FOMC Lowers Interest Rates at September Meeting

At the September FOMC meeting, committee members announced the first interest rate cut since March 2020. This decision was well-telegraphed, but still momentous for individuals and businesses hoping to capture favorable rates for their loans.

In addition to the interest rate announcement, the FOMC released updated projections for the future of the economy and interest rates. With the immediate future of monetary policy settled and projections for the future, companies can begin to update their own outlook and adjust their strategies to make the most of lower rates.

FOMC Announces Lower Interest Rates

The FOMC voted to reduce the Fed Funds Rate by 0.50% to a target range of 4.75 – 5.00%. This cut was larger than the Fed’s typical 0.25% rate reduction, though the decision did not come as a surprise to those who have been following the Fed’s updates in recent weeks. In fact, Federal Reserve Chairman Jerome Powell said that “the time has come” for interest rate cuts back in August at the annual Jackson Hole conference.

Since that time, analysts solidified their forecasts and projections showed a 100% probability of a rate cut prior to the start of the meeting. Additionally, bond and mortgage markets reflected the rate cut before it occurred with rates for mortgages falling to a 19-month low last week.

Data Supporting the Interest Rate Decision

The FOMC is tasked with a dual mandate to support price stability and maximum employment. In a press conference following the announcement, Federal Reserve Chairman Jerome Powell said that the risks to inflation have come down in recent months while the risks to unemployment have increased. Due to this dynamic, the larger-than-average rate cut was appropriate. Recent data supports this claim.

According to the latest data from the Bureau of Economic Analysis [BEA], the Personal Consumption Expenditures Price Index – the Fed’s preferred inflation gauge – rose by 2.5% in July. This figure remains above the Fed’s 2% target but is down considerably from recent highs and continuing to trend lower.

While inflation appears to be moving in a positive direction, data from the Bureau of Labor Statistics shows that the labor market is weakening. The unemployment rate was 4.2% in August, down by 0.1 percentage points from the prior month but up by 0.4 percentage points from one year ago.

Chairman Powell also mentioned that economic growth remains strong. This is not officially a part of the Fed’s mandate, but the overall economy can impact their goals. Recent data from the BEA supports Chairman Powell’s claim. In fact, GDP more than doubled from 1.4% in the first quarter to 3.0% in the second quarter.

Together, a strong economy, moderating inflation, and rising unemployment drove the Fed’s interest rate decision. These factors also contributed to their most recent forecasts for the future of monetary policy and the economy.

Updated Projections for the Economy and Interest Rates

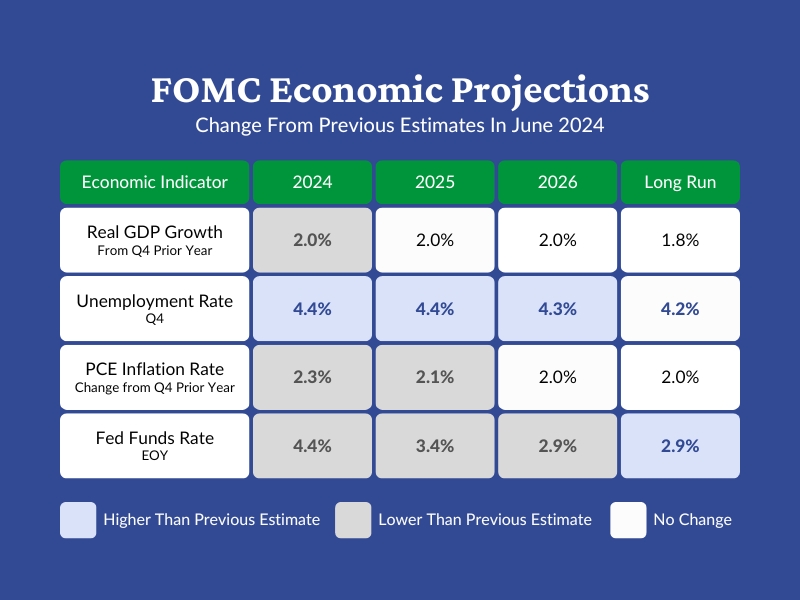

The FOMC releases projections for the economy and interest rates four times per year. The last forecasts were in June and much has changed since that time.

See the graphic below for an overview of the changes.

Unemployment Set to Rise

FOMC members increased their forecasted unemployment rate for year-end 2024 by a substantial 0.4 percentage points to 4.4%. This updated forecast suggests that the labor market will weaken further this year.

Unemployment expectations for the coming years were also revised upwards to 4.4% in 2025 and 4.3% in 2026. However, the long-run forecast held steady at 4.2%.

Inflation Expected to Fall

As incoming data shows a clear downward trend for inflation, FOMC members reduced their expected end-of-year inflation rate by 0.3 percentage points to 2.3%. They also lowered their forecasts for expected inflation in 2025 by 0.2 percentage points to 2.1%. Long-run inflation expectations held steady at the Fed’s target of 2%.

Economic Growth Expectations Were Mostly Unchanged

The projections for economic growth remained relatively stable from the previous forecasts. Projected GDP growth in 2024 was lowered by 0.1 percentage points to 2.0%, but forecasts for the following years held steady.

Interest Rates Projected to Decline

Arguably the most substantial change in the FOMC’s projections was the dramatic reduction in their expected end-of-year Fed Funds Rate. In the June projections, they anticipated this rate to be 5.1% at the end of 2024. Now, they expect it to be 4.4%. The committee projects interest rates will fall further in 2025 and 2026 before settling at 2.9% in the long run.

Chairman Powell ended his prepared speech by reiterating that the projections are not a plan. Instead, the Fed will continue to make decisions meeting by meeting. He also stated that the committee is prepared to adjust if inflation or the labor market produce unexpected results.

Follow ADM For More Valuable Insights

At the American Deposit Management Co. [ADM], we provide actionable resources for leaders in the business and banking industries. Our weekly articles and coverage of recent developments provide the information you need to stay up to date.

Read our past articles on our Insights page and subscribe to our mailing list so you never miss an update. Also, don’t forget to follow us on LinkedIn, Twitter, and Facebook.

An Overview of Regulations Governing the Management of Public Funds

Public entities like school districts and municipalities are held to specific regulations that govern the ways funds are invested.

Business Escrow in 2026

Business escrow services are not a new concept, but modern solutions should offer far more than companies could expect in the past.

FOMC Meets in January Amid Continued Inflation and Softening Employment

The FOMC met for the first time in 2026 on January 27th and 28th. At that meeting, they voted to hold the Fed Funds Rate steady.