FOMC Holds Interest Rates Steady at June Meeting

The FOMC met this week to review changes to the economic situation and vote on a direction for monetary policy. Their interest rate decision was well-telegraphed, with 99% of analysts correctly predicting that they would hold rates steady.

While there were no surprises in the rate decision, the meeting still had plenty of value for business leaders. Chair Powell shared important insights about incoming economic data, and committee members released updated projections for the future of the economy.

Interest Rates Held Steady in June, Expected to Decline This Year

The committee voted to hold the Fed Funds Rate steady at a target range of 4.25 – 4.50% for the fourth consecutive meeting. However, their projections show a decline in interest rates later this year.

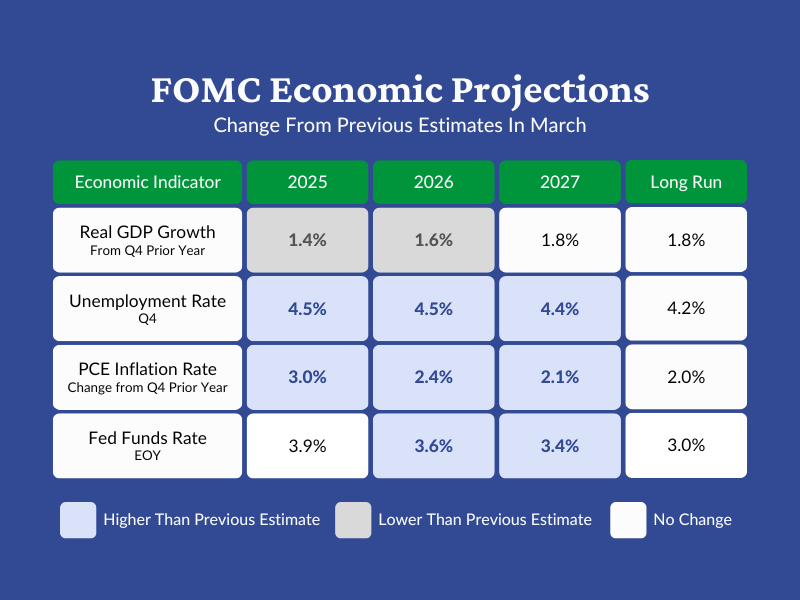

The FOMC updates their forecasts four times per year, and the previous report was in March. Both the March and the most recent projections showed an estimated end-of-year Fed Funds Rate of 3.9%, which signals a reduction of about half a percentage point in the coming months.

While the committee left their 2025 Fed Funds Rate projections stable, they adjusted their expectations for the next few years. Rates are expected to decline to 3.6% in 2026 and fall further to 3.4% in 2027. These forecasts are higher than the March estimates, suggesting that rates will remain elevated for longer than previously expected. However, the committee left their long-run average Fed Funds Rate unchanged at 3.0%.

GDP Expected to Grow for the Year as a Whole

The FOMC reduced their expected GDP growth rate for 2025 and 2026. The expectation for 2025 is now 1.4% GDP growth – down from 1.7% in the March estimate – while 2026 was reduced from 1.8% to 1.6%. The 2027 estimate remained unchanged at 1.8%.

While the anticipated GDP growth rate was revised downward, the latest estimates still predict a rise in GDP from the actual rate of -0.2% in the first quarter. Chair Powell’s comments aligned with this view, and he stated that first quarter GDP data was skewed by additional imports ahead of tariffs.

Unemployment Projected to Rise

Chair Powell indicated that the labor market is near the goal of “maximum employment” with the unemployment rate at 4.2%. However, the FOMC’s projections show the labor market weakening throughout the coming months.

The unemployment rate is forecasted to rise to 4.5% by the end of the year – a slight upward revision from the 4.4% level in the March projections. Elevated unemployment is expected to persist through 2026 and decline slightly in 2027. After that time, the committee expects the unemployment rate to stabilize at a long-run average of 4.2%.

Inflation Expected to Increase Throughout the Year

Despite signs of slowing inflation, the FOMC forecasted that prices would increase by 3.0% for 2025. This represents a marked increase from the 2.7% inflation rate forecasted in March. Chair Powell indicated that the impact of tariffs influenced this adjustment.

Looking ahead, inflation is expected to fall to 2.4% next year and continue declining to 2.0% in 2027. The FOMC projects that the inflation rate will then converge to the long-run average of 2.0%.

The table below summarizes the changes to FOMC projections from the last estimates in March.

Expectations For the Future of the Economy and Monetary Policy

Chair Powell noted that uncertainty surrounding the economic outlook has eased somewhat since the last FOMC meeting but remains elevated as tariff talks continue. He suggested that the future of trade policy will likely impact the Fed’s dual mandate of maximum employment and stable prices, consequently influencing the course of future monetary policy actions.

Despite persistent uncertainty, analysts have already begun to factor the FOMC’s most recent projections into their interest rate forecasts. The CME FedWatch tool compiles these forecasts by measuring activity in Fed Funds futures markets, and the tool currently shows an 89% probability of interest rates remaining steady at the next meeting in July. Then, it shows a 56% probability of a rate cut at the following meeting in September.

In agreement with the FOMC’s projections, a majority of analysts predict the Fed Funds rate will drop below 4% by the end of the year. However, the course of interest rates is highly dependent on the rapidly changing economy and the labor market.

Subscribe For More Interest Rate News and Valuable Insights

At American Deposit Management, we strive to provide valuable information to business and banking leaders that helps drive their strategic decisions. Our weekly articles cover developments in monetary policy, business cash management, and banking.

Find our past articles on the Insights page and subscribe to our weekly newsletter to have our publications delivered straight to your inbox. Also, don’t forget to follow us on LinkedIn so you never miss an update.

An Overview of Regulations Governing the Management of Public Funds

Public entities like school districts and municipalities are held to specific regulations that govern the ways funds are invested.

Business Escrow in 2026

Business escrow services are not a new concept, but modern solutions should offer far more than companies could expect in the past.

FOMC Meets in January Amid Continued Inflation and Softening Employment

The FOMC met for the first time in 2026 on January 27th and 28th. At that meeting, they voted to hold the Fed Funds Rate steady.