Declining Bank Deposits Could Impact Deposit Rates

Each year since WWII total bank deposits have grown which has contributed to stagnant, and in some cases, declining rates on deposits. However, in 2022, bank deposit levels are expected to decline for the first time in more than 75 years.

In the current environment of economic uncertainty, many businesses are holding additional cash to account for unforeseen shocks. The good news is, shrinking deposit levels across the banking industry could lead banks to pay higher rates on deposits.

Deposit Levels Impact the Rate Banks Pay

Deposit levels are one of the factors that impact the rate banks pay their deposit customers. The reason for this is banks need deposits in order to fund their lending activity and generate profits. So, when banks are low on deposits, they often need to entice new deposit customers by offering them higher rates in exchange for their cash. On the other hand, when banks are flush with cash, they often keep deposit rates low since they do not need to attract new customers.

When deposits at a specific bank decline, it could cause that bank to raise their rates above those paid by their competitors. On a larger scale, when deposits decline across the entire banking industry, it can drive rates up across the country.

The Current State of Bank Deposits

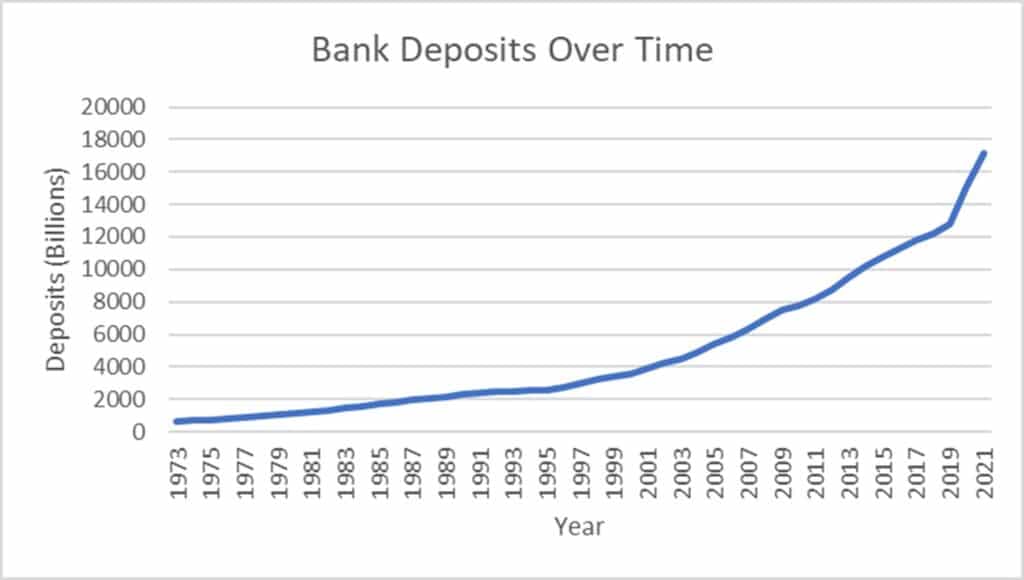

In the U.S., bank deposits have grown each year since WWII. This trend was particularly evident during the COVID-19 pandemic.

Source: FRED

Deposits Grew Rapidly During the Pandemic

During the pandemic, bank deposits soared. At the end of 2019, total bank deposits were $13,257 billion but by the end of 2021, deposits had reached $17,965 billion – a 35.5% increase. In the first half of 2022, deposit growth has slowed but still continued on an upward trajectory, reaching $18,147 billion in June.

In part, deposits grew during the pandemic due to an increase in the personal savings rate, which measures the percentage of disposable income saved by individuals. In April 2020, the personal savings rate reached a multidecade high of 33.8%.

In addition to higher savings by consumers, many businesses increased their cash reserves during the pandemic due to global supply chain difficulties and increased uncertainty regarding the COVID-19 virus. By August 2021, corporate cash reserves reached $6.84 trillion, a 45% increase from the five years preceding the pandemic.

Personal and Business Savings Rates Have Slowed Since the Pandemic

Now that many individuals and businesses have resumed their normal spending following the pandemic, savings rates have declined. By March 2022, the personal savings rate had fallen to 6.2%, slightly lower than the pre-pandemic level. For businesses, capital expenditures increased from $5,315,498 million in Q2 2020 to $7,462,684 million in Q1 2022. With more spending comes less cash reserves and therefore lower business deposits at banks.

While new deposits at banks have slowed, banks are still flush with cash. However, economists predict that individuals and businesses will continue to save less and spend more which could lead to lower bank deposit levels.

Bank Deposits Are Expected to Decline in 2022

Analysts are predicting a 6% decline in bank deposits in 2022, the first such decline since WWII. Under normal conditions, a decline in bank deposits could lead to higher deposit rates. However, the unprecedented growth in deposits during the pandemic has created a unique set of circumstances where banks have excess deposits above and beyond what they can lend.

According to analysts, banks have $8.5 trillion more in deposits than loans. This could lead to a situation where bank deposits decline, but it doesn’t have much of an impact on their operations or profits.

The Future of Deposit Rates

Since banks have record deposits, they have not needed to raise the rates they pay for cash reserves over the past two years. Even as interest rates increased, savings account rates remained stagnant. According to data from the FDIC, the average savings account has yielded between 0.06% and 0.07% for the last 14 months.

The future of deposit rates will depend on many factors, one of which is deposit levels throughout the banking industry. However, individual bank deposit levels, local competition, and bank structure also play a large role in determining deposit rates. Because individual bank needs vary, there are opportunities for businesses to earn more than the average on their cash reserves.

In the past, finding these banks that offer above average interest rates has been a labor-intensive process. Now, with the advent of fintech, businesses can access competitive rates without the hassle.

AMMA™ by ADM Provides Safety and Competitive Returns for Business Cash Reserves

Our company, the American Deposit Management Co. [ADM] helps businesses secure competitive interest rates for their cash reserves. We accomplish this through our proprietary fintech which connects our nationwide network of financial institutions seeking deposits with businesses looking to secure competitive rates.

In addition to competitive rates, our American Money Market Account [AMMA™] provides the highest level of protection for business cash reserves – FDIC / NCUA insurance. Typically, this insurance is limited to $250k per account ownership category at each insured bank, but with AMMA™ businesses can receive access to extended FDIC / NCUA protection for all of their funds. So, if your business needs safety and completive returns for cash reserves, contact us today.

Banking Brief: Q2 2025

A review of the biggest Q2 banking headlines – bank failure, interest rate projections, and two important regulatory changes.

Navigating the Economic Tides: Monetary and Fiscal Policy’s Impact on Banking and Corporate Finance

Prudent financial stewardship requires an understanding of monetary and fiscal policy as well as strategies for adapting to change.

FOMC Holds Interest Rates Steady at June Meeting

The FOMC maintained interest rates at the current level and released updated economic projections at the June meeting.