FOMC Maintains Interest Rates and Updates Economic Projections

The Federal Open Market Committee [FOMC] met for the second time in 2025 on March 18th and 19th. Like the previous meeting, they decided to hold interest rates steady. The move was well-telegraphed with nearly 97% of analysts correctly predicting the outcome prior to the meeting.

While there was no surprise in terms of an interest rate decision, the committee did provide updated forecasts for the future of monetary policy and the economy. This information is vital to business leaders as they prepare their own projections.

Interest Rates Unchanged at March Meeting, Projected to Decline

The FOMC left interest rates unchanged at a target range of 4.25 – 4.50%. They have maintained this level of the Fed Funds Rate since the last reduction in December 2024.

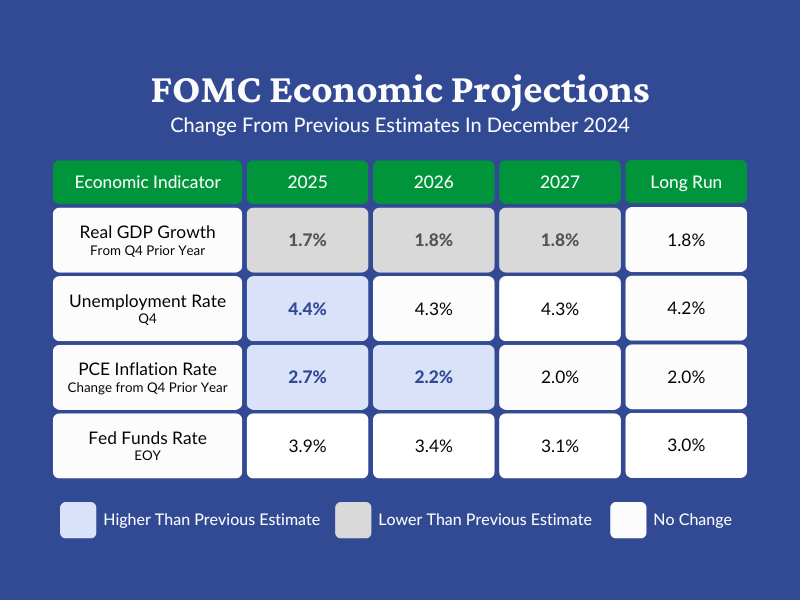

Forecasts for the Federal Funds Rate were unchanged from the previous projections released in December. They continue to show an end-of-year Fed Funds Rate of 3.9% in 2025 – signaling a reduction of about half a percentage point from the current level. Interest rates are expected to decline further in 2026 and 2027 before settling at 3.0% in the long run.

The committee also announced an update to their current bout of quantitative tightening which began in June 2022. Rather than the current $25 billion per month reduction in Treasury security holdings, they will lower the redemption cap to $5 billion per month beginning in April. They will continue to reduce holdings of mortgage-backed securities at a pace of $35 billion per month consistent with their long-term plan to only hold Treasury securities on the balance sheet.

New Data and Updated Economic Projections

The FOMC uses many economic signals to inform their decisions. Three of the most frequently referenced are Gross Domestic Product [GDP], the unemployment rate, and the inflation rate. Each of these reports was updated between the January and March FOMC meetings and factored into the committee’s most recent decision.

Along with informing the interest rate decision, committee members released updates to their projections for these areas of the economy. The committee updates their forecasts four times per year, and the prior update was released in December 2024.

Fourth Quarter GDP Growth Slowed, Projections Revised Down

The Bureau of Economic Analysis [BEA] released a revised estimate of fourth quarter GDP on February 27th. It showed that real GDP rose by 2.3% in the fourth quarter following a rise of 3.1% in the third quarter.

In the December projections, committee members forecasted GDP growth of 2.1% this year. They reduced this estimate considerably in the latest forecasts and now expect a growth rate of 1.7%. Their projections for 2026 and 2027 GDP growth were also revised downward, though less substantially.

Unemployment Rate Rose Slightly, Projections Mostly Unchanged

Data from the Bureau of Labor Statistics released on March 7th showed that unemployment ticked up by 0.1 percentage points to 4.1% but remained within the narrow band of 4.0 – 4.2% that it has maintained since May. Federal Reserve Chairman Jerome Powell said that conditions in the labor market are “broadly in balance” in a press conference following the interest rate announcement.

FOMC members revised their estimate of the year-end unemployment rate for 2025 upward by 0.1 percentage points to 4.4%. If this forecast proves accurate, the labor market will weaken slightly throughout the year. That weakness is expected to moderate in 2026 when the unemployment rate is projected to decline to 4.3%.

Inflation Ticked Down, Short-Term Forecasts Revised Upward

The BEA reported that Personal Consumption Expenditure [PCE] prices rose by 0.3% in January – the same rate as December. The report also showed that the PCE inflation rate was 2.5% in January – a decline of 0.1 percentage points from the previous month. While the PCE inflation rate slowed marginally, it remains well above the Fed’s 2% target.

In addition to the inflation rate remaining elevated, Chair Powell noted that a broad range of surveys have shown higher inflation expectations in the near term. One such survey is the Surveys of Consumers Report from the University of Michigan which showed three consecutive months of unusually large increases in the year-ahead inflation estimate.

In light of this data, committee members also increased their forecasts for the PCE inflation rate in 2025 by 0.2 percentage points to 2.7%. The latest projection indicates an anticipated rise in the inflation rate from its current level. The estimates show the inflation rate declining to 2.2% in 2026 before falling to the Fed’s target of 2.0% in 2027.

The chart below summarizes the changes to FOMC economic and interest rate projections.

Expectations For Future Monetary Policy Actions

Currently, market expectations roughly match the Fed’s interest rate forecasts. The CME FedWatch tool predicts 2 rate cuts in 2025, with approximately a 15% chance of a cut at the next meeting in May and about a 62% chance of a cut by the following meeting in June.

As Chair Powell mentioned in his press conference, there is considerable economic uncertainty at the present time. He noted several factors that could influence the future of the economy including trade policies, immigration, and fiscal policy.

While the Fed is attuned to the potential effects of these policies, they choose to make their decisions based on hard data. Their statement announcing the interest rate decision reiterated that the future stance of monetary policy will be determined based on incoming data such as “readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.”

As the Fed continues to monitor this incoming data, business leaders should do the same. The high degree of uncertainty could lead to rapid changes in the economic situation that drive both the FOMC’s decisions and the business landscape.

Subscribe For More Valuable Insights

At American Deposit Management, we strive to provide the information that business leaders need to inform their decisions. Our weekly articles highlight changes in interest rate policy and developments in the business and banking industries.

Find our past articles on the Insights page and subscribe to our weekly newsletter to have our articles delivered straight to your inbox. Also, don’t forget to follow us on LinkedIn so you never miss an update.

An Overview of Regulations Governing the Management of Public Funds

Public entities like school districts and municipalities are held to specific regulations that govern the ways funds are invested.

Business Escrow in 2026

Business escrow services are not a new concept, but modern solutions should offer far more than companies could expect in the past.

FOMC Meets in January Amid Continued Inflation and Softening Employment

The FOMC met for the first time in 2026 on January 27th and 28th. At that meeting, they voted to hold the Fed Funds Rate steady.