Interest Rate Expectations

Fed policy has been an important consideration for investors, economists, and businesses – particularly in the past year. Since the Fed began tightening policy in March 2022, they have increased the Fed funds rate from near zero during the pandemic to a range of 4.75 – 5.00% as of March 2023.

Higher interest rates have been credited with some positive outcomes – such as a slower pace of inflation and higher savings rates. However, escalating rates are also forcing businesses into higher financing costs and, in some cases, lower demand. With these negative outcomes in mind, many finance leaders are eagerly awaiting the end of the current tightening cycle.

Interest Rate Policy Since the COVID-19 Pandemic

As the world reeled from the onset of the COVID-19 pandemic, the Fed lowered the Fed funds rate to a target range of 0.00 – 0.25%. Along with unprecedented federal stimulus, low interest rates were intended to spur the economy. However, supply chain difficulties and uneven shutdowns around the globe contributed to rapidly rising inflation.

When consumer prices rose at a pace that hadn’t been seen since the early 1980s, the Fed responded with a series of rate hikes which began in March 2022. Since that time, the FOMC has raised rates at each meeting. As rates have risen and supply chain constraints have eased, the pace of inflation has slowed with the March Consumer Price Index and Producer Price Index increasing at annual rates of 5.0% and 2.7%, respectively.

While the latest inflation readings are far below the peaks seen last summer, prices are still rising much faster than the Fed’s target. However, the effects of interest rate hikes often lag their implementation. For this reason, the Fed has noted that they may decide to pause rate increases before inflation has returned to their preferred level.

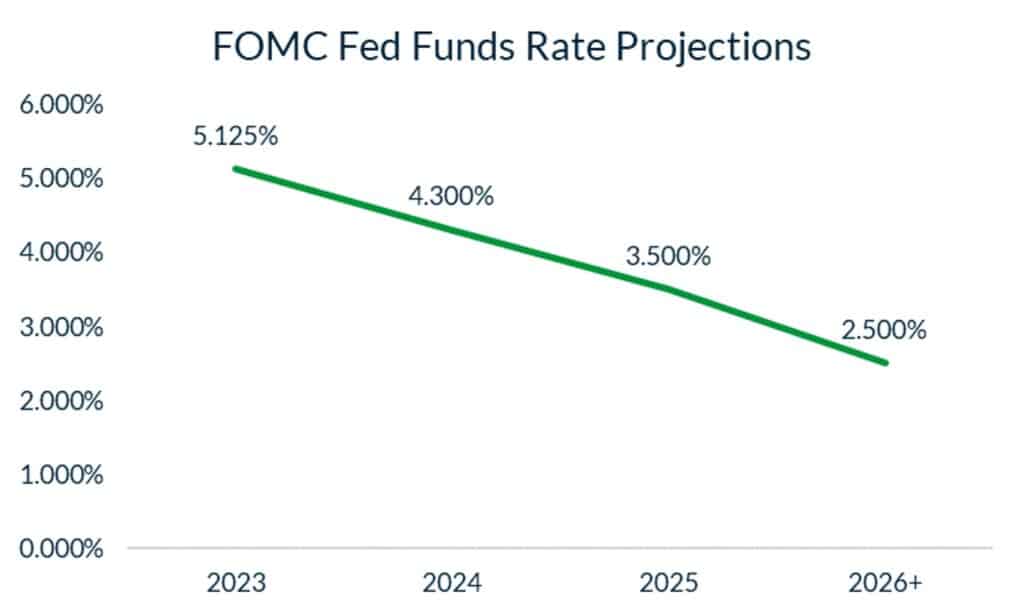

Interest Rate Projections from the Fed

Alongside moderating inflation, the Fed has indicated that rates may be nearing their peak. In their last meeting, FOMC members forecasted a Fed funds target range of 5.00 – 5.25% at the end of 2023. This suggests one additional rate hike, then stable interest rates for the remainder of the year.

The Fed forecasts that interest rates will decline throughout 2024 and fall to 4.3% by the end of that year. Further in the future, more reductions are anticipated which would bring the Fed funds rate to 3.5% by the end of 2025 and around 2.5% in the long-term.

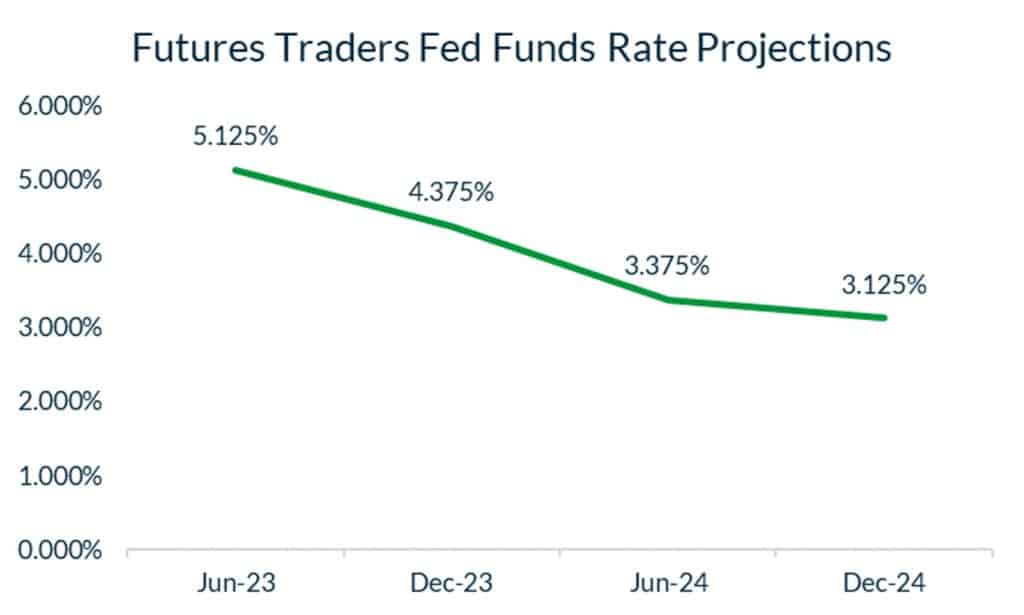

Market Expectations for Interest Rates

While the Fed expects interest rate reductions to begin in 2024, Fed funds futures traders propose a faster timeline. These traders forecast one additional rate hike in the coming months, then declining interest rates for the remainder of the year. Their projections show an anticipated target range of 4.25 – 4.50% at the end of 2023, far below the Fed’s estimate.

Futures traders anticipate further rate decreases in 2024. These are expected to bring the target range to 3.00 – 3.25% by the end of that year.

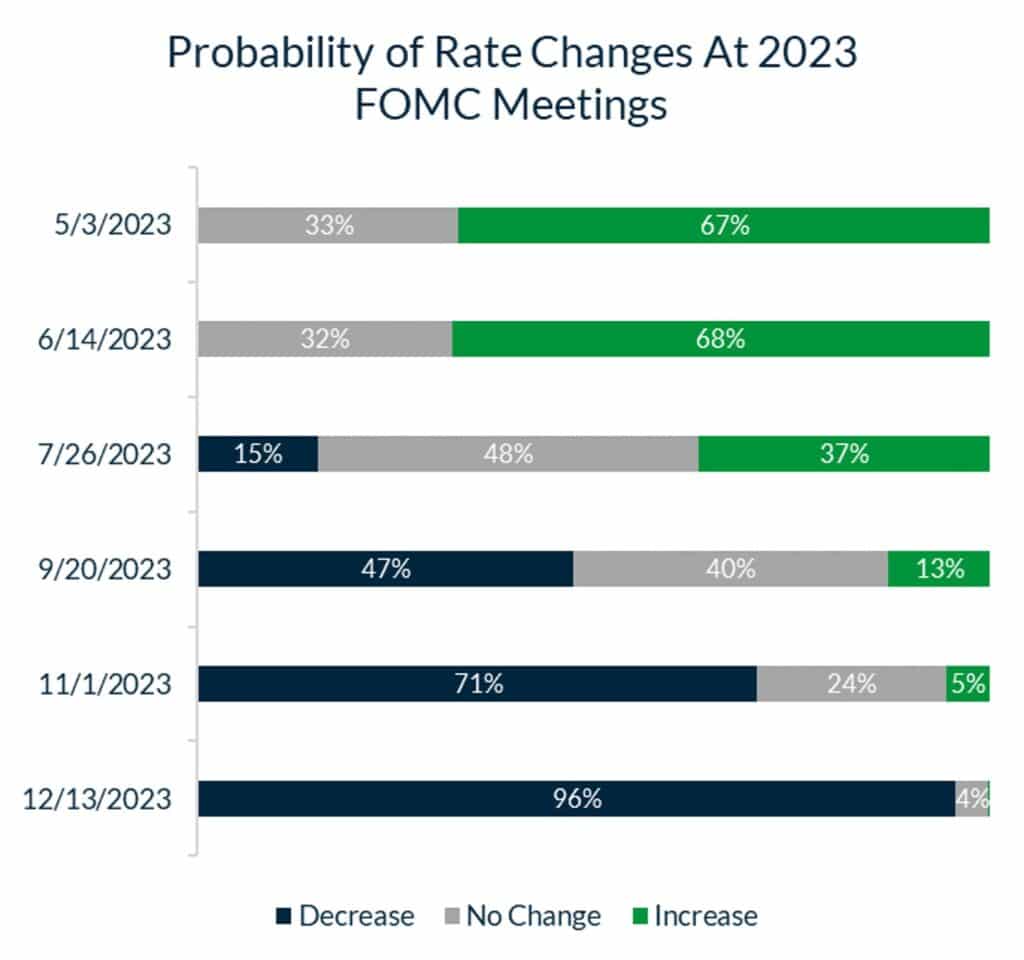

While futures traders and the FOMC differ in their end-of-year projections, both groups anticipate an additional rate hike in the short term. Futures traders forecast a rate hike at May’s meeting with a 67% probability. Then, most traders conclude that the Fed will begin reducing rates at September’s meeting.

How Businesses Can Prepare for Interest Rate Declines

While the future of interest rates is far from certain, both market analysts and the FOMC predict rate decreases in the next year. In light of these estimates, businesses should consider adjusting their strategy to account for declining interest rates. These adjustments can look different depending on the nature of the business, but these are a few common ways firms can make the most of falling rates.

Adjust Sales Forecasts

In many industries, interest rates impact sales. Firms in these sectors can begin to adjust their forecasts to account for lower rates in the future given the current predictions. In interest rate sensitive sectors like real estate and automotives, sales can rise almost immediately following a shift in Fed policy. In other industries more tangentially impacted by interest rates, the increase in sales can be gradual as rates decline and consumers have more disposable income. In either case, businesses that plan for higher sales volume before rates begin to decline can be better prepared to meet customer demand if those changes occur.

Delay Debt

If interest rates follow the projected path, businesses can benefit from delaying new debt until they can achieve a lower rate. This strategy might include waiting a few months to obtain financing for a new property or postponing a new bond issue until rates begin to fall.

Lock In Higher Rates for Cash Reserves

While lower rates can positively impact sales and financing costs, they tend to have the opposite effect on rates for cash reserves. Deposit rates are influenced by many factors, one of which is the Fed funds rate. To prepare for the possibility of declining interest rates, businesses can consider options to lock in the current rates for cash reserves.

Certificates of Deposit [CDs] are one of the most common ways that businesses can lock in their interest rate for an extended period. These investments are FDIC insured up to the $250k per institution limit and provide stable income for the life of the investment.

Before interest rates are projected to fall, businesses can consider reinvesting older CDs at the current high rates. Depending on the length of the CD, this strategy could allow them to lock in the current rates for several years. Additionally, CD ladders can help firms adapt to changing interest rates by providing a predictable liquidity schedule and the opportunity to reinvest funds at set intervals. With advanced financial technology – also known as fintech – companies can get even more from their CDs – like extended FDIC or NCUA protection and nationally competitive rates.

Businesses that prepare early for the possibility of declining interest rates can be poised to take advantage of the new environment. This means adjusting projections and business processes to account for changes in sales volume, financing costs, and deposit rates that could be on the horizon. For many businesses – especially those with large cash reserves – it makes sense to seek the assistance of an experienced and technologically advanced cash management partner.

Optimize Cash Reserves With ADM

At the American Deposit Management Co. [ADM], we have been helping businesses optimize their cash management for more than two decades. Through our proprietary fintech which powers a concept we call Marketplace Banking™, companies can achieve the safety, liquidity, and returns they need.

Our CD reinvestment program helps firms capture additional returns, net of early withdrawal penalties, and lock in those rates for a term that meets their needs. Additionally, our American Money Market Account™ [AMMA™] allows businesses to achieve full government insurance, nationally competitive interest rates, and next-day liquidity.

To learn more and get started today, contact us.

To stay up to date on the latest in interest rates, banking, and the business landscape, sign up for our mailing list to receive our weekly article. Also, don’t forget to follow us on LinkedIn, Twitter and Facebook.

*American Deposit Management is not an FDIC/NCUA-insured institution. FDIC/NCUA deposit coverage only protects against the failure of an FDIC/NCUA-insured depository institution.

FOMC Maintains Interest Rates Amid Increasing Economic Uncertainty

The FOMC cited increasing economic uncertainty as a factor in their vote to hold the Fed Funds Rate steady at the May meeting.

Common Business Cash Investments That Are Excluded from FDIC Insurance

These cash investments are common choices for cash managers but use caution because they are excluded from FDIC insurance.

A Guide to Cash Management for Public Organizations

This guide covers the crucial factors public organizations need to consider when creating an effective cash management plan.