Comparing Business Cash Investments

There are many options for business cash investments, each with a unique blend of accessibility, returns, and safety. These investments may seem similar on the surface, but they are not all created equal.

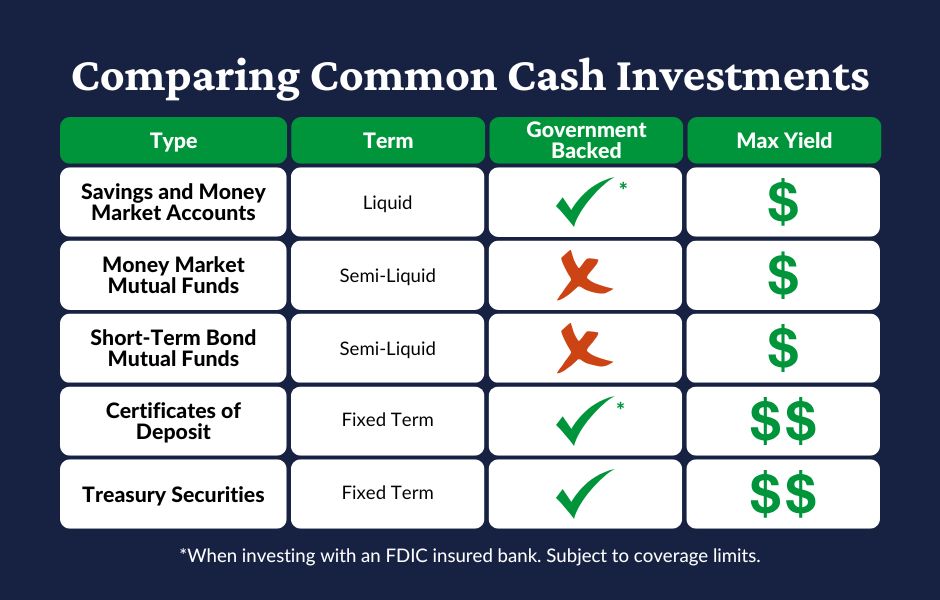

Cash investments have key differences that allow corporate cash managers to gain situational advantages. By comparing the various options, business leaders can understand how their differences impact cash management plans and choose the right one to match their needs.

Liquid Investment Options for Business Cash

For cash that may be needed on short notice, there are three popular investments – deposit accounts, money market mutual funds, and short-term bond mutual funds. All three provide a return and simple access to cash, but only one offers government protection.

Savings and Money Market Accounts Offer Safety and Liquidity Plus Returns

Deposit accounts like savings and money market accounts are available at most banks and credit unions. When investing with a member financial institution, both types of accounts are covered by FDIC or NCUA insurance, up to the $250,000 limit. This insurance is backed by the full faith and credit of the United States government – making it the ultimate protection for cash reserves.

In addition to safety, these accounts can offer a somewhat steady rate of return. However, the yield on a particular account will vary depending on the needs and goals of the financial institution offering it. This means it’s possible to find yields well above the average from financial institutions that need deposits.

While the rate of return on a savings or money market account may change with market conditions, the principal is safe from fluctuations. These accounts are also considered highly liquid since it is simple to withdraw or transfer the funds. However, some financial institutions may place limitations on the number of withdrawals or transfers during each statement period.

Money Market Mutual Funds Offer Liquidity and Returns

Another option for cash reserves is a money market mutual fund. Though similarly named, these investments are different than money market deposit accounts. Instead, they are offered by mutual fund companies and typically purchased through a broker-dealer.

Since these mutual funds are not issued by banks, they are not insured by the FDIC. However, the individual investments inside a money market mutual fund may be backed by the federal government.

Returns for money market mutual funds are determined by the yields of the underlying investments minus the expenses of the fund. They vary based on the structure of the fund, the investments, and the mutual fund company, but are generally comparable with average savings and money market account yields.

Like savings and money market accounts, money market mutual funds offer a stable principal value. They do this by seeking to maintain a stable $1 per share value – though there have been cases where money market mutual funds have failed to uphold this goal.

Unlike deposit accounts, money market mutual funds are considered semi-liquid. In most cases, there are no limitations on the number of withdrawals, but these funds require investors to sell their shares in order to access cash.

Short-Term Bond Mutual Funds Offer Competitive Returns

Short-term bond funds are another type of mutual fund that can be suitable for corporate cash. These funds can vary dramatically based on the type of fund and the sponsor – with some investing only in government-backed securities while others include riskier corporate debt.

Because short-term bond funds have higher risk than money market mutual funds, they tend to pay higher rates of return. However, the actual return will vary based on the fund sponsor, underlying investments, costs of administering the fund, and prevailing interest rates.

One of the main differentiating factors between money market mutual funds and short-term bond mutual funds is their fluctuating value. This means investors must sell the fund at the current market value to access cash – which could provide a profit or a loss depending on market conditions. Because shares must be sold to access cash, these funds are considered semi-liquid.

Business Cash Investments with Fixed Terms

Two of the most popular fixed-term investments for business cash are Certificates of Deposit [CDs] and Treasury securities. Both offer government protection, but only one offers a stable value throughout the term.

Certificates of Deposit Offer Competitive Yields and Government Insurance

CDs are fixed-term investments offered by banks and credit unions. The terms typically range from a few months to 5 years, and sometimes provide the option to customize when the investment matures.

Throughout the term, CDs provide a fixed interest rate which is determined by the bank or credit union offering the investment. These yields are typically higher than more liquid accounts and tend to increase with the length of the investment. Like other accounts, this dynamic makes it possible to find yields well above the average from financial institutions that need deposits.

CDs bought from FDIC insured banks or NCUA insured credit unions are protected by government insurance up to the $250,000 per institution limit. This insurance makes CDs equally as safe as other types of bank accounts including savings and money market accounts.

Financial institution CDs don’t trade on the secondary market. Instead, they have a stable value and charge an early withdrawal penalty to access the funds prior to maturity. This eliminates the risk of market losses, but also prevents the possibility of gains due to shifting market conditions.

Treasury Securities Provide Returns Plus Government Backing

Treasury securities are backed by the full faith and credit of the U.S. government – both principal and interest. Like CDs, they are offered for specific terms and these terms range from 4 weeks to 30 years.

Treasuries pay a fixed interest rate throughout the term of the investment, and this rate is influenced by factors at the time of auction including prevailing interest rates and the level of interest in these securities. Unlike CDs, all Treasuries are issued by the same entity. Therefore, there are typically few opportunities to shop for above-average yields.

If the funds invested in a Treasury security are needed prior to maturity, companies will need to sell the investment on the secondary market at the current market value. This leaves the opportunity to earn a profit or the risk of accepting losses.

The chart below summarizes the key features of the most common investments for business cash.

Achieve Enhanced Safety and Returns with Deposit Management by ADM

With deposit management services from ADM, cash investing is a breeze. Our modern cash solutions spread business cash across a nationwide network of financial institutions that compete for deposits. In turn, companies can enjoy access to full government protection.

In addition to enhanced safety, our solutions help businesses capture nationally competitive rates of return. In fact, our accounts have generated 8x more income for businesses than the national average money market account since 2022.1

Best of all, our team of specialists helps companies achieve their unique safety, liquidity, and return needs. To learn more about how our modern cash solutions can help your business, contact a member of our team today.

1ADM vs. FDIC Money Market National Average. Since 2022. Rates taken from the FDIC’s monthly publication of Money Market National Deposit Rates from 2017 through 7/1/2024. ADM Cumulative Interest is calculated using the 30/365 convention with an original investment of $1,000,000.00 and compounded over the number of months in the comparison period. Net rates are actual delivered rates of a sample client account during the comparison period.

Q4 Banking Trends: Strong Net Income, Rising Deposits, Lower Unrealized Losses

American banks reported strong net income and lower unrealized losses alongside higher loan balances and deposit levels in Q4 2025.

How Did the Gramm-Leach-Bliley Act Facilitate Bank Consolidation?

The Gramm-Leach-Bliley Act passed in 1999 and ushered in a new era of consolidated, one-stop shop banking that perseveres today.

An Overview of Regulations Governing the Management of Public Funds

Public entities like school districts and municipalities are held to specific regulations that govern the ways funds are invested.