FOMC Lowers Interest Rates at Final 2024 Meeting

The FOMC voted to cut interest rates at the September and November meetings. This trend continued at the most recent meeting that was conducted on December 17th and 18th. All three of these cuts were widely telegraphed and came as no surprise to those who had been following analyst forecasts.

Along with the interest rate decision, committee members released updated projections for the economy and interest rates. Business leaders who follow this data can better forecast the future of monetary policy and adjust their strategies to make the most of easing interest rates.

FOMC Further Reduced Interest Rates

Committee members voted to reduce the Fed Funds Rate by 0.25 percentage points – resulting in a target range of 4.25 – 4.50%. This aligned the Fed Funds Rate with the FOMC’s September projection that indicated a year-end rate of 4.4%.

In his statement, Fed Chairman Powell noted that cumulative effects this rate cut cycle have placed interest rates in a more “neutral” position. He continued that neutral rates allow the committee to be more cautious as they consider further adjustments – dampening expectations of more rate cuts in the near term.

Recent Economic Data Supports the Fed’s Decision

In the statement announcing the interest rate cut, the committee mentioned that data supported their decision. The three data points they highlighted as particularly important were a solid pace of economic growth, some weakening in the labor market, and progress toward their inflation goals.

Solid Economic Growth

The latest data from the Bureau of Economic Analysis shows that real GDP rose at an annual rate of 2.8% in the third quarter following a 3.0% increase in the second quarter. Both quarters outpaced the Fed’s estimated long-run average for GDP, demonstrating a solid pace of growth despite restrictive monetary policy. While the Fed’s “dual mandate” does not cover economic growth, the committee must still monitor developments in the economy since their actions can have a significant impact.

A Weakening Labor Market

The unemployment rate has risen steadily this year, and in May, it surpassed 4.0% for the first time since January 2022. The most recent data from the Bureau of Labor Statistics shows the unemployment rate at 4.2%. Maximum employment is one part of the Fed’s “dual mandate,” so they tend to pay close attention to changes to the workforce.

While the unemployment rate has risen significantly over the past year, the Fed still describes it as low. Additionally, Chair Powell mentioned that downside risks to the labor market have diminished since the last FOMC meeting in September.

Inflation Remains Elevated

The Personal Consumption Expenditures [PCE] inflation rate currently sits at 2.3% – down from the highs last year but still above the Fed’s 2% target. This is the Fed’s preferred measure of inflation and achieving their target is the other half of their “dual mandate.”

Overall, the Fed must find the balance between promoting maximum employment and price stability without causing undo harm to economic growth. The latest interest rate cut has the potential to help prevent further weakening of the labor market but could result in elevated inflation for a longer period.

FOMC Released Updated Economic Projections

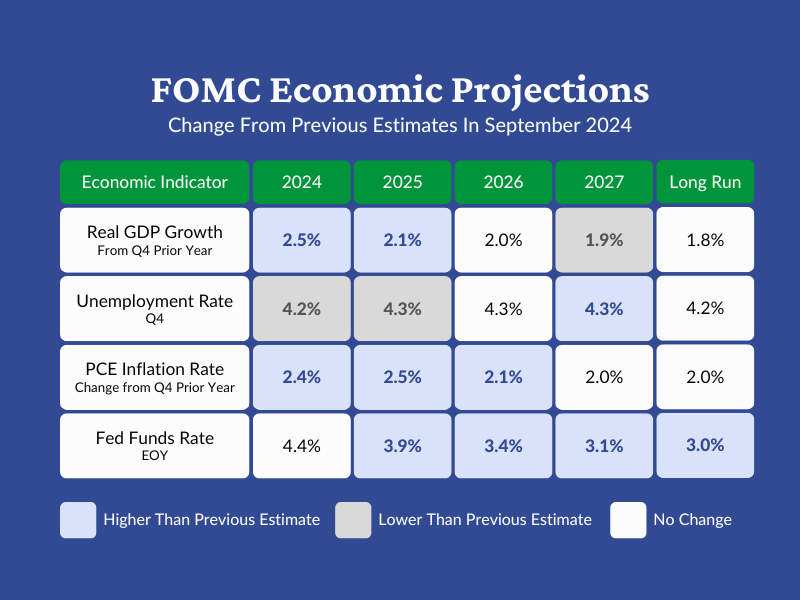

Along with the interest rate decision, committee members published updated projections for the economy, labor market, inflation, and interest rates. The latest forecasts show a significant shift from the outlook presented in the last projections released in September. See the table below for an overview of the changes.

Economic Growth Expected to Steadily Decline

The latest projections show real GDP falling from 2.5% in 2024 to 2.1% in 2025. Then, growth is expected to slow further in the following two years before settling at 1.8% in the long run.

Unemployment Expected to Be Relatively Stable in The Coming Years

Committee members expect the unemployment rate to rise marginally from 4.2% in 2024 to 4.3% in 2025. It is then expected to hold steady for the following two years before declining to 4.2% in the long run.

Inflation To Remain Elevated Through 2026

Prices are expected to rise faster than the Fed’s target in 2024 and 2025. Then in 2026, the Fed expects the pace of inflation to begin slowing and reach the 2% target in 2027. Price growth is forecasted to continue at the Fed’s target in the long run.

Interest Rates Projected to Fall at A Slower Pace

The Fed’s expectations for the Fed Funds Rate were markedly changed from the September projections. The committee projected in September that interest rates would fall by 1 percentage point in 2025. That estimate has been cut in half and committee members now expect just a 0.5 percentage point reduction.

Forecasts for the following years were similarly adjusted, and the Fed’s latest projections show a steady decline in interest rates from 2025 through 2027. After that time, the committee expects the Fed Funds Rate to settle at 3.0% in the long run.

While the latest projections can be a useful tool to predict the future of the economy and interest rates, Chair Powell has made it clear that they are not a plan of action. Instead, the committee will continue to make decisions meeting by meeting based on incoming data.

Follow ADM For More Valuable Insights

At American Deposit Management, we publish weekly articles that provide the information leaders need to inform their decisions. Our analysis covers topics related to the economy, business, and banking. Review past coverage on our Insights page and subscribe to our mailing list to have our updates delivered straight to your inbox. Also, don’t forget to follow us on LinkedIn, Twitter, and Facebook for the most up-to-date information.

An Overview of Regulations Governing the Management of Public Funds

Public entities like school districts and municipalities are held to specific regulations that govern the ways funds are invested.

Business Escrow in 2026

Business escrow services are not a new concept, but modern solutions should offer far more than companies could expect in the past.

FOMC Meets in January Amid Continued Inflation and Softening Employment

The FOMC met for the first time in 2026 on January 27th and 28th. At that meeting, they voted to hold the Fed Funds Rate steady.