EB-5 Fund Administrators Optimize Cash Management with ADM

EB-5 visa issuance reached a fresh peak in 2024 and is on pace to reach new heights this year. The additional interest in the program, coupled with the regulatory changes in the EB-5 Reform and Integrity Act of 2022, have expanded the duties of Fund Administrators. Their role now encompasses increased reporting, additional compliance responsibilities, and greater demand for security.

Today, Fund Administrators are expected to secure protection for project funds, grow cash with competitive returns, manage portfolios for multiple clients, and effectively deploy funds for value-added projects. At American Deposit Management, we simplify EB-5 cash management through patent-pending technology that delivers simple solutions to meet the unique needs of Fund Administrators.

Competitive Interest Rates Without the Risk of Principal Loss

Some popular investments for EB-5 cash provide the opportunity for competitive interest rates but also include the potential for principal loss. One such investment is a money market mutual fund, which seeks to maintain a $1 per share value, but there have been instances where they failed to uphold this valuation. Another example is Treasuries which are backed by the full faith and credit of the U.S. government, but selling them on the secondary market can result in changes to the principal value.

Unlike these options, our company deploys cash to investments with no risk of principal loss – like Certificates of Deposit and our American Money Market Account™. That’s how our clients achieve stable principal value along with nationally competitive returns.

Competition Between Financial Institutions Optimizes Returns

Our solutions work by spreading cash across a nationwide network of banks and credit unions that compete for deposits. This competition can generate interest rates that vastly exceed market rates.

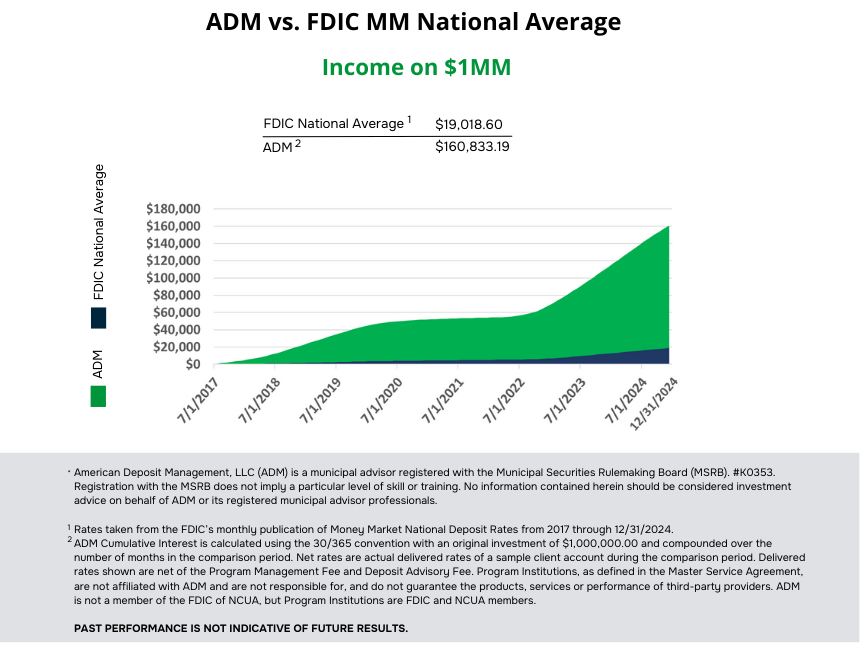

In fact, ADM accounts have generated 7x more interest income than traditional FDIC money market accounts since 2022. As the chart below shows, our clients have earned an average of $160,000 in interest on a $1 million investment since 2017 – compared to only $20,000 in interest in the average FDIC-insured money market account.

Access to Government Protection for All Funds

Along with nationally competitive interest rates, our solutions provide access to full government protection from the FDIC or credit-union equivalent, NCUA. These agencies are backed by the full faith and credit of the U.S. government and provide unparalleled protection for both principal and accrued interest.

Government deposit insurance is generally limited to $250,000 per ownership category at each insured bank, which is not enough to cover the minimum EB-5 investment. However, our solutions spread cash across multiple banks and credit unions which allows clients to access extended protection.

While the FDIC and NCUA provide the strongest protection available for business cash, there are some instances where other coverage provides a better balance between safety and returns. We understand this delicate balance and can tailor our solutions to match specific return needs.

Manage Multiple Portfolios and Disburse Funds with Ease

Fund Administrators often balance multiple clients with differing investment needs and schedules for paying vendors. Fortunately, our streamlined online platform makes it simple to manage investments and track performance for multiple portfolios with a single account and intuitive dashboard.

Our Intuitive Dashboard Offers Full Visibility and Dual Control

Management of multiple accounts across projects and phases requires transparency. Fortunately, our partners can use a single, easy-to-navigate portal to monitor all fund flows in real time. This comprehensive view supports Fund Administrators’ duty to maintain accurate records and verify transfers.

Additionally, Fund Administrators need to ensure that only authorized personnel move funds. We support this with built-in dual authorization to ensure no single person can unilaterally move funds. This safeguard reinforces internal controls and aligns with RIA expectations for independent oversight and fraud prevention.

Disbursements Made Simple with Vendor Payments

Our automated vendor payment program, American Payment Solutions, also streamlines disbursements with simple approvals and reconciliations. This pivotal solution allows Fund Administrators to pay vendors directly from their ADM account – enabling them to earn interest until the payment is due and reducing the risk of payment fraud that is common with paper checks.

By combining our vendor payment and modern cash solutions, Fund Administrators can simplify EB-5 fund management throughout the lifecycle of the investment. From investing cash to disbursing funds, they can reduce their workload while delivering the safety and returns their clients need.

Get Started with Cash Management From ADM

At ADM, we’re not just a place for Fund Administrators to park cash. We’re truly a partner in responsible and secure capital management.

Our tailored approach can provide the security, returns, and ease of use that makes fund administration simple. Best of all, our solutions are backed by an experienced team who understands what it takes to manage EB-5 investments and is always available to provide support.

To learn more about our services, contact us today.

Q4 Banking Trends: Strong Net Income, Rising Deposits, Lower Unrealized Losses

American banks reported strong net income and lower unrealized losses alongside higher loan balances and deposit levels in Q4 2025.

How Did the Gramm-Leach-Bliley Act Facilitate Bank Consolidation?

The Gramm-Leach-Bliley Act passed in 1999 and ushered in a new era of consolidated, one-stop shop banking that perseveres today.

An Overview of Regulations Governing the Management of Public Funds

Public entities like school districts and municipalities are held to specific regulations that govern the ways funds are invested.