Deposit Rates Could Continue to Rise in 2024

The business community has welcomed higher yields on their deposit accounts over the past two years. This additional interest income helped to protect the value of cash reserves against inflation and, in some cases, even boosted profitability.

Higher deposit rates are generally a side-effect of higher interest rates, and the Fed Funds Rate has risen dramatically over the last twenty-one months. However, there are several other factors at play that could raise deposit rates – even if the Fed begins lowering interest rates next year.

Do deposit rates always follow the Fed Funds Rate?

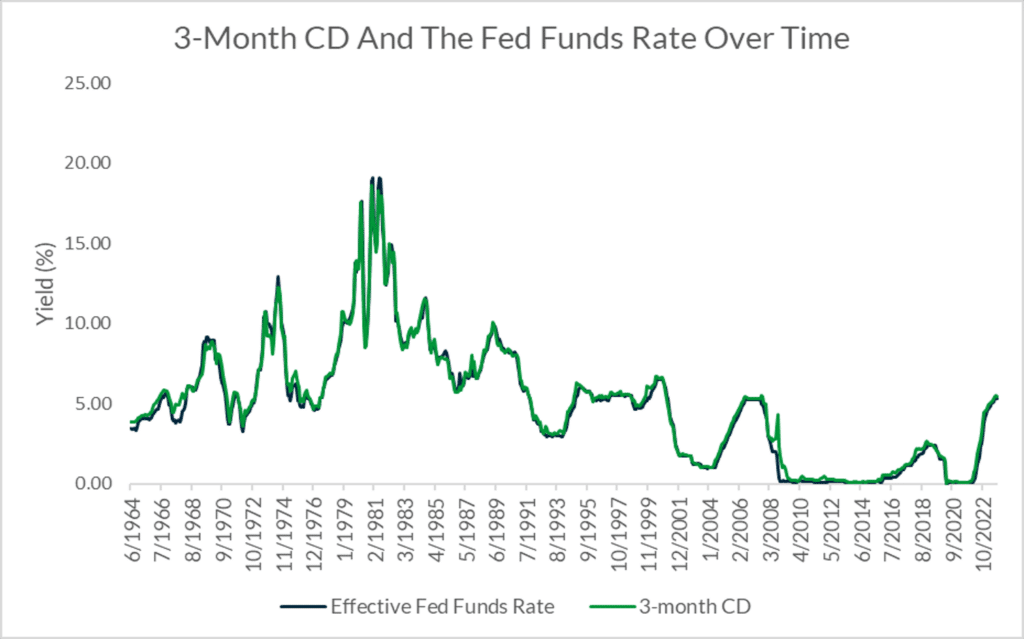

Yields for bank accounts – including checking, savings, and Certificates of Deposit [CDs] – tend to follow the Fed Funds Rate. The correlation is strongest between the Fed Funds Rate and the yield for 3-month CDs. However, the chart below shows that there have been several times in history where deposit yields have deviated from the Fed Funds Rate.

One of the main factors that causes these deviations is competition within the banking sector. Under normal circumstances, competition between banks is localized to a geographical area or a particular segment of the market. On the other hand, there are factors that spur competition within the entire banking industry – like the total level of deposits.

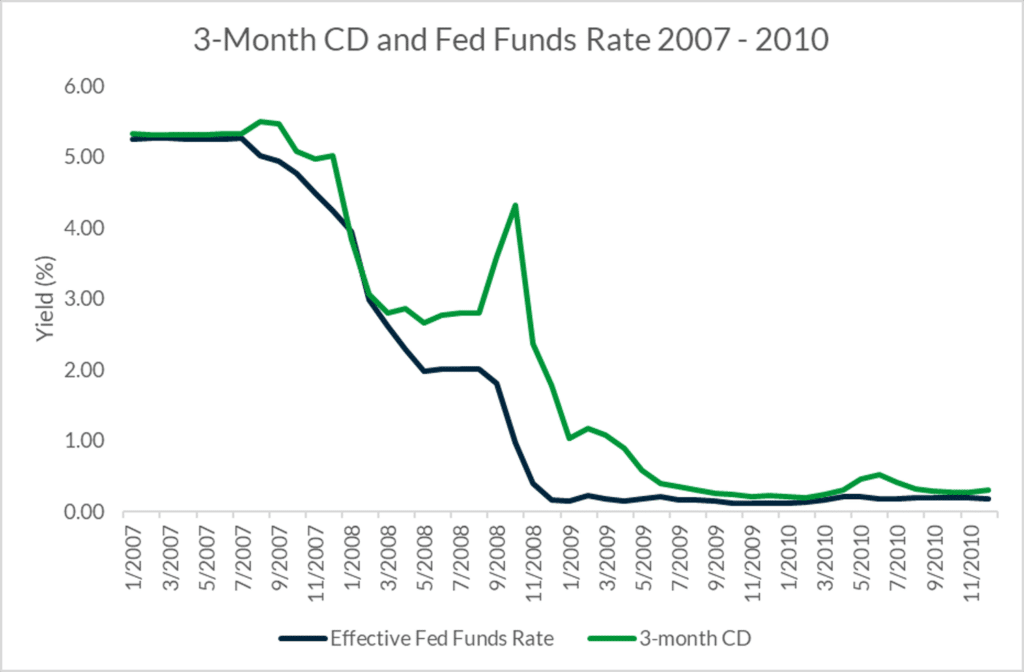

For example, a significant deviation between the Fed Funds Rate and the 3-month CD yield was recorded around the time of the 2008 financial crisis. Total bank deposits from 2008 through 2009 grew by 14.2% compared to 18.2% in the two preceding years. This slowdown in new deposits coupled with the widespread news of turmoil in the banking sector led to additional competition between banks. The increased competition helped to keep deposit rates high even as the Fed lowered interest rates, as evidenced by the divergence in the graph below.

Increased Competition Could Drive Deposit Yields Higher in 2024

Today, turmoil in the banking sector and slower savings rates have contributed to six consecutive quarters of declining bank deposits. For perspective, $645 billion in deposits have left the banking industry since January 2022. Compare this to the 2008 – 2009 period where deposits continued to grow despite a banking crisis, and you can see this decline is historic.

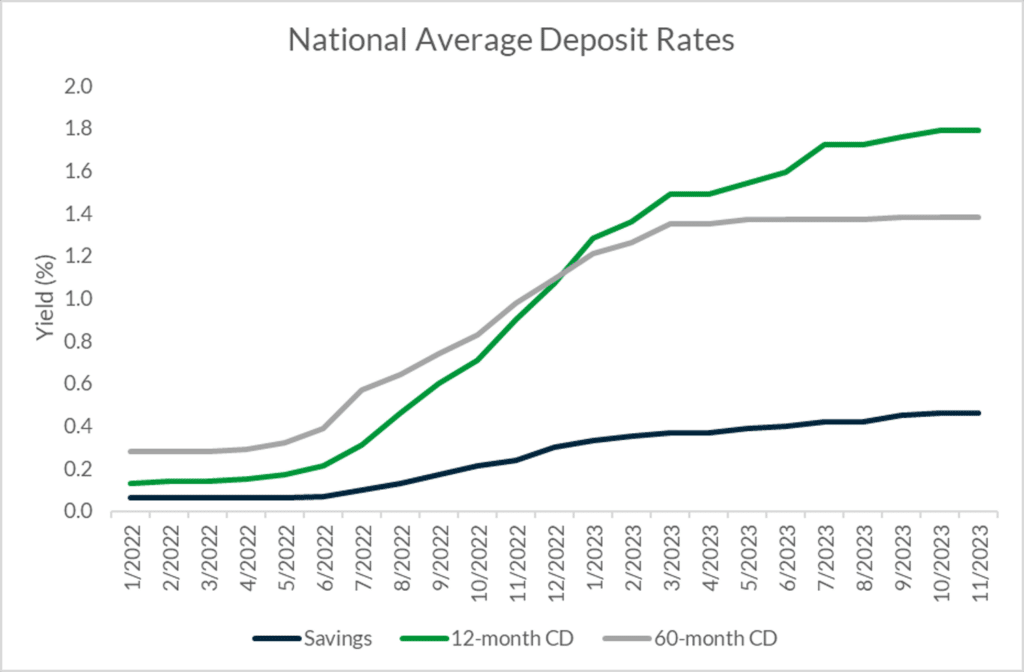

As the chart below illustrates, bank deposit yields have more than quadrupled across all types of accounts since early 2022. In addition, rates have continued to climb in recent months despite the Fed Funds Rate remaining flat during that period.

If deposit levels continue their decline in the coming year, banks will face even more competition, and that could put more upward pressure on deposit yields. This dynamic could be enough to overcome some of the projected rate cuts, and keep deposit rates elevated in the near term.

Businesses Can Take Advantage of Competition to Find Above-Average Yields

Several geographic areas have seen above-average competition for deposits in recent months. As expected, this competition has resulted in higher deposit yields in these areas.

Businesses can take advantage of increased competition between banks to capture higher rates of return if they have know-how and the resources. These above-average yields can be achieved by monitoring rates from banks across the country and moving cash to the financial institution with the most competitive rates.

While this process might sound simple, it requires constant monitoring and the ability to manage many different banking relationships. The higher returns are often eroded by the extraordinary amount of effort required to execute this strategy. Fortunately, there is a company that has simplified this process using their proprietary fintech.

Capture Nationally Competitive Yields for Business Cash with ADM

At the American Deposit Management Co. [ADM], we’ve developed a concept called Marketplace Banking™ that helps businesses achieve nationally competitive rates for their cash with a single account and monthly statement. The best part about this service is you keep your current bank as we understand the value of a local banking relationship. We do not replace your current banking relationship; we simply enhance it.

In addition to competitive yields, our fintech allows businesses to access full government protection for their cash – above and beyond the traditional limits. We also offer liquidity to meet your needs and outstanding customer service.

To learn more and get started, contact us.

*American Deposit Management is not an FDIC/NCUA-insured institution. FDIC/NCUA deposit coverage only protects against the failure of an FDIC/NCUA-insured depository institution.

FOMC Lowers Interest Rates at Final 2024 Meeting

At the last FOMC meeting of 2024, committee members voted to reduce the Fed Funds Rate and released updated economic projections.

History of Economic Turmoil in the U.S. Part 2 of 3 – Mid-20th Century

Part two of this three-part series explores the catalysts and resolutions of the worst recessions in the mid-20th century.

A Brief History of U.S. Bank Failures

Devastating bank failures occur frequently in U.S. history, but government action has significantly reduced the risk of losses.