Navigating the Economic Tides: Monetary and Fiscal Policy’s Impact on Banking and Corporate Finance

For seasoned financial professionals, understanding the intricate balance between monetary and fiscal policy is more than an academic exercise. It’s a fundamental driver of strategic decisions, risk management, and ultimately, the bottom line.

At the highest level, both monetary and fiscal policy aim to foster stable economic growth – characterized by low inflation and high employment. However, they achieve these objectives through different tools. By discerning these differences, financial leaders can anticipate shifts, manage liquidity more effectively, and optimize financial strategies.

Monetary Policy: The Fed’s Domain

Monetary policy refers to actions undertaken by the Federal Reserve [Fed] to manipulate the money supply and credit conditions, aiming to stimulate or restrain economic activity. Their goal in these actions is achieving a delicate balance between stable prices and maximum employment.

The Fed has multiple tools to achieve these goals, and they can use them in combination or separately to support economic stability. Some of their most commonly used tools include:

- Interest Rate Adjustments. This is the most prominent tool in the Fed’s arsenal. It includes influencing short-term interest rates by adjusting the Federal Funds Rate – the rate at which banks borrow from one another overnight. By raising this benchmark, borrowing becomes more expensive, theoretically cooling down an overheating economy and curbing inflation. Conversely, lowering rates makes borrowing cheaper, encouraging investment and spending.

- Open Market Operations. This refers to the Fed buying or selling government securities in the open market. Buying securities injects liquidity into the banking system, encouraging lending and lower interest rates. On the other hand, selling securities withdraws liquidity, tightening credit conditions.

- Modifying Reserve Requirements. These requirements dictate the percentage of deposits that commercial banks must hold in reserve, rather than lend out. Increasing reserve requirements reduces the funds available for lending, while decreasing them expands lending capacity. This tool is used less frequently due to its disruptive potential.

- Issuing Forward Guidance. In recent decades, forward guidance – communicating the Fed’s future policy intentions – has become a key tool to influence market expectations.

- Quantitative Easing and Tightening. Quantitative Easing [QE] involves injecting liquidity into money markets by purchasing assets and is often implemented when short-term rates are already near zero. Quantitative Tightening [QT] is the reverse process and shrinks the central bank’s balance sheet. QT is often employed to ‘unwind’ periods of QE.

The Fed is fairly nimble in their actions, as they can announce monetary policy changes at any of their eight regularly scheduled meetings per year. They also have the option to hold emergency meetings – like they did in 2020 amid the pandemic.

While the Fed can respond quickly to economic changes, they are also often described as a “blunt instrument” – meaning their actions tend to impact the overall economy. This presents a challenge when different sectors are facing competing issues.

Fiscal Policy: The Government’s Lever

Fiscal policy refers to decisions made by the legislative and executive branches of government that aim to stimulate demand during recessions, cool down an overheating economy, provide public goods, or redistribute income. There are two main avenues that the federal government can take to achieve these goals. They are:

- Government Spending. This includes expenditure on infrastructure, defense, education, healthcare, and direct transfer payments like Social Security or unemployment benefits. Increased government spending directly boosts aggregate demand, while reduced spending lowers demand.

- Taxation. The federal government can alter corporate and individual income tax rates, sales taxes, property taxes, and introduce tax incentives or credits for specific activities. Tax cuts can increase disposable income for consumers and profits for businesses, potentially stimulating demand and investment, while tax hikes typically have the opposite effect.

In contrast to monetary policy, fiscal changes involve a lengthy process, often centered around budget cycles and complex legislative approval. These political hurdles are the norm, but in rare cases, Congress has called emergency sessions and passed legislation rapidly in response to crises.

If monetary policy is a blunt instrument, then fiscal policy is a scalpel. Its impact can be directed toward a specific group of people or a certain sector through taxation or direct spending. For example, spending on a specific infrastructure project immediately creates jobs and demand in that sector.

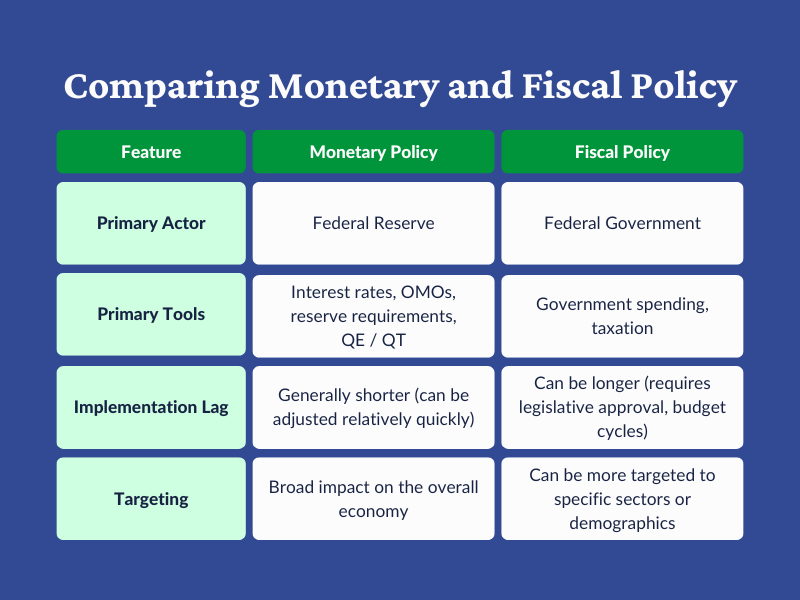

The chart below highlights the key features and differences between monetary and fiscal policy.

Monetary and Fiscal Policy Impact on Business Cash Management and Banking

Both monetary and fiscal policy have significant consequences for business cash management and bank operations. These outcomes arise in five key areas: borrowing costs, purchasing power, asset valuation, liquidity management, and exchange rate volatility.

Borrowing Costs and Credit Availability

Monetary policy that raises interest rates increases the cost of variable-rate debt and new loans for businesses. These higher borrowing costs can reduce the appeal of capital expenditures. Conversely, monetary policy that reduces interest rates lowers the cost of debt and encourages expansion.

For banks, higher rates can improve net interest margins if assets are repriced faster than liabilities. High rates can also lead to reduced loan demand and increased credit risk. On the other hand, accommodative monetary policy lowers borrowing costs, potentially spurring investment and loan growth.

Fiscal policy that results in a large government deficit can lead to “crowding out.” This occurs when government borrowing pushes up interest rates for private sector borrowers. The results of this scenario are similar to an interest rate hike from the Fed.

Another form of fiscal policy – tax incentives – can have the opposite effect on credit markets. These tax breaks encourage companies to invest in certain products or services, which can lead to increased borrowing to fund those projects.

Inflation

One of the main goals of the Fed is to control inflation. If they are successful through monetary policy actions, both companies and banks can enjoy stable prices. However, failure to control inflation leads to a reduction in the value of cash and can complicate financial strategies.

Fiscal policy that is designed to increase the money supply generally fuels inflation. This has wide-ranging implications including raising business costs and possibly increasing the value of their assets. Policies intended to reduce the money supply often have the opposite effect and can help curb rapid price increases – reducing business costs and dampening asset prices.

Investment Decisions and Asset Valuation

Monetary policy is important to investment markets because interest rates are a key component in formulas used for valuing investments and assets. This means lower rates generally push asset prices higher, while higher rates can depress them.

Fiscal policies – such as changes in capital gains tax or corporate tax rates – directly influence after-tax returns on investments. This can have a great influence on the types of investments that businesses choose, and the value of their portfolios. Additionally, government spending on infrastructure can create new investment opportunities or improve the productivity of existing assets.

Liquidity Management

The Fed’s actions also influence overall liquidity in the financial system. For example, QE injects liquidity, while QT withdraws it.

Both businesses and banks must actively manage their liquidity to navigate these shifts. Banks, in particular, face scrutiny of their liquidity coverage ratios and net stable funding ratios – which can be directly affected by monetary policy operations.

The impact of fiscal policy on liquidity management is more nuanced and typically centers around the timing of required payments or disbursements. For example, the annual tax due date and the timing of refunds can have a significant impact on short-term liquidity needs. Both businesses and banks require careful forecasting surrounding these periods to ensure they have appropriate levels of cash on hand.

Exchange Rate Volatility

Rising interest rates in the U.S. can result in a stronger dollar compared to other currencies, while falling rates typically have the opposite effect. Understanding these changes is crucial to companies with international operations, import / export businesses, and those managing foreign currency cash flows.

Fiscal policy can also impact exchange rates through public perception. For example, large and persistent fiscal deficits will generally undermine confidence in a currency, while prudent fiscal management supports currency stability.

Monetary and Fiscal Policies Can Work Together or Against Each Other

While monetary and fiscal policies can each have an independent impact on the economy, neither type of policy exists in a vacuum. Instead, monetary and fiscal policy occur simultaneously, and coordinated policies can be highly effective.

On the other hand, challenging scenarios arise when monetary and fiscal policies are not aligned. For example, the Fed might be tightening monetary policy to combat inflation while the federal government implements expansionary fiscal measures. This can create uncertainty, market volatility, and conflicting signals for businesses and banks.

How can finance leaders respond to changing policies?

For CFOs, treasurers, and bank executives, a passive approach to monitoring monetary and fiscal policy just doesn’t work. Instead, they should consider the following actions to thrive in the face of changing policy:

- Scenario Analysis. Develop and stress-test financial plans under various monetary and fiscal policy scenarios.

- Agile Cash Management. Maintain flexible cash management strategies that can adapt to changing interest rate environments and liquidity conditions. This includes optimizing the return on cash reserves while ensuring sufficient liquidity.

- Sophisticated Hedging. Review and refine hedging strategies to account for policy-induced volatility in exchange rates and prices.

- Capital Structure Optimization. Assess the firm’s capital structure in light of evolving borrowing costs and credit market conditions influenced by monetary policy.

- Advocacy and Engagement. Understand and contribute to the dialogue on financial regulation and policy through industry associations.

Financial leaders who deeply understand these tools, in addition to both monetary and fiscal policy, are better positioned to safeguard their organizations’ financial health.

Safeguard Cash Reserves With ADM

The only constant in federal policymaking is uncertainty. That’s why organizations need to maintain sufficient cash reserves to navigate unexpected shifts in monetary and fiscal policy.

At American Deposit Management, we help organizations manage reserve cash through modern solutions that deliver access to extended government insurance, nationally competitive returns, and liquidity to meet their needs. Our patent-pending technology makes all this possible with one account and one consolidated monthly statement.

To get started with our modern cash solutions, contact a member of our team today.

Q4 Banking Trends: Strong Net Income, Rising Deposits, Lower Unrealized Losses

American banks reported strong net income and lower unrealized losses alongside higher loan balances and deposit levels in Q4 2025.

How Did the Gramm-Leach-Bliley Act Facilitate Bank Consolidation?

The Gramm-Leach-Bliley Act passed in 1999 and ushered in a new era of consolidated, one-stop shop banking that perseveres today.

An Overview of Regulations Governing the Management of Public Funds

Public entities like school districts and municipalities are held to specific regulations that govern the ways funds are invested.