Is Your Business Leaving Interest Income on The Table?

Companies set aside cash for various reasons such as funding future projects, protecting from market downturns, and even counteracting seasonality. These are the primary functions of cash reserves, but your liquid assets also serve a secondary purpose – to generate investment income.

You may think that returns on cash reserves are negligible and therefore not worth considering. However, that mentality could be very costly to your company.

Deposit Management Services Help Businesses Capture Additional Interest Income

At the American Deposit Management Co. [ADM], our Modern Cash Solutions provide access to nationally competitive returns for business cash. This additional income can reduce the impact of inflation and even add to profitability.

Without deposit management services, you might spend hours scouring the internet to find competitive rates of return for your cash. You’d then spend even more time shifting your funds between accounts to capture those returns. Fortunately, our solutions take this work off your plate.

ADM clients receive competitive rates from our nationwide network of financial institutions, and we handle the investments on their behalf. In turn, our clients collect competitive interest income and can rest assured that their funds are protected by the highest level of safety.

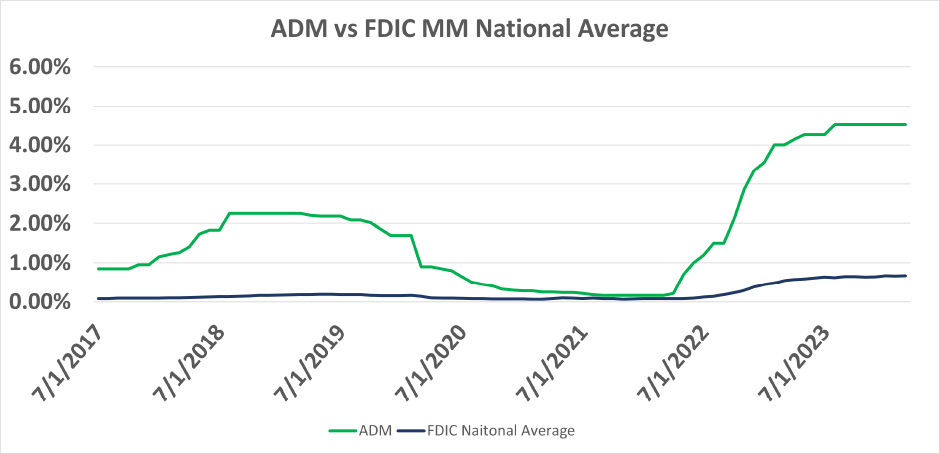

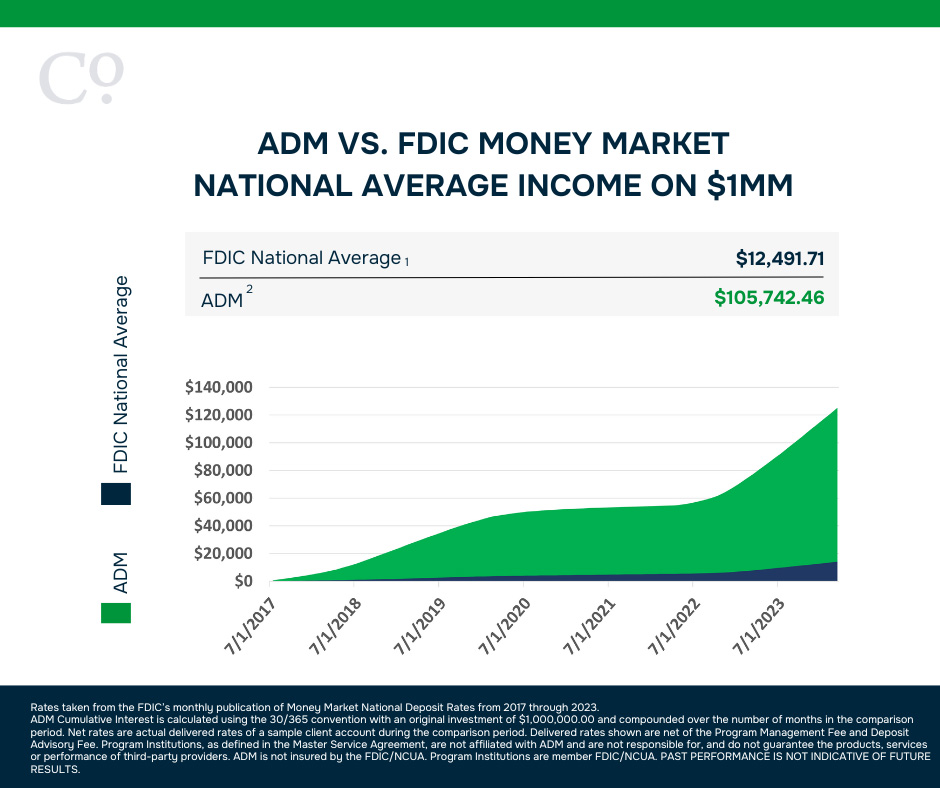

ADM Accounts Generate 7x More Interest Income Compared to The National Average

Since 2017, our accounts have generated 7x more interest income than the national average money market account. As the graph below shows, our returns have remained well above the national average throughout various interest rate cycles.

Over time, those higher returns add up to significant income for your company. For example, a business with $1million in cash would have gained $105,742.46 in interest income with an ADM account since 2017. On the other hand, a money market account earning the national average would have generated only $12,491.71 over the same time frame.

How Do Deposit Management Services Help Businesses Achieve Above-Average Returns?

Banks have autonomy when setting the rate they pay for cash and those that need deposits often pay rates much higher than the average. However, monitoring hundreds of banks to find competitive rates takes time and costs money.

To overcome this challenge, we have curated a network of over 400 banks and credit unions across the country that are seeking business deposits and often pay much higher-than-average rates. Then, our proprietary fintech spreads that cash across our network to achieve nationally competitive rates of return.

Earn More Without Sacrificing Safety or Liquidity

Competitive returns are important for cash reserves, but your business also needs assurance that funds are safe and available when needed. Fortunately, our solutions provide unparalleled safety and liquidity to meet your needs.

All your cash can be protected from bank failure with access to extended government insurance. Your funds are also available as soon as the next business day with our customizable liquidity options.

With deposit management services from ADM, you can have it all – a reduced workload, the ultimate safety, and access to your cash when you need it. Best of all, you can rest assured that you aren’t leaving interest income on the table.

Learn How Much Your Company Could Earn With ADM

Our team can analyze your current cash investments and help you determine if you can capture a more competitive rate of return. Then, we can compare your options for deposit insurance, liquidity, and other factors to help you find the right combination for your business.

To learn more about our deposit management services and get a customized cash proposal, contact a member of our team today.

An Overview of Regulations Governing the Management of Public Funds

Public entities like school districts and municipalities are held to specific regulations that govern the ways funds are invested.

Business Escrow in 2026

Business escrow services are not a new concept, but modern solutions should offer far more than companies could expect in the past.

FOMC Meets in January Amid Continued Inflation and Softening Employment

The FOMC met for the first time in 2026 on January 27th and 28th. At that meeting, they voted to hold the Fed Funds Rate steady.