Comparing Banks and Credit Unions for Business Cash

Cash managers have a tough choice ahead of them when deciding where to invest their company’s cash. They often compare many factors to aid in this decision – with three of the most crucial being safety, returns, and ease of management.

Banks and credit unions are popular choices for business cash, but they often fall short in at least one of those areas. Fortunately, businesses now have a third, more robust option to invest their cash. Before diving into this newer solution, we’ll compare the benefits and drawbacks of traditional financial institutions.

Banks and Credit Unions Offer Equal Protection for Business Cash Reserves

Deposits at most U.S. banks are covered by insurance from the Federal Deposit Insurance Corporation [FDIC], and credit unions are covered by insurance from the National Credit Union Administration [NCUA]. Both institutions are independent agencies of the federal government, and their insurance is backed by the full faith and credit of the United States.

Because both agencies are backed the same entity, cash managers can consider banks and credit unions equally secure – provided the financial institution they choose is insured by one of these agencies. However, government deposit insurance is limited to $250,000 per account ownership category at each financial institution.

Businesses with more than $250,000 in cash can spread their funds across multiple banks or credit unions to achieve extended protection, but as the balance of cash grows, the process becomes very cumbersome. In fact, it could take an entire team to review balances, move cash when necessary to remain under the insurance limit, and reconcile statements.

Yields Can Vary Between Banks and Credit Unions

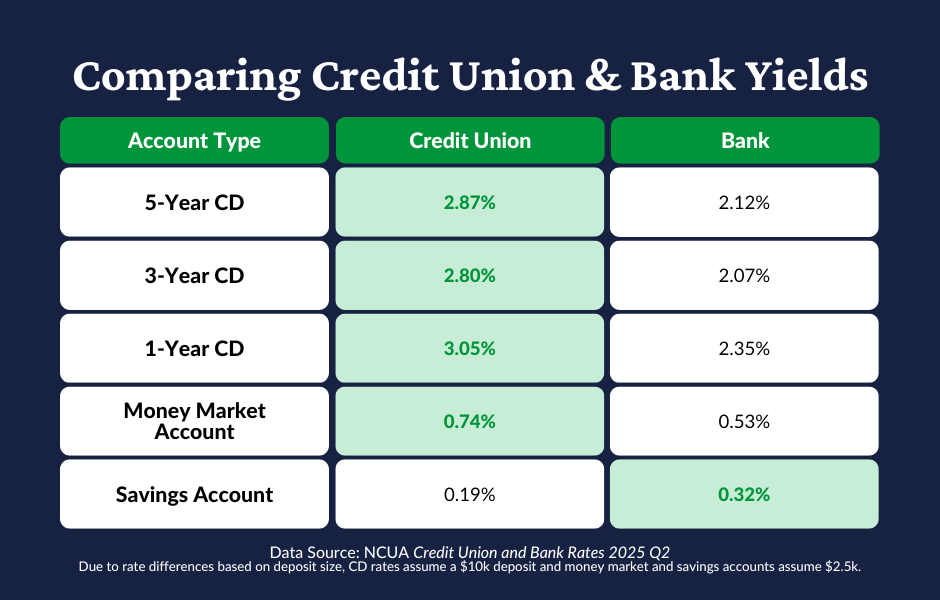

While the safety of deposits is the same, the returns on cash at banks and credit unions can vary widely. The most recent data from the NCUA shows that credit unions offer higher yields for money market deposit accounts and certificates of deposit, but banks offer slightly higher rates of return for savings accounts.

The chart below summarizes the average rates by financial institution type in Q2 2025.

When reviewing this data, it is important to remember that these numbers are averages. Yields often vary dramatically between institutions, because each sets its own deposit rates based on a variety of factors, including:

- Geography and Competition. A financial institution in a highly competitive market may offer more attractive rates than one in a less competitive area.

- Financial Institution Need. An institution seeking new deposits to fund loans may offer higher rates than one with ample liquidity.

- Economic Factors. Broad economic conditions, including the Federal Reserve’s monetary policy and prevailing interest rates, play a significant role in determining deposit rates.

The differences in yield between financial institutions mean that a business can shop for the best rates to improve their overall yield. However, this process is time-consuming – particularly for a business with multiple accounts.

Ease Of Management and Customer Service Can Differ Between Banks and Credit Unions

Another consideration for cash managers is the ease of managing funds. This includes everything from the accessibility of services to the quality of customer support.

Credit unions have built a reputation for outstanding customer support, mostly accredited to their unique membership structure. They also generally operate with a smaller footprint and fewer branches than regional or national banks – which can make account management more challenging.

Banks are more of a mixed bag. For example, smaller community banks – much like credit unions – can provide more personal customer service, and many depositors see that as an advantage. Alternatively, large banks have often invested in technology upgrades to make their online account management seamless, but it’s also less personal. Larger banks are also more likely to offer customer service outside of typical business hours, which is a must for some organizations. The key takeaway is, while larger institutions generally offer more products, services, and convenience, smaller ones tend to get higher marks for overall customer satisfaction.

Bridging the Gaps with Deposit Management by ADM

Fortunately, business cash managers no longer need to choose between a bank and a credit union. Our company, American Deposit Management, has an innovative option that simplifies cash management with a single account that provides access to safety and competitive rates from both banks and credit unions along with liquidity that meets your schedule.

At ADM, our deposit management services provide:

- Access to Unlimited Government Insurance. Using patent-pending technology, we spread our clients’ cash across a network of banks and credit unions. This allows them to take advantage of combined FDIC and NCUA insurance with a single account – eliminating the administrative burden of managing multiple relationships.

- Nationally Competitive Yields. The financial institutions in our network compete for deposits, which means businesses earn an average of 7x more interest than the national average money market account.

- Outstanding Customer Service. Our experienced team offers dedicated support to help businesses achieve their cash management goals.

- Simple Management. Our solutions simplify cash management with a single, consolidated monthly statement, a single annual tax form, and an intuitive online portal that allows you to keep track of cash, 24 / 7.

Whether your business needs competitive CD returns or access to the ultimate protection for reserve cash, our deposit management solutions are the answer. Our experienced team is available to help you create a custom cash management strategy that balances your safety, return, and liquidity needs.

To speak to a member of our team about your company’s cash, contact us today.

The One Account Advantage for Business Cash Management

Fragmented cash management creates unnecessary complexity, but a consolidated platform can fundamentally reshape your results.

Q4 Banking Trends: Strong Net Income, Rising Deposits, Lower Unrealized Losses

American banks reported strong net income and lower unrealized losses alongside higher loan balances and deposit levels in Q4 2025.

How Did the Gramm-Leach-Bliley Act Facilitate Bank Consolidation?

The Gramm-Leach-Bliley Act passed in 1999 and ushered in a new era of consolidated, one-stop shop banking that perseveres today.