Case Study: How Deposit Rates React to Changes in the Fed Funds Rate

Often business leaders look to the Fed funds rate as the primary indicator of market interest rates. While this can be a good gauge for most market interest rates, the relationship between the Fed funds rate and rates on deposit accounts is more nuanced than many believe.

As businesses adjust to rate hikes in 2022, leaders should be aware of the relationship between the Fed funds rate and the rate that their cash reserves earn. With this information, they can tailor their forecasts and decisions to the new interest rate environment.

A Historical Look at Deposit Rates and the Fed Funds Rate

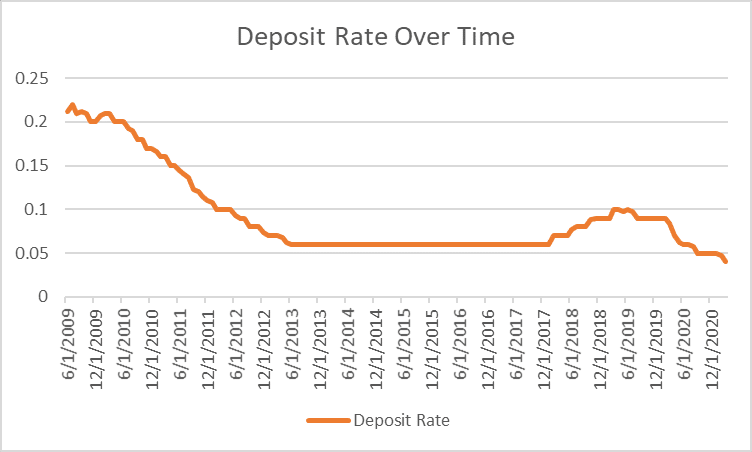

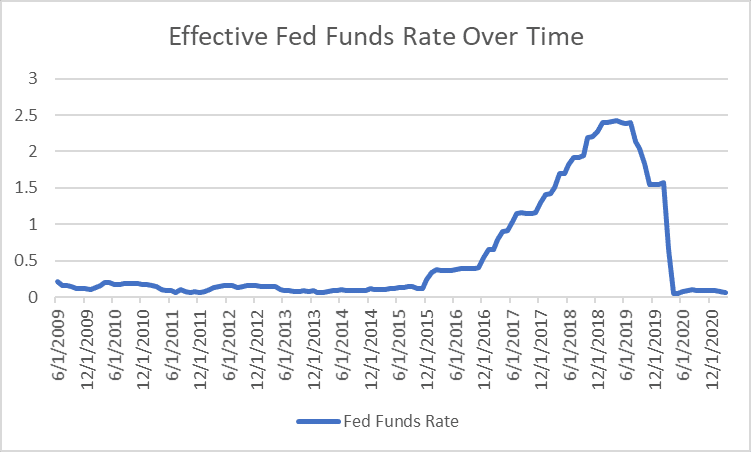

Since the Great Recession, the Fed has raised and lowered rates several times. Deposit rates have likewise risen and fallen, though not always in tandem with the Fed funds rate. See the charts below for an overview of the relationship between deposit rates and the Fed funds rate.

Deposit Rates Following the Rate Reductions of 2008 – 2009

In mid-2007, the effective Fed funds rate hovered around 5.25%. When economic activity slumped during the financial crisis, the Fed dropped the Fed Funds rate repeatedly. By December 2008, the target range for the Fed funds rate was at the lower bound, between 0% – 0.25%.

Deposit rates took years to adjust. In June of 2009, deposit rates were 0.21%, but by December of that year, they declined to 0.20%. Deposit rates ended 2010 and 2011 at 0.17% and 0.11%. In 2012, they fell further and ended the year at 0.07%. Finally, in 2013, deposit rates settled at 0.06% and remained there for several years.

The financial crisis and subsequent recovery provided a unique set of circumstances for banks. However, this pattern of deposit rates lagging behind changes in the Fed funds rate is not uncommon. In the years that followed, a similar pattern emerged.

Deposit Rates in the Rising Rate Environment of 2015 – 2018

After the economy had recovered from the financial crisis, the Fed began raising rates. In December 2015, the Fed raised the Fed funds rate by a quarter of a percent – the first rate hike since the Great Recession. Later, in December 2016, the Fed raised rates again, bringing the target range to 0.5%- 0.75%. Following both rate hikes, deposit rates remained flat at 0.06%.

Deposit rates finally rose in 2018 following a significant tightening of monetary policy in the preceding two years. In 2017 and 2018, the Fed raised rates 7 times, bringing the Fed funds rate from a range of 0.75%-1.00% to 2.25%-2.50%. By the end of 2018, deposit rates had risen to 0.09%.

While the increase in deposit rates might seem significant, it was far less than the increase in the Fed funds rate. In 2017 – 2018, the Fed funds rate rose 200%. Conversely, deposit rates only rose 50%.

Deposit Rates Following the Rate Reductions of 2019

In 2019, the Fed once again began reducing interest rates. The Fed lowered rates three times that year, bringing the Fed funds rate to a target range of 1.50%-1.75% by the end of 2019. However, deposit rates remained flat, ending the year at 0.09%.

Deposit Rates Following the COVID-19 Recession in 2020

In response to the COVID-19 pandemic and subsequent recession, the Fed lowered the Fed funds rate to the effective lower bound, a target rate of 0%-0.25% in 2020. Deposit rates followed and fell throughout the year – ending the year at 0.05%.

In the years between the Great Recession and the COVID-19 pandemic, Fed interest rate policy changed often, and the Fed funds rate rose and fell with the economy. Deposit rates also changed throughout the years, but less dramatically and rarely in perfect tandem with the Fed funds rate. That’s because deposit rates are not tied directly to the Fed funds rate, like some other investment interest rates. Though there is often a correlation between the Fed funds rate and the rate that banks pay for deposits, the Fed funds rate is only one of the factors that determine deposit rates.

How Does the Fed Funds Rate Impact Deposit Rates?

When the Fed raises rates, it can lead to healthier profits for banks, which translate to higher deposit rates. That’s because banks earn a large portion of their profits from their lending activity. So, when the Fed funds rate increases and market interest rates rise in response, banks bring in more revenue. And when banks are bringing in more income, they can better afford to raise deposit rates for their customers.

The Fed funds rate also impacts consumer expectations. When market interest rates rise, consumers demand more income from their deposit accounts. After all, the yields on alternatives have increased along with the Fed funds rate. So, banks will often raise deposit rates to match consumer demands, or risk losing their depositors to other investments.

Bank revenue and consumer expectations can cause deposit rates to move in the same direction as the Fed funds rate. This can explain a portion of the disjunction between the Fed Funds Rate and deposit rates. However, there are many other factors that impact deposit rates, and these factors can greatly impact the rates that businesses and consumers earn on their cash.

What Other Factors Impact Deposit Rates?

A bank’s structure and needs can be a key driver of the rates they pay. Banks earn a profit from lending activity, and lending activity must be supported by deposits. So, in order to increase lending activity, banks must often attract new depositors through higher rates. However, when banks have an excess of deposits, they are less inclined to raise deposit rates because they don’t need to attract new deposit customers.

Competition between banks can also drive deposit rates. When there are few new depositors to be had, banks often must raise rates more quickly to compete with other banks for those deposits. On the other hand, when banks have enough deposits to fund their lending activity, or there are many depositors available in their market, they made be slower to raise the rates that they pay.

Where are deposit rates headed in 2022?

In 2022, the Fed has already begun tightening monetary policy. Based on the historical comparisons, business leaders can expect deposit rates to increase over the next few years, but these increases will likely be slower and smaller than many expect. That’s because banks are currently flush with cash.

In January 2020, total deposits at all U.S. commercial banks were $13,326 billion. By January 2022, this number had grown to $18,068 billion, a 36% increase. Because bank deposits have grown so significantly, many don’t need additional deposits. Therefore, they are unlikely to raise rates quickly to attract depositors.

However, individual bank needs vary, and deposit rates can vary as well. This provides an opportunity for business leaders to earn more than the average on their deposits. In the past, locating the banks that offer better-than-average rates has been a time-consuming process. Now, with fintech, businesses can get competitive rates for their cash reserves without the hassle.

Get Safety and Competitive Returns with AMMA™ by ADM

Our company, ADM, has developed proprietary fintech that connects our nationwide network of banks and credit unions that need deposits with businesses looking for competitive returns. With an American Money Market Account™ [AMMA™] by ADM, business leaders can access nationally competitive returns for their cash all with a single account and a consolidated monthly statement.

In addition to competitive rates, our proprietary fintech ensures that all of a business’ cash can be covered by the highest level of protection – FDIC / NCUA insurance. And, best of all, businesses don’t have to sacrifice liquidity in order to achieve full protection and competitive rates, because with AMMA™, businesses have access to next-day liquidity. To learn more about ADM and AMMA™, contact us today.

To stay abreast of interest rate changes, banking industry insights, and other valuable financial information, be sure to check out our Insights page and follow us on LinkedIn, Twitter, and Facebook.

*American Deposit Management is not an FDIC/NCUA-insured institution. FDIC/NCUA deposit coverage only protects against the failure of an FDIC/NCUA-insured depository institution.

FOMC Maintains Interest Rates Amid Increasing Economic Uncertainty

The FOMC cited increasing economic uncertainty as a factor in their vote to hold the Fed Funds Rate steady at the May meeting.

Common Business Cash Investments That Are Excluded from FDIC Insurance

These cash investments are common choices for cash managers but use caution because they are excluded from FDIC insurance.

A Guide to Cash Management for Public Organizations

This guide covers the crucial factors public organizations need to consider when creating an effective cash management plan.