The Relationship Between The Fed Funds Rate and Unemployment

The Federal Reserve is tasked with promoting maximum employment, and the most robust tool in their arsenal is monetary policy. It includes adjusting interest rates, and this process has an indirect, but important, influence on the labor market.

Understanding the connection between rates and jobs requires a review of history to gain insight into the factors that shape economic theory. We’ll delve into this topic starting with the father of modern economics – John Maynard Keynes.

Keynes Introduced the Relationship Between Unemployment and Interest Rates

The Great Depression broke the long-held assumption that free markets were “self-correcting.” This allowed a British economist named John Maynard Keynes to gain traction for his new economic theory.

Keynes argued that aggregate demand was the driving force of the economy, and inadequate demand could lead to prolonged periods of high unemployment. He further stated that demand could only come from four sources – consumption, investment, government spending, and exports.

This baseline for his economic framework made the case for the three tenants of Keynesian economics:

- Aggregate demand is influenced by public and private factors.

- Prices – including wages – slowly respond to changes in supply and demand.

- Changes in aggregate demand have the greatest short-term effect on output and employment.

According to this framework, the monetary policy actions of the Federal Reserve are a public factor that influences aggregate demand. In turn, this influence on demand is the basis for the belief that monetary policy can impact the labor market.

The Impact of Monetary Policy on Demand

One of the major responsibilities of the Federal Reserve is setting the target for the Fed Funds Rate. It acts as a baseline for other interest rates, and when this rate changes, it has ripple effects throughout the economy.

The Economic Impact of Rate Changes

Rate hikes have a “cooling” effect on the economy – meaning they lower demand for consumers and businesses by increasing borrowing costs. Consumers generally react to higher rates by forgoing large purchases that typically require financing and reducing their discretionary spending. The reduction in everyday costs occurs because loan payments consume a greater share of their budget, credit card balances become more expensive to carry, and higher yields for cash incentivize saving.

In the corporate space, some businesses thrive in a high-rate environment, like lenders who generally receive more income when loan rates rise. However, most businesses respond to rate hikes by avoiding expansion or other growth activities that require financing. They may also reduce spending on inputs to match lower consumer demand for their products.

On the other hand, rate cuts have a “heating” effect on the economy – increasing demand by lowering borrowing costs. Both consumers and businesses generally react to lower loan costs in the opposite fashion to rate hikes. In short, they increase spending and save less money.

The Role of Demand in the Labor Market

In general, businesses strive to match their output to demand for their products. When demand decreases across the economy, businesses make fewer products and need a smaller workforce. This reduced labor need results in hiring freezes or even layoffs depending on the business and the size of the change in demand.

On the other hand, increased demand leads businesses to make more products and hire more workers to create them. This hiring boom often affects the labor market as a whole when demand shifts across the economy.

Putting It All Together: The Impact of Interest Rates on Employment

In summary, higher interest rates negatively impact demand. This leads to fewer products being made and a reduction in the labor force. The unemployment rate, therefore, tends to increase following periods of interest rate hikes.

Conversely, lower interest rates increase demand. This leads to more products being made and more jobs. Consequently, the unemployment rate tends to decline following periods of interest rate cuts.

Does Economic Theory Match Reality?

Keynesian theory remains fundamental to modern economics, but the real world is far more complex than any single model can encompass. In particular, the correlation between interest rates and unemployment is far from perfect in practice.

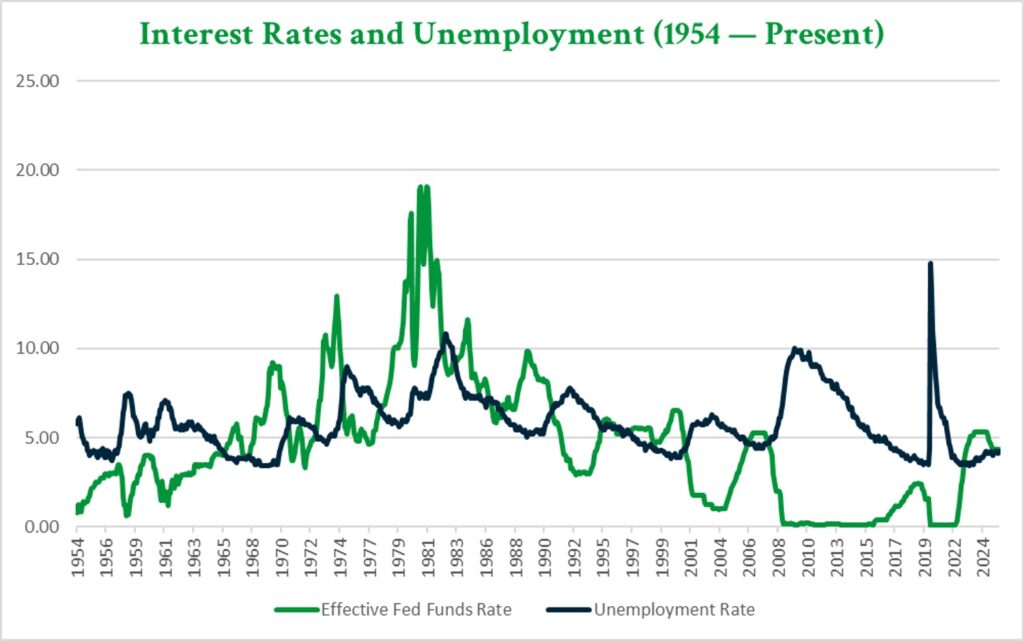

As the following graph shows, unemployment tends to increase following periods of elevated interest rates and fall following interest rate cuts. However, this relationship operates with a significant lag, and it does not hold true in every situation as you can see below.

Historical analysis clearly shows that interest rates are not the only factor that affects the job market. A host of other influences impact the labor market and sometimes overshadow the effects of monetary policy.

Some of these factors include:

- Shocks To the Market. From the oil embargo of the 1970s to the recent pandemic, external shocks can have an immediate impact on business and the labor market, outside of interest rates.

- The Makeup of the Labor Force. Changes to the share of the population that are working or actively looking for work can distort unemployment figures. This could include widespread worker discouragement, where people stop looking for work because they don’t believe they will find a job, or an influx of new workers. Generational shifts can also influence this – like the trend of Baby Boomers retiring later than previous generations.

- Wages and Inflation. In general, people want to work when their salary will provide for their needs. Low wages and high inflation can leave some potential workers discouraged and remove them from the unemployment rate since they are no longer looking for a job. On the other hand, increased wages can encourage people to seek work who otherwise would have remained out of the labor force.

- Business Decisions. Factors like offshoring manufacturing, onshoring key functions, and automation can change the number of domestic workers a company needs to create the same number of products.

- Fiscal Policy. Government spending can increase demand and lead to a stronger job market. Conversely, lower government spending can reduce demand and lead to more unemployment. Tax policies can also have a similar impact to a change in interest rates, making employers more likely to hire when they have free cash flow or less likely to hire when they owe more in taxes.

- Geopolitical Events. Wars, trade disputes, and international crises can disrupt business operations. These events impact supply chains, consumer confidence, and demand. In turn, they can influence business hiring decisions.

The abundance of factors that influence the labor market demonstrate that the Federal Reserve does not have absolute control over the labor market. However, the Fed still has an important role to play in the economy and controlling unemployment.

Stay Up to Date on Interest Rate Changes With ADM

For business leaders, quick reactions to Fed policy shifts and even anticipating the Fed’s next moves are crucial to strategic planning. At ADM, we cover the most important developments in interest rates and every FOMC meeting to help leaders get the information they need.

Our weekly articles also offer historical insights plus actionable information for business and banking leaders. Subscribe to our mailing list to have these valuable publications delivered straight to your inbox or browse our past articles on the Insights page.

If your company needs access to extended government insurance and nationally competitive returns for cash reserves, don’t hesitate to reach out to a member of our team.

Q4 Banking Trends: Strong Net Income, Rising Deposits, Lower Unrealized Losses

American banks reported strong net income and lower unrealized losses alongside higher loan balances and deposit levels in Q4 2025.

How Did the Gramm-Leach-Bliley Act Facilitate Bank Consolidation?

The Gramm-Leach-Bliley Act passed in 1999 and ushered in a new era of consolidated, one-stop shop banking that perseveres today.

An Overview of Regulations Governing the Management of Public Funds

Public entities like school districts and municipalities are held to specific regulations that govern the ways funds are invested.