How Is CD Interest Compounded?

Albert Einstein called compound interest the eighth wonder of the world, and his reasoning still holds true today. Compounding allows cash to grow exponentially over time, because interest is effectively added to the principal so that it too can earn interest.

A Certificate of Deposit is a clear example of an investment that benefits from compounding interest, and CDs are a key part of many business cash management plans. The timing of interest payments and the method of CD compounding can vary between CDs, and understanding the subtle differences is crucial to evaluating the risk and reward.

When is CD interest paid?

Most CDs pay interest on a set schedule throughout the life of the investment – such as daily or monthly. That interest can be paid to the investor or reinvested to take advantage of compounding.

Investors who choose to reinvest their interest should note that the frequency of earning interest and compounding can be the same or they can be different. For example, a CD could earn interest monthly, but compound annually. This information will be detailed in the documentation provided before purchasing the investment.

The timing of interest payments is especially important to investors who experience the need to cash out their CD prior to maturity. In this situation, some CDs prorate unpaid interest while others forfeit unpaid interest.

Another group of people who should pay attention to the timing of payments are those who use interest as income. These people typically receive a check or transfer of interest as it is earned, so it stands to reason that they would be concerned with the date on which they receive their cash. However, the timing of payments is moot for investors who are taking advantage of compounding and planning to hold their CD until maturity.

How Is CD Interest Compounded?

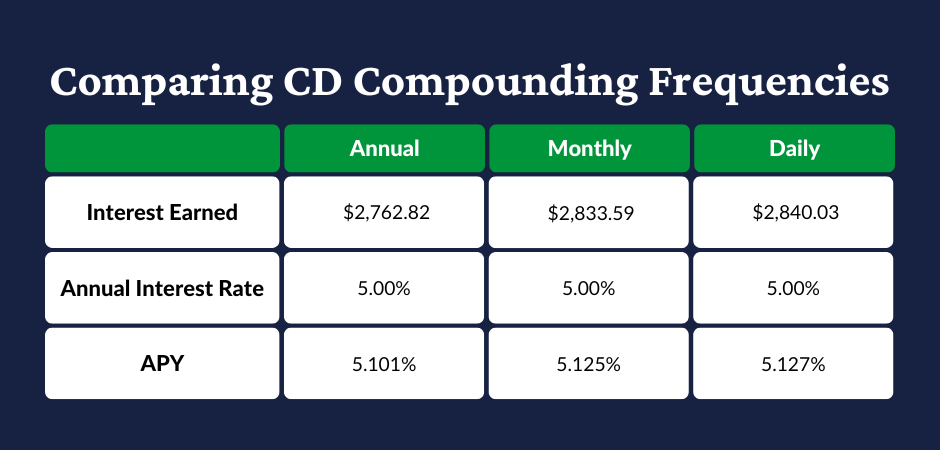

CDs earn compound interest according to a set timeframe – usually annually, monthly, or daily – that is explained in the documentation provided before purchase. The more frequently a CD compounds, the more interest is earned over the total life of the investment – with all other factors remaining constant.

Annual Interest Compounding

When a CD earns compound interest on an annual basis, the interest is applied to the principal once per year. The next year, interest is calculated on the total balance including principal and previously earned interest.

Consider this simplified example to illustrate the effect of annual compounding interest. A business buys a $10,000 CD with a 5-year term at an annual interest rate of 5%, compounded annually. At the end of the first year, the interest is calculated by multiplying the principal by the annual interest rate. This gives an interest amount of $500. That interest is added to the CD’s principal and brings the total balance to $10,500. At the end of the second year, the interest is calculated by multiplying the new balance by the annual interest rate. This provides a slightly higher interest amount of $525 after year two. That interest is added to the balance of the CD, and the process continues until the CD matures. At the end of the CD term, the total interest earned is $2,762.82.

Monthly Interest Compounding

With monthly compounding, interest is compounded twelve times per year, usually on a set day of the month. This results in a slightly higher total amount of interest earned than annual compounding when all other factors remain constant.

To illustrate, consider a modification to the previous example. The business buys a $10,000 CD with a 5-year term at an annual interest rate of 5%, compounded monthly. The interest rate is divided by 12 to calculate a monthly interest rate of approximately 0.417%. At the end of the first month, the principal is multiplied by the monthly interest rate to get an interest amount of $41.66. This is added to the principal, and the new balance is $10,041.66. At the end of the second month, the interest is calculated by multiplying the new balance by the monthly interest rate, which gives a slightly higher interest amount of $41.84. This process continues throughout the term of the CD and results in a total interest amount of $2,833.59 – an increase of $70.77 over the annually compounded CD in the prior example.

Daily Interest Compounding

Some CDs compound interest daily. This allows the investor to earn even more interest over the life of the investment than monthly or annual compounding, with all other factors remaining consistent.

This simplified example will illustrate the process of daily compounding. A business buys a $10,000 CD with a 5-year term at an annual interest rate of 5%, compounded daily. The interest rate is divided by 365 to calculate a daily interest rate of approximately 0.014%. At the end of the first day, the principal is multiplied by the daily interest rate to get an interest amount of $1.3699. Like the previous examples, the interest is added to the principal – bringing the new balance to $10,001.37. At the end of the second day, the interest is calculated by multiplying the new balance by the daily interest rate, which gives an interest amount of $1.3701. Over the course of the investment, the daily interest amount will slowly increase as the CD earns interest on both the principal and accrued interest. At the end of the CD term, the total interest earned is $2,840.03 – an increase of $6.45 over the monthly compounded CD in the prior example.

How to Compare CDs With Different Compounding Frequencies? APY.

Annual Percentage Yield – more commonly referred to as APY – is an incredibly useful tool to compare CDs. It is a standardized measure that takes the effects of compounding into consideration and provides a rate of return that can be used as an apples-to-apples comparison.

Other types of deposit accounts such as savings and money market deposit accounts also quote their yields using APY. This allows cash managers to compare the various options for investing their cash with confidence.

Considerations When Buying CDs

In order to weigh the risk and reward for a particular CD, a cash manager needs to understand a few factors. These include the interest rate, APY, schedule for earned interest, compounding frequency, early withdrawal penalty, and whether interest will be prorated if they need to access the funds before maturity.

All this information is available in the documentation provided before purchasing the CD. However, it can be extremely time consuming to manually compare dozens or hundreds of CDs. Fortunately, the right deposit management partner can help businesses compare CDs from hundreds of banks across the nation and choose the most advantageous option.

Get Nationally Competitive Returns for CDs with ADM

At American Deposit Management, we offer CDs for business from our nationwide network of banks and credit unions that compete for deposits. This allows our clients to receive nationally competitive rates of return.

In addition to competitive interest rates, our solutions spread business cash across our network so that every penny has access to full government insurance from the FDIC or NCUA. To learn more about how we provide access to extended safety and nationally competitive returns, contact a member of our team today.

The One Account Advantage for Business Cash Management

Fragmented cash management creates unnecessary complexity, but a consolidated platform can fundamentally reshape your results.

Q4 Banking Trends: Strong Net Income, Rising Deposits, Lower Unrealized Losses

American banks reported strong net income and lower unrealized losses alongside higher loan balances and deposit levels in Q4 2025.

How Did the Gramm-Leach-Bliley Act Facilitate Bank Consolidation?

The Gramm-Leach-Bliley Act passed in 1999 and ushered in a new era of consolidated, one-stop shop banking that perseveres today.