How Does the Fed Funds Rate Impact CD Yields?

Yields for newly issued Certificates of Deposit [CDs] change regularly based on the needs of the financial institution issuing the investment and market factors. One of the most prevalent of these market factors is the Fed Funds Rate.

The relationship between the Fed Funds Rate and CD yields is indirect, but it can greatly influence the amount of interest a business can earn. Cash managers who understand this relationship can time their CD purchases to take advantage of elevated yields and keep their reserve cash working.

How does the Fed Funds Rate impact CD yields?

Banks have autonomy when setting the rates they pay for CDs. However, many external factors influence these rates including bank revenue, yields for debt investments, and consumer expectations. The Fed Funds Rate impacts each of these factors and therefore indirectly affects CD yields.

Bank Revenue

As the Fed Funds Rate rises, many of the country’s interest rates typically follow – including bank loans. Banks can afford to pay businesses more for their CD investments when interest rates are high and they earn more revenue from loans. Conversely, banks tend to reduce the rates they pay for CDs when interest rates are lower, and they earn less revenue from loans.

Returns on Debt Investments

Like other forms of debt, bond yields are highly sensitive to changes in the Fed Funds Rate. Bank CDs often compete with bonds, so the rates for the two investments tend to move similarly.

Consumer Expectations

Changes to the Fed Funds Rate impact consumer expectations. Depositors expect their investments to yield more when this rate rises. Therefore, banks often raise the rates they pay for CDs to match consumer expectations. On the other hand, when yields are falling nationwide, depositors expect less income from their investments, and banks tend to lower CD yields.

How closely do CD yields mirror the Fed Funds Rate?

The Fed Funds Rate sets somewhat of a baseline for CD yields. Then, other factors – like risk – determine the yield for specific CDs.

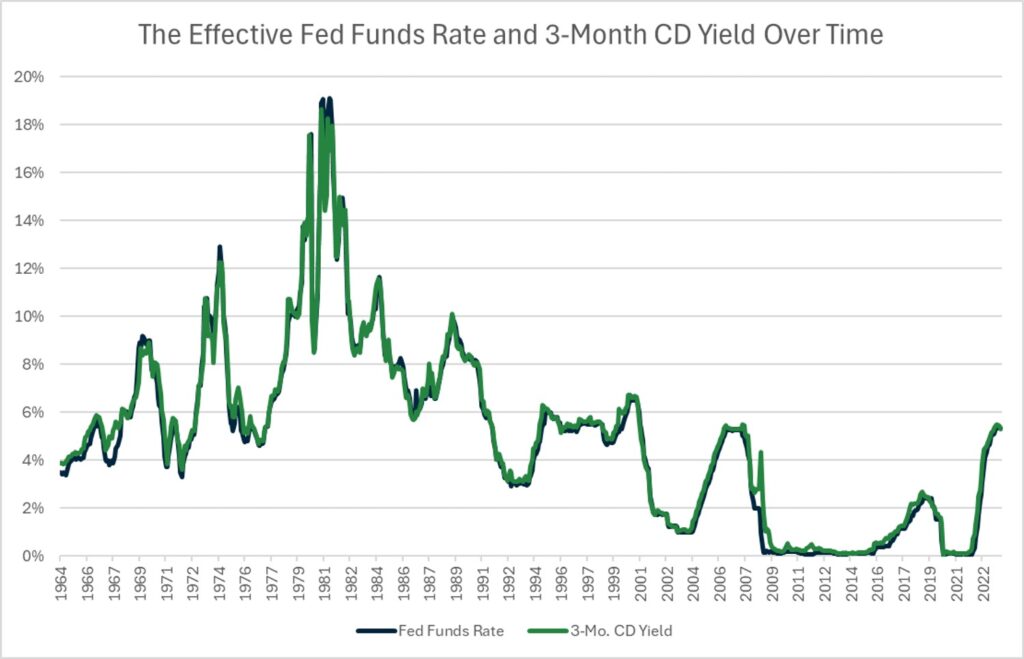

The Fed Funds Rate has historically had the strongest correlation with low-risk CDs. In fact, the national average rates for 3-month CDs have moved almost in tandem with the Effective Fed Funds Rate since 1964.

In the chart below, the blue line represents the Effective Fed Funds Rate, and the green represents the average 3-month CD yield. As you can see, these two rates have moved almost in lockstep for nearly sixty years.

Data sources: Effective Fed Funds Rate: FRED. 3-month CD Rates: FRED.

Other Factors that Impact CD Yields

While the Fed Funds Rate has an outsized impact on CD yields, other factors also influence the rate that banks pay for these investments. As previously mentioned, risk is among the most prominent of these factors. Additionally, individual bank needs can lead CD rates to vary significantly between banks and geographical areas.

How Risk Impacts CD Yields

Longer-term CDs have increased interest rate, inflation, and opportunity risk. For this reason, CDs with longer terms generally have higher yields than shorter-term options in normal economic times. However, when interest rates are rising, these risks can be heightened and demand for long-term CDs can fall. While rare, these changes in demand can lead to an inverted yield curve where shorter-term CDs have higher yields than longer-term options.

Individual Bank Needs Can Influence CD Yields

The rates that each bank offers for CDs can vary greatly depending on their individual needs. Banks that have enough deposits to fund their lending activity typically don’t need to attract new depositors and may pay below average yields. On the other hand, banks that need to attract new depositors tend to raise the rates they pay above the competition.

Because yields can vary dramatically between banks, it requires additional effort for cash managers to determine if they are getting a competitive rate from their local bank. Fortunately, businesses no longer need to manually monitor rates from hundreds of banks to achieve a competitive yield. The right deposit management company can help analyze current CD holdings, invest in new CDs with competitive yields, and even replace current CDs with higher yielding options.

Earn More, Risk Less® with CD Investments from ADM

At American Deposit Management, we offer CD solutions that provide a safe and predictable way for businesses to grow their cash reserves. These solutions allow cash managers to access competitive CD yields from financial institutions across the country, and we do all the work – and never let a CD just roll over into a new term.

Our modern deposit management solutions spread cash across our nationwide network of financial institutions that compete for deposits. This provides access to full government protection from the FDIC or NCUA along with nationally competitive rates of return.

To learn more about our CD solutions for business, contact us today.

How Did the Gramm-Leach-Bliley Act Facilitate Bank Consolidation?

The Gramm-Leach-Bliley Act passed in 1999 and ushered in a new era of consolidated, one-stop shop banking that perseveres today.

An Overview of Regulations Governing the Management of Public Funds

Public entities like school districts and municipalities are held to specific regulations that govern the ways funds are invested.

Business Escrow in 2026

Business escrow services are not a new concept, but modern solutions should offer far more than companies could expect in the past.