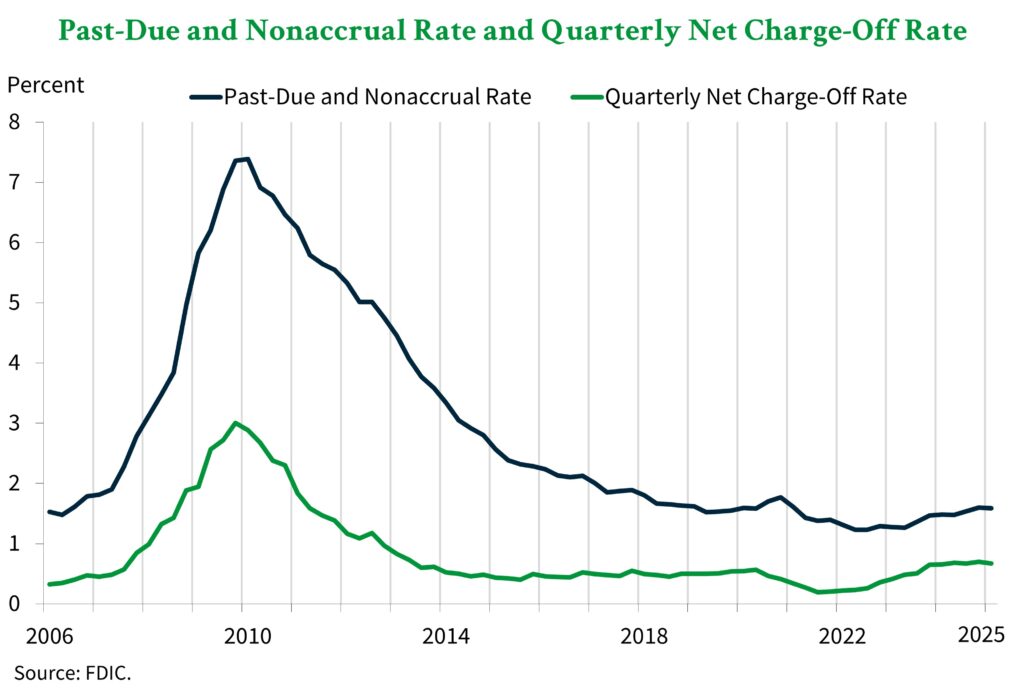

Bank Loan Quality Metrics Improved Slightly

Along with loan growth, the safety of loan portfolios improved last quarter. This change is evidenced by a 0.01 percentage point decline in the overall past-due and nonaccrual [PDNA] rate. At 1.59%, this rate remains well below the pre-pandemic average of 1.94%.

Past due rates for credit cards and auto loans improved for the quarter and contributed to the overall decline in the PDNA rate. On the other hand, PDNA for Commercial Real Estate [CRE] loans continued to climb and reached the highest rate since Q4 2014.

Similarly, the net charge-off rate fell by 0.03 percentage points from the previous quarter to 0.67%. However, this rate remains 0.19 percentage points higher than the pre-pandemic average. In fact, the FDIC reported that most portfolios have net charge-off rates above the pre-pandemic average including credit card loans which are currently 1.23 percentage points higher than the pre-pandemic average.

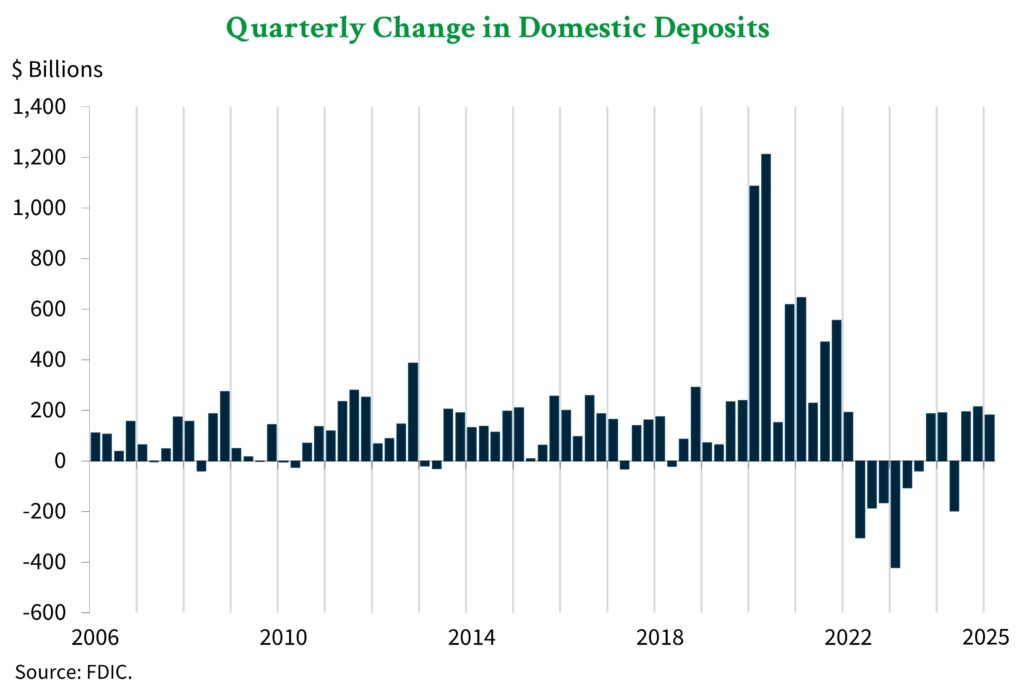

FDIC Member Banks Continued to Add Deposits

Bank deposit levels are a key driver of deposit rates, as banks that need to attract more customers often raise the rates they pay to become more competitive. The latest FDIC data showed that banks continued to attract more cash, and overall domestic deposits increased by $180.9 billion or 1.0%.

As the chart below shows, deposits have increased for three consecutive quarters. However, the rate of increase slowed in the most recent quarter, which may have been influenced by a continued decline in brokered deposits. These deposits fell by $14.9 billion or 1.2% for the quarter.

The FDIC Remains Well Positioned to Respond to Potential Crises

In the event of a bank failure, the FDIC facilitates a transfer of deposits to a solvent bank or reimburses them from the Deposit Insurance Fund [DIF]. Therefore, the agency needs a healthy DIF balance to achieve their mandate of insuring deposits.

The DIF balance was $140.9 billion on March 31st – an increase of $3.8 billion from the previous quarter. This growth was driven by a $3.2 billion rise in assessment income. Negative provisions for insurance losses and unrealized gains on securities added another $1.2 billion to the fund. On the other hand, operating expenses of $617 million partially offset the additions.

Another key point in determining whether the FDIC can achieve their mandate is the number of banks that are likely to fail. This is measured by the Problem Bank List, and the number of banks on this list declined from 66 to 63 in the first quarter. Problem banks are currently 1.4% of total banks – which is well within the normal range of 1 – 2% for a non-crisis period.

Overall, the health of the banking industry continued to improve in the first quarter, despite economic uncertainty. Additionally, the FDIC remains well positioned to respond if the situation should change.

Stay In-The-Know with Our Weekly Insights

At American Deposit Management, we publish weekly articles that help business and banking leaders stay up to date on the information that matters to them. Subscribe to our newsletter to have our valuable insights delivered straight to your inbox and review our past articles on the Insights page.

In addition to valuable publications, we help improve the safety of business cash through modern cash solutions. These innovative solutions are powered by patent-pending technology and deliver access to full government protection from the FDIC or NCUA, nationally competitive returns, and liquidity to match your needs. Contact us today to learn how your company could benefit from extended safety and competitive returns.

The One Account Advantage for Business Cash Management

Fragmented cash management creates unnecessary complexity, but a consolidated platform can fundamentally reshape your results.

Q4 Banking Trends: Strong Net Income, Rising Deposits, Lower Unrealized Losses

American banks reported strong net income and lower unrealized losses alongside higher loan balances and deposit levels in Q4 2025.

How Did the Gramm-Leach-Bliley Act Facilitate Bank Consolidation?

The Gramm-Leach-Bliley Act passed in 1999 and ushered in a new era of consolidated, one-stop shop banking that perseveres today.