How Businesses Can Benefit from Reinvesting Existing CDs

Certificates of Deposit [CDs] can help businesses earn a higher rate of return on their cash than traditional savings or money market accounts, without sacrificing FDIC protection. However, the same long-term structure that allows CDs to provide superior rates can create issues when interest rates rise.

As rates increase, businesses with existing CDs may miss out on potential returns. This has become increasingly apparent over the last year when CD rates have skyrocketed. As rates for new CDs rise, some firms are considering reinvesting existing CD funds in new ones at higher rates. This strategy can result in higher overall returns for some businesses, even after considering early withdrawal penalties.

Benefits of Reinvesting CDs

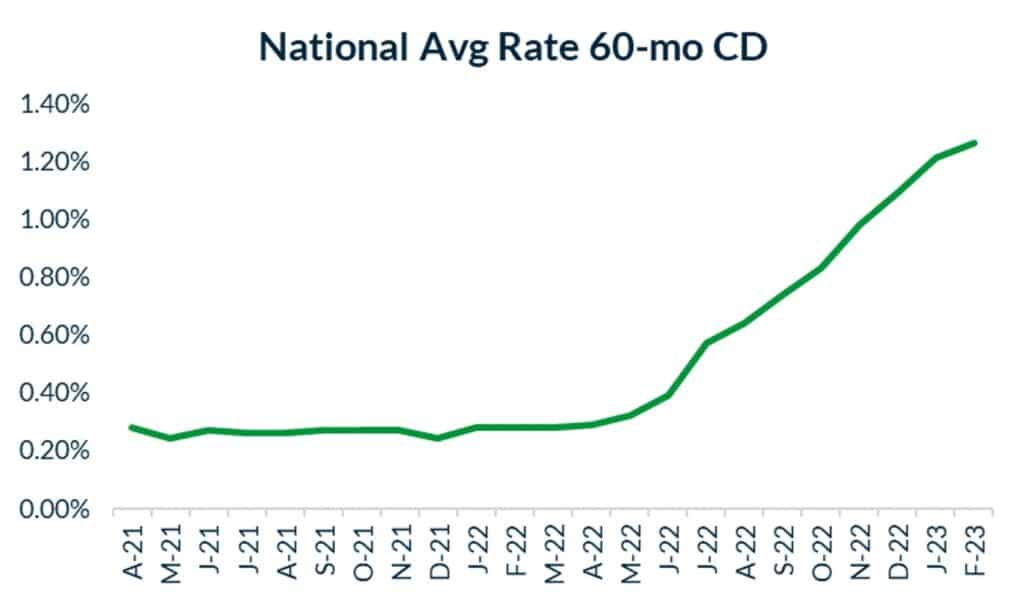

Over the past twelve months, CD rates have risen rapidly. In fact, from February 2022 to February 2023, the average rate for a 60-month CD increased from 0.28% to 1.26%. To put this in perspective, a company with $1 million in CDs would have earned about $2,800 per year in interest with CDs purchased at the average rate in February 2022. With a CD purchased at the average rate in February 2023, annual interest increases to $12,600.

While average CD rates have climbed dramatically, there are opportunities for businesses to earn even higher rates. Interest rates from individual banks vary based on many factors including the needs of the bank. By locating banks with above average CD rates, businesses can earn upwards of 5% on CDs in the current market. With so much potential for additional returns, many firms are evaluating their current CDs and looking for opportunities.

Drawbacks to Reinvesting CDs

When interest rates rise, replacing an older CD with a newer one at a higher rate can be beneficial in some cases – similar to refinancing a loan when rates decline. However, there are also important considerations before implementing this strategy. The most significant drawback of reinvesting CD funds is the penalty for withdrawing funds from current CDs prior to maturity.

Due to the long-term nature of CDs, banks are required by law to charge an early withdrawal penalty. These penalties typically range from 3 to 12 months’ interest, depending on the length of the CD. For businesses, this means they must pay a fee to withdraw funds from old CDs before they can reinvest those funds at the new, higher rates.

When does it make sense for a business to reinvest their CDs?

Before committing to a CD reinvestment strategy, businesses should ensure that all the following conditions are true:

Returns Can Be Improved

A business can profit from reinvesting CD funds if the interest they earn on new CDs, net of early withdrawal fees, surpasses the interest they would earn from allowing current CDs to mature. In the current environment, there are many opportunities for firms to locate CDs at higher rates than those purchased months or years ago. However, CD rates vary by bank. So, just because a bank pays a higher rate today than six months ago, does not mean that a business is maximizing their potential interest. Before committing to a new CD, companies should ensure that their new rate is competitive.

Locating competitive CD returns has historically been time consuming and tedious for businesses. It has involved shopping for rates online or calling several banks to determine their current rates. Fortunately, advances in financial technology – a.k.a fintech– have streamlined this process. Now, companies can partner with an experienced cash management company that harnesses the latest technology to invest funds at nationally competitive rates without sacrificing safety or liquidity.

Liquidity Is Not Reduced

In addition to returns, companies should consider their liquidity needs when determining if a CD reinvestment strategy is a wise choice. If CD funds are needed for future projects on a particular schedule, then it may not be wise to extend that timeline with a new CD of the same term. For example, if a company purchased a 60-month CD in January 2022 expecting to use those funds in January 2027, it would not make sense to purchase another 60-month CD at the current time. Instead, the company should consider a shorter-term CD that allows the funds to mature when needed. With an experienced cash management partner, firms can implement a CD strategy that retains the liquidity they need while earning a competitive return.

Safety is Maximized

Safety for business cash is top priority in any market condition, but it has become increasingly important as recent bank failures have made headlines. CDs are FDIC insured up to the $250k limit per institution, but companies often have far more cash than the traditional limit. Fortunately, advances in fintech have made it possible for businesses to access extended protection.

A CD reinvestment strategy can be extremely beneficial if a business can earn additional interest – net of fees, maintain their current liquidity schedule, and ensure that funds are safe. However, managing a CD reinvestment strategy alone can be time consuming and frustrating. Fortunately, there is another option – partnering with an experienced cash management firm.

Earn More, Risk Less® With CD Reinvestment From ADM

At the American Deposit Management Co. [ADM], we have been helping businesses manage their cash reserves for more than a decade. Our proprietary fintech allows firms to access full FDIC / NCUA protection for their funds, liquidity to match their needs, and nationally competitive returns. In the current environment of rising interest rates, we can also help businesses reinvest their current CDs to capture additional returns, net of early withdrawal penalties.

Our CD Reinvestment Program is overseen by experienced cash management specialists that can help businesses analyze their current CD rates, the fees for withdrawing early, and the potential gains from new CDs. We can also invest funds on a business’ behalf at nationally competitive rates while ensuring safety and appropriate liquidity. To learn more about our CD Reinvestment Program, contact us today or reference the following Frequently Asked Questions.

Frequently Asked Questions About ADM’s CD Reinvestment Program

Why did ADM create the CD Reinvestment Program?

The best interest of our clients is always at the forefront of our actions. In this new, high-rate environment, we found an opportunity for some clients to capture substantially higher interest income, even after paying early withdrawal penalties on current CDs. This discovery led us to create our CD Reinvestment Program which helps locate opportunities to improve returns without sacrificing safety or liquidity for both current clients and non-clients.

How does ADM’s CD Reinvestment Program work?

The CD Reinvestment Program begins with a thorough review of a business’ current CDs. Our experienced cash consultants evaluate the rates, terms, and withdrawal penalties, then compare this information to new CDs available through our nationwide network of financial institutions. After extensive analysis, we offer solutions to help firms achieve higher overall returns, net of fees, without extending the maturity of their CDs.

Can ADM close my current CDs?

For current ADM clients, we handle the entire CD reinvestment process. We locate the CDs that match a business’ needs, close existing CDs, and reinvest the proceeds in new, higher yielding CDs. This process drastically reduces the effort needed to manage a company’s funds.

For new clients, we do not have the access to close current CDs, but we still add significant value to the CD reinvestment process. Our experienced cash consultants analyze current CD holdings, locate new opportunities, and invest CD proceeds at nationally competitive rates.

What CD rates does ADM provide?

ADM is not a bank, so we do not issue CDs. Instead, we are a fintech company that has developed a nationwide network of financial institution partners that compete for business deposits. Through these partnerships, ADM facilitates the purchase and maintenance of CDs for our clients. With ADM, clients achieve nationally competitive rates, extended government protection, and liquidity to match their schedule – all in a single account.

Are CDs FDIC insured?

CDs offered by FDIC member banks are insured up to the $250k limit, but with ADM, businesses can access government insurance for all their funds. Our fintech allows us to spread business cash across our nationwide network of financial institutions so that every penny can be covered by government insurance – even those funds above the $250k limit.

Q4 Banking Trends: Strong Net Income, Rising Deposits, Lower Unrealized Losses

American banks reported strong net income and lower unrealized losses alongside higher loan balances and deposit levels in Q4 2025.

How Did the Gramm-Leach-Bliley Act Facilitate Bank Consolidation?

The Gramm-Leach-Bliley Act passed in 1999 and ushered in a new era of consolidated, one-stop shop banking that perseveres today.

An Overview of Regulations Governing the Management of Public Funds

Public entities like school districts and municipalities are held to specific regulations that govern the ways funds are invested.