FOMC Holds Interest Rates Steady, Projects Longer Recovery

At this week’s FOMC meeting, committee members followed expectations and held interest rates steady. However, the meeting still generated important news that could impact your business.

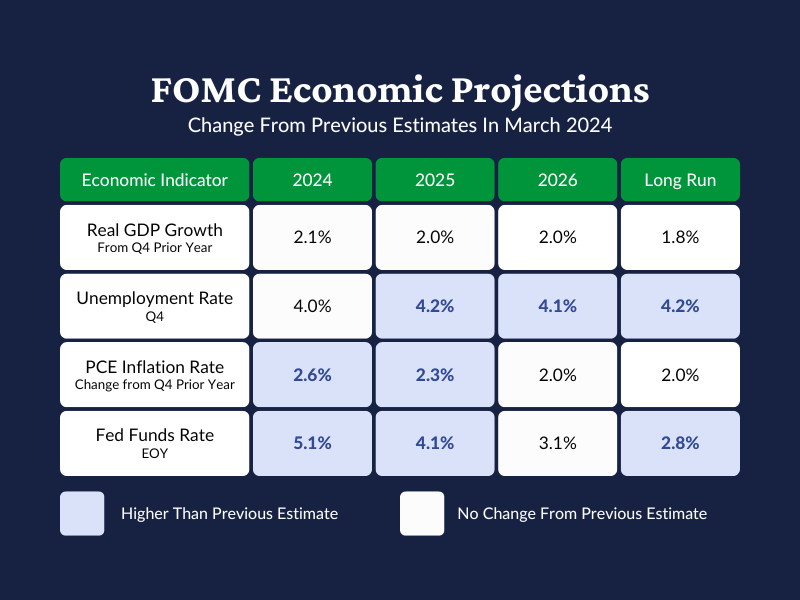

Notably, the committee released updated projections for the economy and interest rates. These updates could reshape your company’s predictions and help you better prepare for the evolving economic situation.

FOMC Holds Interest Rates Steady

The FOMC left the Fed Funds Rate unchanged at a target range of 5.25 – 5.50% for the seventh consecutive meeting. This decision was almost universally anticipated by analysts given the Fed’s recent language.

At the last FOMC meeting in April, committee members stated that they would need additional evidence that inflation was moving toward the 2% target before lowering interest rates. Since that time, the committee judged that there has been “modest further progress” toward their inflation goal. However, recent data shows little change to economic activity, inflation, or employment since the previous meeting.

Since the prior meeting in March:

- The Bureau of Economic Analysis [BEA] revised first quarter real GDP from 1.6% in the first estimate to 1.3% in the latest estimate released on May 31st.

- New data from the BEA showed that inflation – as measured by the PCE Price Index – held steady at 2.7% from March to April.

- The Bureau of Labor Statistics reported that the unemployment rate rose by 0.1 percentage points to 4.0% in May.

Overall, the FOMC described economic activity as expanding at a “solid pace” and unemployment as “low.” These positive descriptors were offset by the mention that inflation “remains elevated” despite recent progress in that area.

New Projections Signal a Longer Recovery

In addition to an interest rate decision and commentary on the current economic situation, committee members updated their projections for the future. The latest estimates show a steady path toward economic equilibrium, but their anticipated “finish line” has shifted in some key areas.

Economic Growth Expectations Held Steady

Committee members left their estimates for GDP growth unchanged from the previous meeting. They anticipate economic activity to expand by 2.1% this year, 2.0% in 2025 and 2026, and 1.8% per year in the long run.

Higher Unemployment Anticipated

The expected unemployment rate for this year held steady at 4.0% but rose by 0.1 percentage points in each of the next two years to 4.2% and 4.1%, respectively. The long-run expectation for the unemployment rate was also revised upward by 0.1 percentage points to 4.2%.

Inflation To Slowly Decline

The projected path of inflation was also revised upward. By the end of this year, the FOMC expects the PCE inflation rate to reach 2.6% – which is 0.2 percentage points higher than the previous estimate. Committee members also raised their 2025 estimates by 0.1 percentage points to 2.3%. However, expectations for the inflation rate in 2026 and long-run held steady at 2.0%.

Interest Rates Expected to Fall More Slowly

The latest estimates show a long-run Fed Funds Rate of 2.8% – up from 2.6% in the previous projections. The path toward that goal has also shifted to show a more gradual series of interest rate reductions including an end-of-year Fed Funds Rate of 5.1% this year – up from 4.6% in the previous estimate.

An end-of-year Fed Funds Rate of 5.1% suggests only one interest rate cut this year. Analysts expect that cut to come at September’s meeting at the earliest. In the meantime, we’ll continue to monitor inflation and economic data for clues to the Fed’s next move.

Follow ADM For the Latest Interest Rate and Business News

At the American Deposit Management Co. [ADM], we help companies stay informed with the latest business, banking, and interest rate news. Subscribe to our mailing list to receive our weekly insights direct to your inbox.

If you’re looking for more valuable information today, visit our Insights page and follow us on LinkedIn, Twitter, and Facebook.

FOMC Meets in January Amid Continued Inflation and Softening Employment

The FOMC met for the first time in 2026 on January 27th and 28th. At that meeting, they voted to hold the Fed Funds Rate steady.

How Are Money Market Account Yields Determined?

Yields for money market accounts can vary widely between banks based on business needs, regulatory changes, and competition.

FDIC Insurance Limits in 2026

The Federal Deposit Insurance Corporation guarantees the safety of business deposits at member banks up to a certain limit.