Interest Rates and Recession History in the U.S. (1970 – Present)

Federal Reserve Chairman Jerome Powell ended his prepared comments at the most recent FOMC meeting with a familiar refrain, “we [the FOMC] understand that our actions affect communities, families, and businesses across the country.” He uses a variation of this phrase at nearly every meeting, so the words should not be overlooked.

The FOMC’s management of the Fed Funds Rate impacts borrowing costs for American businesses and consumers, which then has a level of impact on the economy. However, an important question remains:

How much influence does monetary policy have on the U.S. economy as a whole?

To answer this question, we will explore monetary policy decisions surrounding the eight recessions since 1969 – as identified by the Econbrowser Recession Indicator Index. These periods of turmoil will provide important evidence on how interest rate changes impact consumers and businesses in the U.S.

The 1970s: A Decade of Inflation and Oil Shocks

Monetary policy in the 1970s and 80s was significantly influenced by the “Great Inflation.” This period began in 1965 and was characterized by persistent inflation and a series of recessions.

The 1969 – 1970 Recession

The Fed Funds Rate was low heading into the “Great Inflation,” but it rose considerably between 1965 and 1969. From a trough of about 1.5% in mid-1961, the Effective Fed Funds Rate rose to 6.3% in January 1969. It continued to climb throughout the year, and the high borrowing costs were partially credited with causing the brief recession at the turn of the decade.

The recession began in Q2 1969 and lasted through Q4 of 1970. During that period, GDP fell by less than 1% and unemployment reached a moderate 5.9%.

The Fed dropped interest rates during the recession, and the Effective Fed Funds Rate tumbled from a peak of 9.19% in summer 1969 to less than 5% at the end of 1970. Lower borrowing costs helped to stimulate economic activity and likely contributed to the short duration of the recession. However, inflation continued to present an issue.

The 1973 – 1975 Oil Embargo Recession

Interest rates started to climb from their post-recession lows in 1972 and continued to rise in 1973. By the end of Q3 1973, the Effective Fed Funds Rate had reached 10.78%.

Around this time, OPEC imposed an embargo on oil imports to the U.S. in response to American support for Israel during the Arab-Israeli War. The sudden spike in oil prices choked economic activity, and a severe recession ensued.

The recession lasted from Q4 1973 to Q1 1975. The crisis spurred a significant reduction in interest rates, and the Effective Fed Funds Rate was virtually halved – falling to 5.54% by March 1975. The end of the oil embargo and increased domestic oil production helped to ease the country out of recession in 1975.

The reduction in interest rates during this recession along with tax cuts that occurred around the same time helped to spur consumer spending and propel economic growth. However, the impact of interest rates during this time is largely discussed in terms of the negative effect of lower rates on inflation, rather than the positive outcome of fostering economic activity.

The First Half of the “Double-Dip” Recession 1979 – 1980

Interest rates remained low for a few years after the 1973 – 1975 recession before starting to rise again towards the end of the 1970s, hitting 10.09% at the end of Q1 1979. This marked the beginning of what would become a “double-dip” recession. The catalysts were a combination of tight monetary policy implemented by the Fed and persistent global energy shortages.

In an unconventional move to combat rampant inflation, the Federal Reserve, under Chairman Paul Volcker, began aggressively raising the Fed Funds Rate. It surged from approximately 11% in 1979 to nearly 18% by the spring of 1980. This aggressive tightening of monetary policy, even in the face of a looming recession, showcased the Fed’s determination to break the back of inflation. By Q2 1980, the effective Fed Funds Rate stood at a staggering 17.19%.

This recession was unique because high interest rates were partially to blame for the economic slowdown. However, the Fed did not reduce the Fed Funds Rate, and the recession ran its course without a significant reduction in rates.

The 1980s: Taming Inflation and Gulf War Impact

The early 1980s were dominated by the continued fight against inflation. This period was characterized by exceptionally high interest rates that brought the inflation rate down from around 12% at the start of the decade to a manageable 4.4% at the end of the period. Then, geopolitical events once again created turmoil by the end of the decade.

The Second Half of the “Double-Dip” Recession 1981 – 1982

After a brief dip in mid-1980, interest rates began to rise toward the end of the year, then continued to climb in 1981before reaching an unprecedented 19.10% in June. Economic activity slowed, with high borrowing costs noted as a contributing factor to the 1981 – 1982 recession.

Interest rates moderated somewhat during the recession and fell to 8.95% by December 1982. Like previous recessions, a reduction in interest rates helped to drive economic growth and pull the country out of recession.

The 1989 – 1991 Gulf War Recession

Interest rates, while lower than their early 1980s peaks, remained relatively high by modern standards through the end of the 1980s. Then, the Gulf War Recession struck from Q4 1989 to Q4 1991. This downturn was largely attributed to a combination of these higher interest rates and a sharp spike in oil prices following Iraq’s invasion of Kuwait.

During this recession, GDP contracted by 1.5%, and unemployment reached 7.8%. In response, the Fed aggressively cut rates, bringing the Fed Funds Rate down significantly. There were five rate cuts in 1990 and ten in 1991, reducing the Fed Funds Rate from 8.25% to 4.00%. The Fed continued to ease monetary policy with three more rate cuts in 1992, pushing the rate down to 3.00%. Rates would not begin to rise again until 1994.

Similar to past periods of economic turmoil, the Fed’s interest rate reductions helped to spur economic growth. In combination with easing energy constraints, lower rates helped to bring an end to the recession.

The 2000s: Tech Bubble and the Great Recession

The new millennium brought two distinct, and memorable recessions. The first was tied to an investment bubble, and the second emerged during a global financial crisis.

The 2000 – 2001 Tech Bubble Recession

The bursting of the “tech bubble” was the defining characteristic of the recession that lasted from Q1 2000 to Q3 2001. Leading up to this, the Fed had raised rates three times in 1999 and three times in 2000, bringing the Fed Funds Rate to 6.50%.

The recession resulted in a modest, 0.6% decline in GDP, and unemployment reached a moderate 5.6%. The greatest pain was seen in stock markets where the Nasdaq Composite plummeted by 78%.

Throughout the recession, the Fed swiftly cut interest rates. They made 11 cuts in 2001, which brought the Fed Funds Rate down to 1.75%. Lower borrowing costs combined with tax rebates that acted similarly to modern stimulus checks helped to stimulate spending and restore economic stability.

The 2007 – 2009 Great Recession

The Great Recession, spanning from Q4 2007 to Q2 2009, was a far more severe economic downturn. It was characterized by a significant decline in GDP, falling by 4.3%, and unemployment soaring to 10%.

Prior to this recession, the Fed had raised rates eight times in 2005 and four times in 2006, bringing the Fed Funds Rate to 5.25%. As the housing market began to unravel and financial markets showed signs of distress, the Fed began cutting rates in 2007, with three cuts. The cuts became more aggressive in 2008, with seven rate reductions that ultimately brought the Fed Funds Rate to near zero.

The Great Recession was so severe that the Fed also introduced Quantitative Easing – the process of buying securities to stimulate the economy. This raises the money supply, incentivizes banks to lend, and typically puts downward pressure on interest rates.

This recession was unique in its depth and length, but like past recessions, lower interest rates helped to combat stifled economic growth. Quantitative Easing and time further aided in the recovery.

The 2020 COVID-19 Recession

The COVID-19 recession from Q1 2020 to Q2 2020 was unprecedented in its abruptness and depth. GDP plummeted by 5% in Q1 and then an astounding 31.7% in Q2, while unemployment spiked dramatically to 14.8%. This, however, was not a recession caused by traditional economic imbalances, but rather a sudden, global health crisis that forced widespread shutdowns.

Leading into the pandemic, the Fed had already decreased interest rates three times in 2019, from a range of 2.25 – 2.50% to 1.50 – 1.75%. As the severity of the pandemic became clear, the Fed acted swiftly and decisively. They implemented an emergency rate cut of 0.50 percentage points on March 4, 2020, followed by an even larger cut of 1.00 percentage points on March 16, bringing the target range for the Fed Funds Rate to effectively zero. This aggressive easing was aimed at providing immediate liquidity and support to the financial system and the broader economy during an extraordinary crisis.

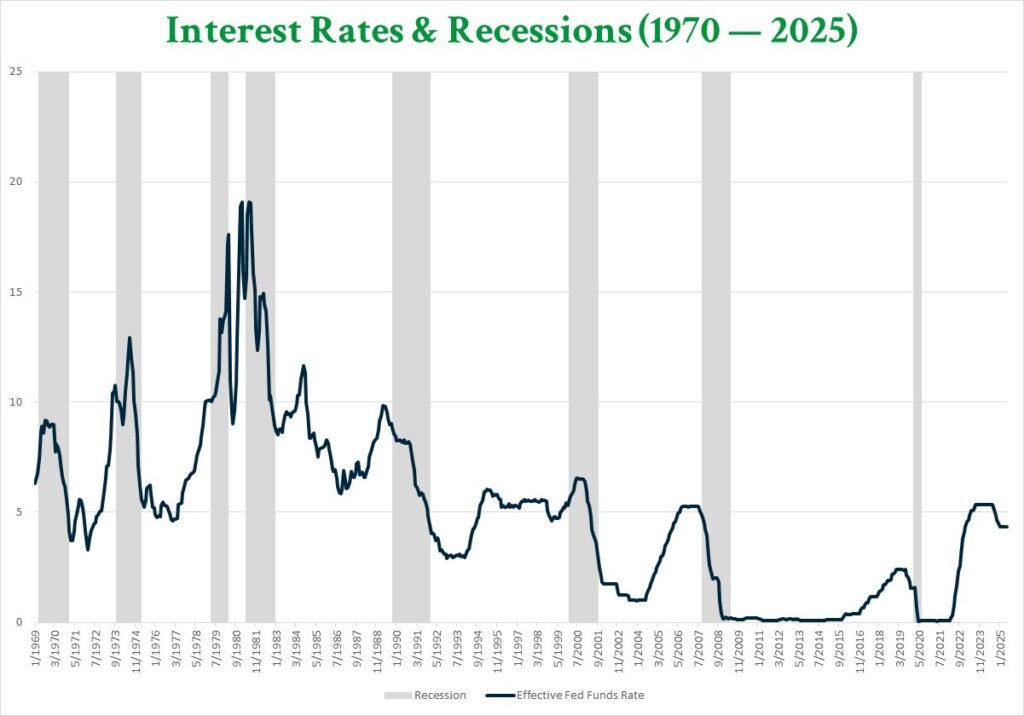

The following chart summarizes the interest rate policies surrounding recessions since 1970. As the chart shows, the Fed tends to lower interest rates during bouts of economic crisis and raise them as needed during more stable periods.

Key Takeaways for Businesses

Understanding this historical context provides valuable lessons for business leaders. Interest rate policy has been a primary tool for the Federal Reserve to manage inflation and stimulate, or cool, economic activity.

While each recession has its unique characteristics, common threads emerge:

- Proactive Rate Hikes Often Precede Recessions. The Fed often raises rates to combat inflation, and these increases can contribute to economic slowdowns.

- Rapid Rate Cuts During Recessions. The Fed typically responds to recessions by aggressively cutting interest rates to encourage borrowing, investment, and economic growth.

- External Shocks Matter. Events like oil embargos and pandemics can trigger recessions regardless of prevailing interest rate policy, though monetary policy still plays a crucial role in the response.

- The Fed’s Shifting Strategies. From Volcker’s aggressive inflation-fighting in the 80s to the rapid response to the COVID-19 pandemic, the Fed adapts its strategies to emerging challenges.

For businesses, staying attuned to the Federal Reserve’s signals and understanding the broader economic landscape is crucial to strategic planning and investment management. In particular, cash management becomes even more vital during periods of economic uncertainty and large swings in interest rates. By understanding the Fed’s typical response to economic activity, leaders are better equipped to forecast interest rate changes and proactively adapt their strategies.

Dive Into More Economic History With ADM

At American Deposit Management, we provide valuable insights that help business leaders inform their decisions. Our past articles include historical viewpoints on banking and the economy as well as updates on new developments in the business and banking sectors.

Review prior articles on our Insights page, subscribe to our mailing list, and follow us on LinkedIn to be alerted when we publish new information.

If your company needs access to extended government insurance for cash reserves along with nationally competitive interest rates, reach out to a member of our team today!

Q4 Banking Trends: Strong Net Income, Rising Deposits, Lower Unrealized Losses

American banks reported strong net income and lower unrealized losses alongside higher loan balances and deposit levels in Q4 2025.

How Did the Gramm-Leach-Bliley Act Facilitate Bank Consolidation?

The Gramm-Leach-Bliley Act passed in 1999 and ushered in a new era of consolidated, one-stop shop banking that perseveres today.

An Overview of Regulations Governing the Management of Public Funds

Public entities like school districts and municipalities are held to specific regulations that govern the ways funds are invested.