FOMC Raised the Fed Funds Rate to the Highest Level Since 2001

FOMC members met on July 25th and 26th to determine the future of monetary policy. At this meeting, they discussed numerous factors that have shaped the current economic landscape. In response to this data, committee members voted to raise the Fed funds rate for the fourth time this year.

The Rate Decision

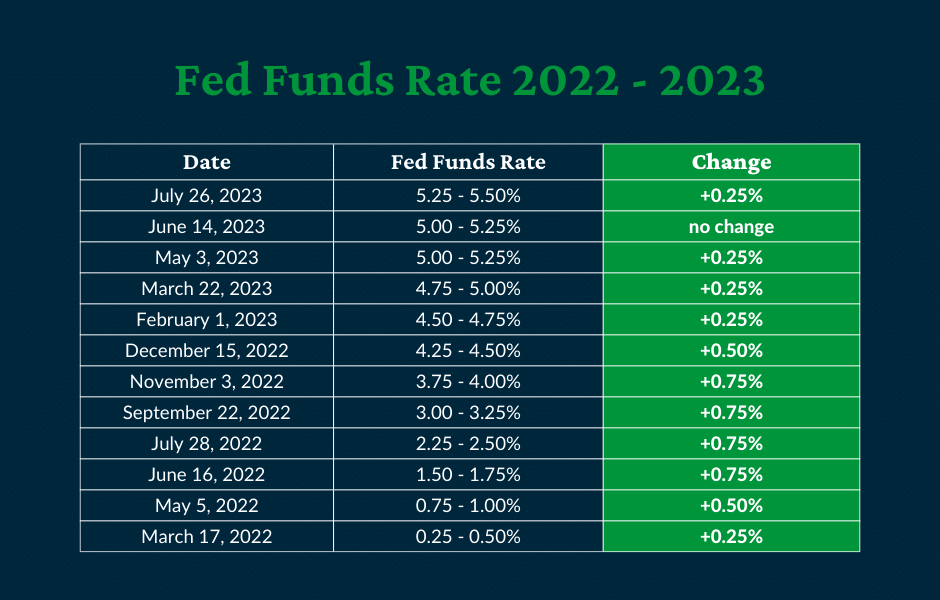

The FOMC voted to raise the Fed funds rate by 0.25% to a target range of 5.25 – 5.50%. This is the highest level since January 2001.

The current tightening cycle began in March 2022 amid rising consumer prices, strong economic growth, and a tight employment market. Since that time, the Fed has raised interest rates eleven times, while reducing bond holdings in a process called quantitative tightening.

Tighter monetary policy is generally intended to slow the economy, thereby lowering inflation. In the press conference following the interest rate announcement, Fed Chair Powell referred to the current policy level as “restrictive” and indicated that higher interest rates are “putting downward pressure on the economy” as intended.

The Reasoning Behind the Rate Hike

The FOMC has repeatedly stated that their monetary policy decisions are made meeting-by-meeting – based on the current state of the economy and the cumulative effects of policy tightening. According to Chair Powell, the data that was made available between the June and July meetings was “broadly in-line with expectations.”

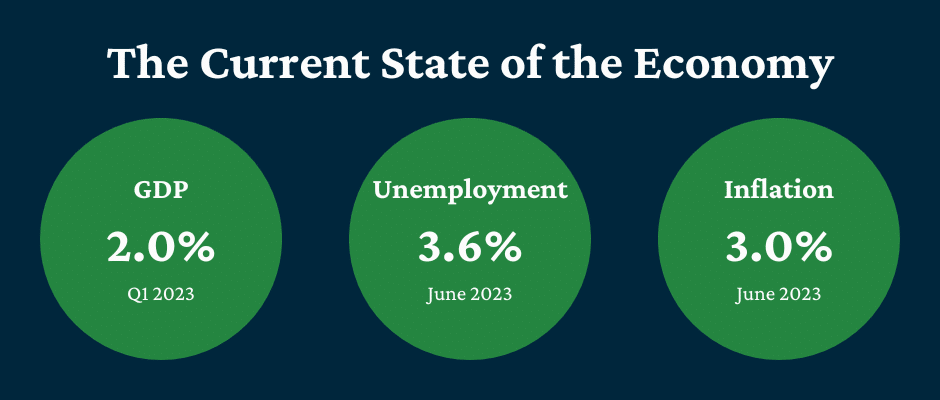

The recent economic data reflected the Fed’s previous efforts and the effects of higher interest rates. Some of the economic factors the FOMC noted as contributing to their most recent decision were moderate economic growth, a low unemployment rate, and persistently elevated inflation.

Moderate Economic Growth

The traditional measure of economic growth is Gross Domestic Product [GDP]. The most recent data from the Bureau of Economic Analysis showed that Real GDP rose at an annual rate of 2.0% in the first quarter of 2023. This followed a 2.6% increase in the fourth quarter of 2022. The moderation in GDP was in line with the traditional goal of restrictive policy – to slow the economy without pushing it into recession.

Low Unemployment Rate

The latest data from the Bureau of Labor Statistics showed that the unemployment rate was 3.6% in June, slightly lower than the 3.7% rate in May. This rate has remained in a narrow band between 3.4% and 3.7% since March 2022.

Chair Powell stated that unemployment has historically risen when the Fed tightens monetary policy. This has not been the case in the current tightening cycle. However, Powell noted that job openings have declined, and the labor force participation rate has risen – factors that suggest the labor market could be cooling.

Persistently Elevated Inflation

The FOMC noted that prices are still rising more quickly than their target. The June Consumer Price Index registered a 3.0% increase from the year prior. This followed a 4.0% increase in May.

Personal Consumption Expenditure [PCE] inflation is the Fed’s preferred gauge of price trends. The June numbers were not available prior to the meeting, but May’s increase was 3.8% from the previous year. Overall, price increases have slowed markedly from the highs seen last summer, but the inflation rate is still much higher than the Fed’s 2% target.

While the economy and inflation have shown signs of cooling, Powell noted that further progress is needed to restore a sustained economic equilibrium. The latest interest rate hike factors into the Fed’s plan to keep monetary policy restrictive until inflation has shown lasting signs of moderation.

The Potential Impact of Higher Interest Rate Hikes

In the press conference, Powell noted that reducing inflation through tighter monetary policy “is likely to require a period of below-trend growth and some softening of labor market conditions.” Other committee members echoed this sentiment in their recent projections.

These projections show GDP falling to a 1.0% annual growth rate for 2023 followed by a 1.1% rate for 2024. Additionally, the Fed’s projections indicate that unemployment could begin to reflect the softening labor conditions later this year. By the end of 2023, FOMC members predict that the unemployment rate will rise to 4.1%. In the following year, this rate is expected to increase further, reaching 4.5% by the end of 2024.

The restrictive policy is expected to help reduce inflation over time. However, Powell explained that the Fed does not need to see inflation return to the 2% target before pausing interest rate hikes. In fact, the FOMC’s projections show inflation continuing above that target throughout 2024 and 2025 while the Fed funds rate is expected to decline over the same period.

Expectations for the Future of Monetary Policy

In the June projections, FOMC members forecasted an end of year Fed funds rate of 5.6%, which suggests one additional rate hike this year. Then in 2024, the committee predicts that they will begin to lower interest rates.

Pundits project a faster conclusion to the current tightening cycle. In fact, almost 80% of Fed funds futures traders predict that the Fed will keep rates steady at the next meeting in September. This interest rate pause is expected to be followed by cuts in 2024.

While businesses can gain some insights from the FOMC and markets about the future of monetary policy, the Fed’s ultimate decision will be based on data. Between the July and September meetings, the FOMC will have access to an array of economic data including two monthly employment and inflation reports as well as the estimates for second quarter GDP. These data points will give the Fed insight into how the economy has reacted to past rate hikes and help them determine the future of monetary policy.

Don’t miss our Federal Reserve updates.

At the American Deposit Management Co. [ADM], we help companies stay up to date on the latest developments in interest rates, business, and banking. Subscribe to our mailing list to receive our weekly article directly to your inbox. For more valuable information, check out our insights page. Also, don’t forget to follow us on LinkedIn, Twitter, and Facebook.

Navigating the Economic Tides: Monetary and Fiscal Policy’s Impact on Banking and Corporate Finance

Prudent financial stewardship requires an understanding of monetary and fiscal policy as well as strategies for adapting to change.

FOMC Holds Interest Rates Steady at June Meeting

The FOMC maintained interest rates at the current level and released updated economic projections at the June meeting.

Community Financial Institutions Face 2 Common Problems in 2025. ADM Is the Solution.

Banks and credit unions face two key problems in 2025. Fortunately, our company offers solutions to attract and retain depositors.