Too Big to Fail: A History of Global Systemically Important Banks

Failures of financial institutions are an unfortunate, but widespread, aspect of American history. They are often a result of economic turmoil and sometimes spur action by the federal government to avoid similar tragedies in the future.

A new term emerged during the 2008 financial crisis to describe certain companies as “too big to fail.” For the banking system, this designation refers to Global Systemically Important Banks [G-SIBs], and the changes implemented after the crisis marked a significant shift in banking regulations.

The Rise of Bank Interconnectedness

The concept of banking has a long history, but it took a significant stride forward in the early twentieth century alongside the proliferation of globalization. During this time, innovations in communications technology spurred the rise of large, national banks with extensive footprints.

Toward the end of the century, further technological innovations and rapid deregulation in the banking industry coincided with a new wave of globalization. Banks grew exponentially in both size and complexity as a result, and a more highly connected financial system emerged. The modern system proved efficient, but it also presented new risks.

A Financial Crisis Brought Systemic Risk to the Forefront

During the Great Recession of the late 2000’s and the bursting of the housing bubble, the value of mortgage-backed securities plummeted. Losses from these securities cascaded through financial markets with disastrous consequences.

The crisis culminated with the failure of two prominent investment banks – Lehman Brothers and Bear Stearns. Similar to bank runs of the past, the failures sowed doubt within the broader economy and highlighted weaknesses in the financial system.

Around the time Lehman Brothers collapsed, American International Group [AIG] – the largest insurer in America at the time – was also on the brink of failure. Unlike Bear Stearns and Lehman Brothers, the U.S. government stepped in and rescued AIG in September 2008.

Later that month, a slew of bank failures began. Governments across the globe were forced to bail out some of the largest banks to prevent the collapse of the entire, interconnected global economy. During this intervention, some large financial companies, including several banks, were deemed “too big to fail.”

The FSB Was Created, and the First G-SIBs Were Identified

The Financial Stability Board [FSB] was created in 2009 as an international body tasked with protecting the global financial system. This body, along with the Basel Committee on Banking Supervision [BCBS], created the framework for identifying G-SIBs.

The FSB and BSCB use 5 criteria to determine which banks earn the designation of G-SIB:

- size

- interconnectedness

- substitutability

- global activity

- complexity

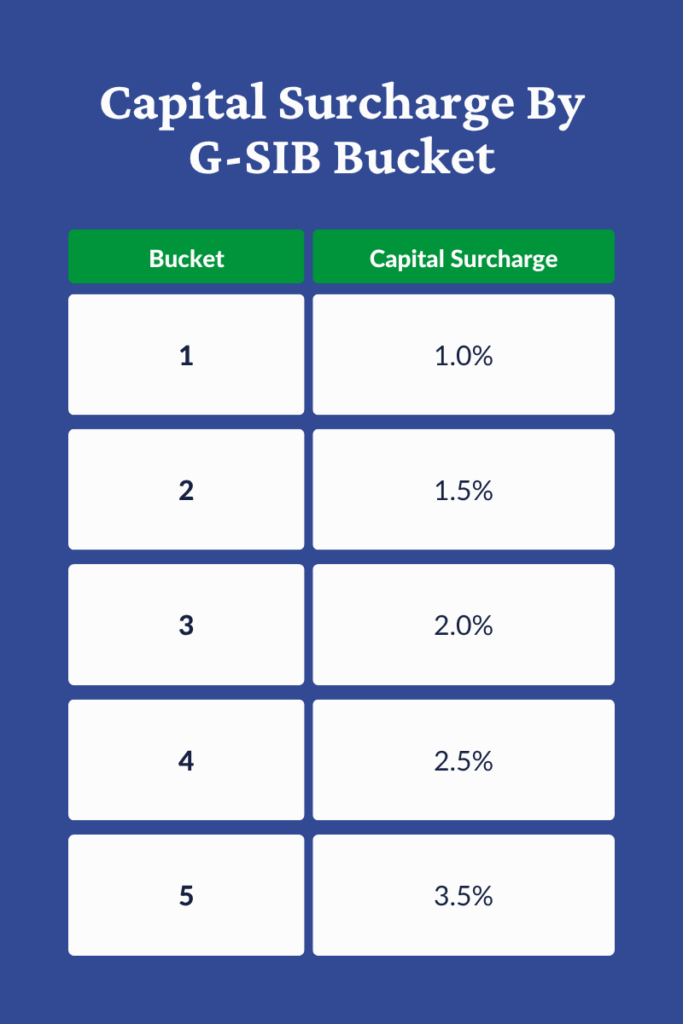

Based on scores in these categories, banks are placed into 1 of 5 “buckets.” Bucket 1 represents banks with the least amount of systemic risk and Bucket 5, while it has never been used, would represent banks with the highest level of systemic risk. These buckets determine the additional requirements a bank must meet to ensure it can withstand a market shock.

Regulation of G-SIBs

To reduce the likelihood of another bailout, G-SIBs are required to have a higher capital buffer than other banks, and the amount they are required to hold corresponds to their bucket. They must also meet Total Loss-Absorbing Capacity or TLAC requirements that detail minimum amounts of capital and eligible debt that would be sufficient to absorb potential losses.

In addition to more cash on hand, G-SIBs are required to maintain resolution plans, which detail a framework for handling emergency circumstances. Finally, these organizations are required to perform additional supervision over risk management functions, risk data aggregation capabilities, risk governance, and internal controls.

Which Banks Are G-SIBs?

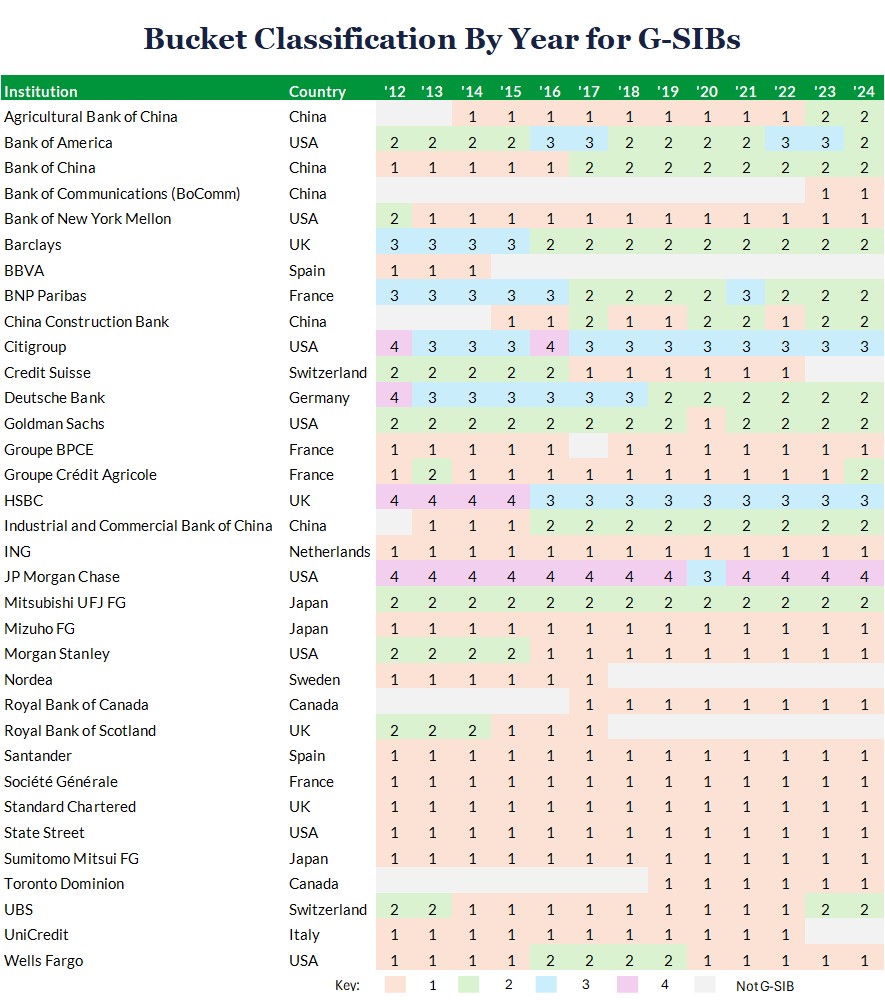

There are currently 29 G-SIBs, and the majority are in the lowest buckets, 1 and 2, which correspond to the lowest capital surcharges of 1.0% and 1.5%, respectively. This surcharge is the amount of additional capital the bank must hold in addition to risk-based capital requirements and other buffers. Two banks are in bucket 3, Citigroup and HSBC, and these organizations must meet a higher capital surcharge of 2.0%. Further, JP Morgan Chase is the only bank in bucket 4 and is subject to a capital surcharge of 2.5%.

The composition of the G-SIB bank list changes each year as scoring criteria are updated and global financial institutions are reevaluated. The following table summarizes the changes to G-SIBs since the list was first developed in 2011.

Why Should Businesses Care About G-SIBS?

When determining the best partner to hold a company’s cash, classification as a G-SIB is generally not an important factor. Instead, cash managers typically focus on the safety, accessibility, and returns they can achieve with a particular bank.

All U.S. banks that are members of the FDIC, including G-SIBs, offer the same government protection of $250,000 per ownership category. Companies seeking safety for cash above this limit may feel more comfortable with a G-SIB that is subject to additional capital requirements than a smaller bank. However, there are more robust options to achieve safety for large cash reserves along with accessibility and superior returns.

The right cash management partnership can provide access to unlimited government insurance from the FDIC or NCUA – the most robust protection for cash reserves. Along with extended safety, businesses can achieve 7x more interest income than the average money market account and next-day access to funds.

Secure Your Company’s Cash With ADM

At American Deposit Management, we help businesses keep their cash safe and earning a competitive rate of return. Our patent-pending technology enables us to spread millions in funds across a network of banks and credit unions that compete for deposits. In turn, our clients receive access to unlimited deposit protection.

Our solutions go beyond extended safety and provide access to exclusive interest rates that typically generate significantly more income than the average money market account. Further, we offer a variety of liquidity options, including next-day access.

To learn more about our deposit management services, contact a member of our team today.

An Overview of Regulations Governing the Management of Public Funds

Public entities like school districts and municipalities are held to specific regulations that govern the ways funds are invested.

Business Escrow in 2026

Business escrow services are not a new concept, but modern solutions should offer far more than companies could expect in the past.

FOMC Meets in January Amid Continued Inflation and Softening Employment

The FOMC met for the first time in 2026 on January 27th and 28th. At that meeting, they voted to hold the Fed Funds Rate steady.