Q2 Banking Trends: Higher Net Income, Lower Deposits, Fewer Banks

Each quarter, the Federal Deposit Insurance Corporation [FDIC] releases a lengthy report detailing developments in the banking industry called the Quarterly Banking Profile. This information is important for leaders in the business and banking industries because it shows the direction and health of U.S. banks.

The most recent report showed resilience in the banking sector despite weakening in one area that could create opportunities for businesses with cash to invest. To save you time, we have summarized the key points from this report.

The Number of Insured Banks Declined

The total number of FDIC insured banks declined by 29 to 4,539. This figure includes the sale of three banks to credit unions and the merging of 26 banks with other financial institutions. Additionally, one bank failed last quarter, but it was not included in the total number of banks in the prior quarter because it did not file a call sheet. No new banks were opened to offset the failure, sales, or mergers.

In general, bank consolidation can be good for financial institutions since it means they have less competition. However, the same dynamic can be harmful for businesses who are seeking the best rates for their loans and deposits. The shrinkage last quarter was relatively minor, but both businesses and banks should continue to watch for a trend of mergers and acquisitions since it could impact their goals.

The Total Level of Bank Deposits Declined

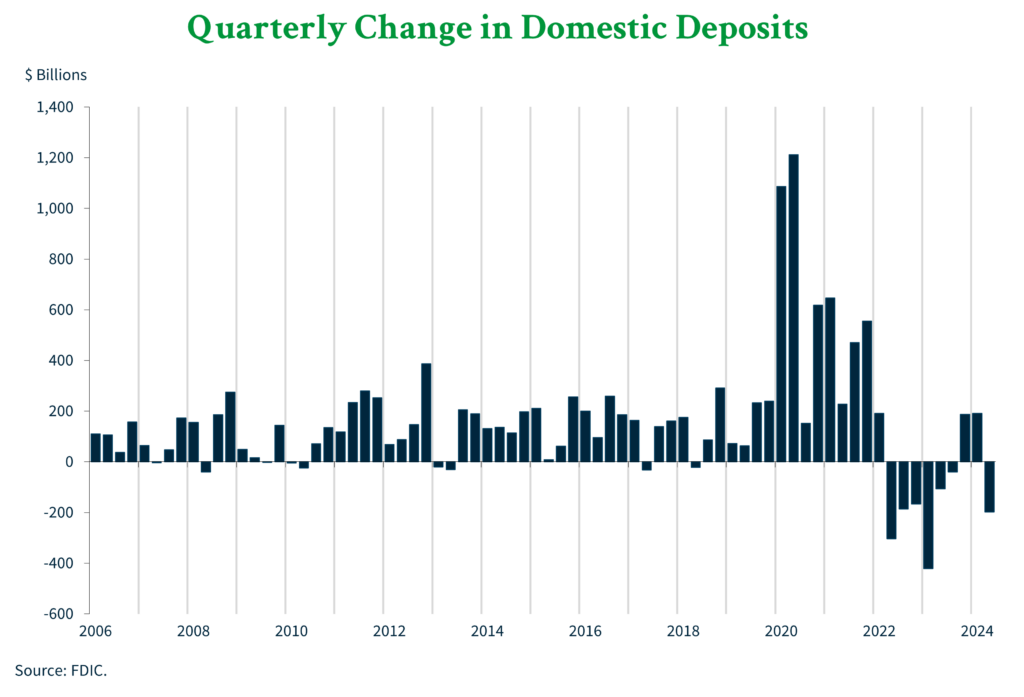

In a reversal of the previous quarter’s trend, total bank deposits declined by $197.7 billion – or 1.1%. This decline was driven by lower savings and transaction account balances but was partially offset by higher ‘time deposits.’

Both insured and uninsured deposits fell last quarter. Insured deposits – those under the $250,000 FDIC insurance limit – decreased by $96 billion while uninsured deposits – those over the FDIC limit – fell by $50.4 billion.

The level of deposits is important for banks since it determines how much competition they will face when attempting to attract new depositors. It is also important for businesses since competition is one factor that determines the rate banks pay for cash.

For example, some banks choose to raise the rate they pay for deposits when there is less cash to go around. This trend can help businesses capture higher rates of return when they shop for rates or partner with a deposit management company to capture competitive yields.

Like the total number of banks, the decline in deposits was relatively small last quarter. However, both banks and businesses should continue to monitor this figure in case it becomes a trend.

See the chart below for an overview of past changes in deposit levels.

Bank Net Income Increased

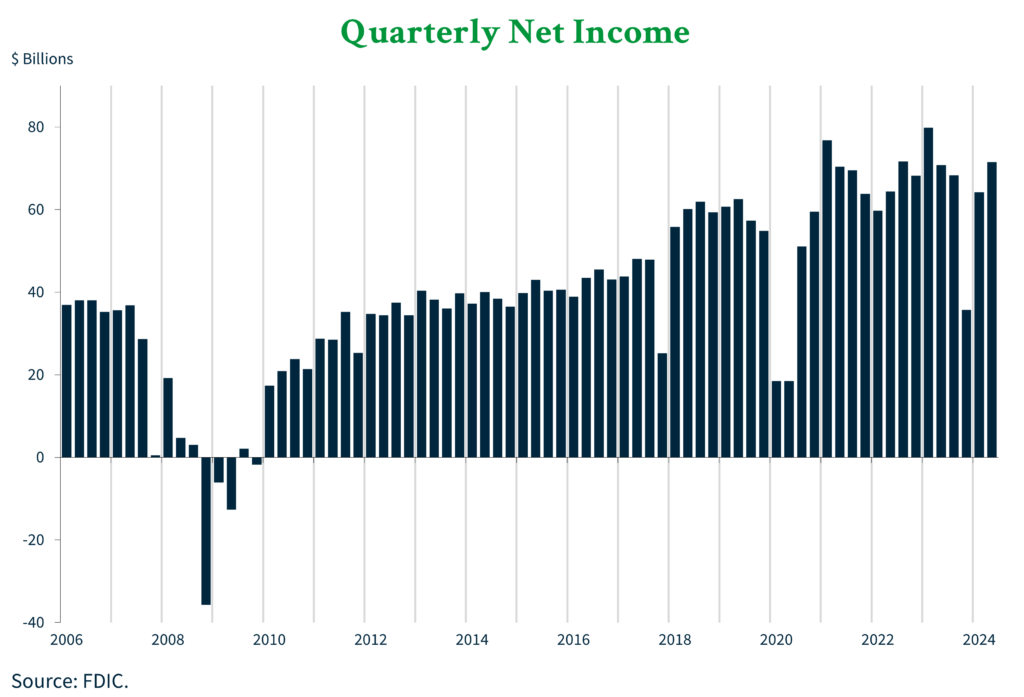

Banks earned $7.3 billion, or 11.4%, more than in the previous quarter. Like the previous quarter, higher net income was bolstered by a reduction in FDIC special assessment payments. These assessments were levied to replenish the FDIC’s reserves in response to the bank failures last year.

Banks also reported a 2.4% reduction in noninterest expenses, a 1.5% increase in noninterest income, and higher gains on the sale of securities. Also helping to bolster overall net income, one bank sold its insurance division for an after-tax gain of $4.9 billion. These gains were partially offset by several large banks selling bond portfolios at a loss.

With these changes, the aggregate return-on-assets ratio rose to 1.20%. This is 0.12 percentage points higher than the previous quarter, but 0.01 percentage points lower than one year ago.

Quarterly improvements in net income and the return-on-assets ratio show resilience in the banking industry, despite losses on bond sales. These signs of strength offer a hopeful outlook for banking leaders.

The chart below summarizes past changes in bank net income.

Loan Balances Rose Slightly and Asset Quality Remained Stable

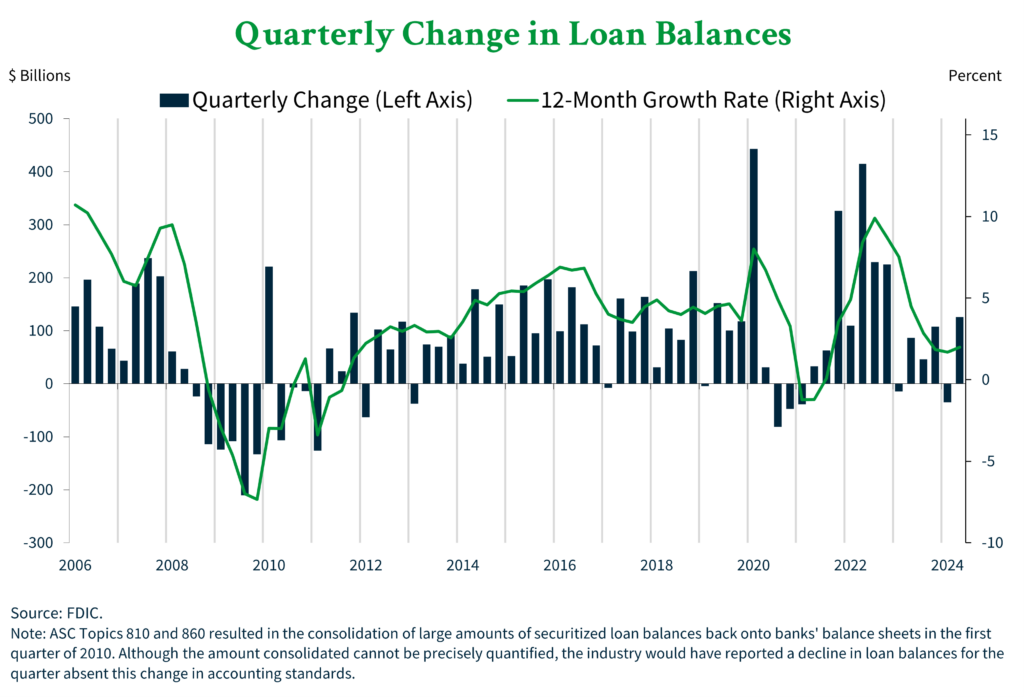

Over 75% of banks reported quarterly loan growth, and the industry added $125.8 billion to loan and lease balances from the previous quarter – roughly a 1% increase. The change was driven by a 1.2% increase in consumer lending and a 9.6% rise in loan balances for non-depository financial institutions [NDFIs]. The majority of the increase in NDFI lending appears to be due to reclassification of current loans rather than new lending.

In addition to higher lending, asset quality measures remained stable for current loans. Overall, noncurrent loans – those whose borrowers are more than 90 days behind on payments – were unchanged at 0.91% of total loans. This figure is well below the pre-pandemic level of 1.28%.

On the other hand, one particular sector of loans experienced a sharp drop in asset quality. The noncurrent rate for non-owner occupied commercial real estate loans rose to 1.77% – the highest level since Q3 2013. This change was mostly confined to office portfolios at the largest banks. The FDIC stated that these banks tend to have a lower concentration of such loans in relation to total assets compared to smaller institutions, which mitigates the overall risk.

The increase in loans is heartening for banks, especially given the high interest rates that put downward pressure on lending. Additionally, stable asset quality is a positive indicator for the overall health of the industry.

See the graph below for a summary of bank loan balances over time.

The FDIC Continues to Be Well Positioned to Protect Cash

The FDIC plays a pivotal role in maintaining safety in the banking industry by guaranteeing deposits in the event of bank failure. In order to do that, they need the Deposit Insurance Fund [DIF].

The DIF took a hit last year after multiple large bank failures, but the FDIC is growing those funds again. Last quarter, the DIF balance rose by $3.9 billion to $129.2 billion, and the reserve ratio rose by 0.04 percentage points to 1.21%.

Positive signs in the industry like higher net income, loan balances, and stable asset quality make a compelling case that the banking industry is strong. Additionally, the FDIC’s progress toward replenishing the DIF shows that they are well positioned to protect depositors in the event of bank failure.

Subscribe To Our Mailing List for More Valuable Insights

At the American Deposit Management Co. [ADM], we provide weekly articles that cover important developments in the business and banking industries. Visit our Insights page to review our past articles and subscribe to our newsletter so you never miss an update.

In addition to valuable insights, we offer deposit management services that provide access to extended government insurance, nationally competitive returns, and liquidity to match your needs. Contact a member of our team today to learn more about how these services can benefit your business or to inquire about becoming a bank partner.

Navigating the Economic Tides: Monetary and Fiscal Policy’s Impact on Banking and Corporate Finance

Prudent financial stewardship requires an understanding of monetary and fiscal policy as well as strategies for adapting to change.

FOMC Holds Interest Rates Steady at June Meeting

The FOMC maintained interest rates at the current level and released updated economic projections at the June meeting.

Community Financial Institutions Face 2 Common Problems in 2025. ADM Is the Solution.

Banks and credit unions face two key problems in 2025. Fortunately, our company offers solutions to attract and retain depositors.