At the FOMC meeting held June 13th and 14th, committee members discussed the progress of the economy and inflation. Based on this data, they chose not to raise the Fed funds rate. Board members also updated their projections for the economy this year and in the long run. The updated forecasts reflect a shift in outlook since the last projections were released in March.

The FOMC Held Rates Steady at June’s Meeting

FOMC members voted to keep the Fed funds rate at a target range of 5.00% – 5.25% during their meeting earlier this week. In the statement accompanying the interest rate decision, participants noted that, “holding the target range steady at this meeting allows the Committee to assess additional information and its implications for monetary policy.” Along the same lines, Fed Chair Jerome Powell noted that June’s pause will allow the committee to review almost a full quarter of economic data at July’s meeting before deciding their next step.

Data Influenced the FOMC’s Decision

The decision to maintain the current Fed funds rate came after recent data showed inflation remains well above the Fed’s target and the labor market remains extremely tight by historical standards. These factors, along with moderate economic growth, were mentioned as contributing to the FOMC’s most recent decision.

PCE Inflation Remains Above the Fed’s Target

Personal Consumption Expenditure [PCE] inflation increased by 4.4% from April 2022 to April 2023. Core PCE inflation, which excludes the volatile food and energy sectors, rose by 4.7% over the same period. Chair Powell noted that goods and housing services inflation have begun to moderate. However, prices for non-housing services continue to escalate. Prices for these services are heavily dependent on labor market conditions.

The Labor Market Remains Strong

The most recent data from the Bureau of Labor Statistics showed that employment increased by 339,000 in May and the unemployment rate was 3.7%. While the unemployment rate is moderately higher than earlier in the year, the labor market remains tight by historical standards.

Rising wages are traditionally associated with a tight labor market, and the current economic cycle has followed this pattern. In the past year, average hourly earnings have increased by 4.3%. In the press conference following the interest rate announcement, Chair Powell noted that “some softening of labor market conditions,” along with a period of below-trend growth, will be needed to reduce inflation.

FOMC Members Updated Economic Projections

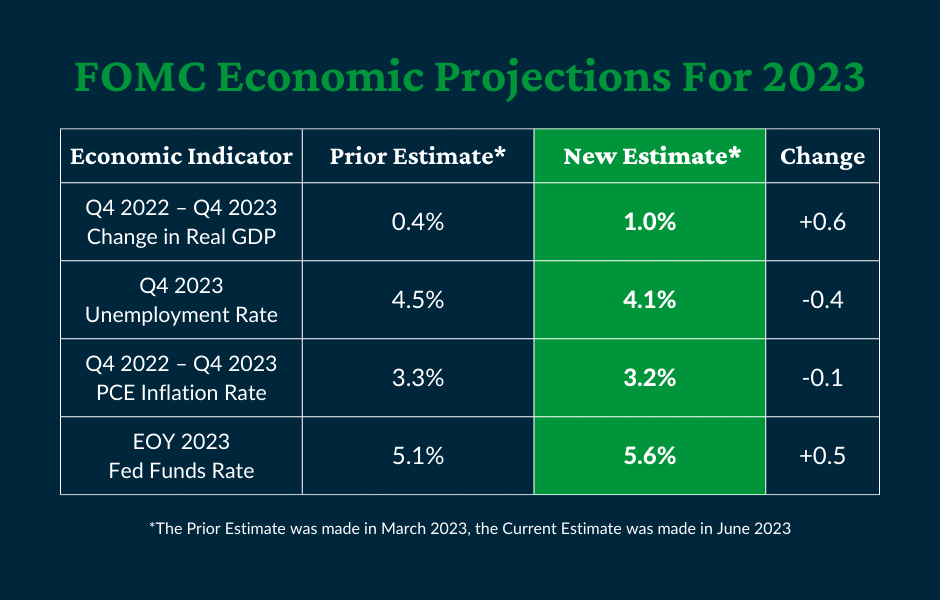

In addition to an interest rate decision, FOMC members submitted updated economic projections at the June meeting. These projections are made four times per year and the last estimates were in March. Since that time, committee members have changed their outlook on economic growth, unemployment, and the path of the Fed funds rate.

Economic Projections for 2023

In March, FOMC members projected a 0.4% annual increase in Real GDP from the fourth quarter of 2022 to the fourth quarter of 2023. This expectation was revised to 1.0% annual growth in the most recent projections. Along with higher growth, the anticipated unemployment rate was lowered from 4.5% to 4.1%. Additionally, the estimated PCE inflation rate was reduced by a modest 0.1% to 3.2%. Together, these estimates show a slightly more optimistic outlook for the economy this year.

The change to the anticipated Fed funds rate was the most significant update to the FOMC’s current year projections. Committee members increased their year-end Fed funds rate estimate from 5.1% to 5.6%. This signals that the committee now forecasts additional rate hikes by the end of the year.

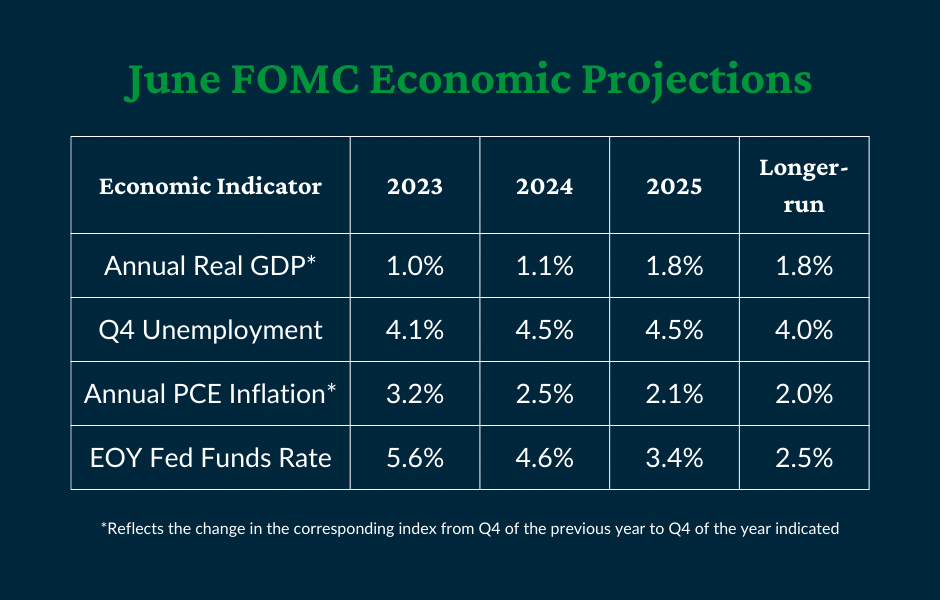

FOMC Projections for 2024 and Beyond

Committee members made small adjustments to their longer-term economic outlooks from the previous projections in March. GDP growth was revised down marginally for 2024 and 2025 while the long-run average remained well anchored at 1.8%. Similarly, the anticipated unemployment rate was slightly reduced for the next two years while the long-run expectation remained at 4.0%. Inflation expectations held steady at 2.5% for 2024, 2.1% for 2025, and 2.0% long-run.

The path of the Fed funds rate was the only factor to significantly change from the previous projections. The estimate for 2024 was increased by 0.3% to 4.6%. Along the same lines, the forecast for 2025 was increased by 0.3% to 3.4%. However, the long-run estimate remained steady at 2.5%.

Overall, the latest FOMC projections forecast stronger economic growth, lower unemployment, and higher interest rates over the next several years. In addition, inflation is expected to decline over the next three years before settling at the long-run target.

To achieve this disinflation, the FOMC anticipates that additional interest rate increases will be necessary. However, committee members have continuously stated that interest rate decisions will be made meeting-by-meeting – based on incoming data.

Don’t miss our Federal Reserve updates.

Stay up to date on the latest developments in interest rates, business, and banking with our weekly insights. Subscribe to our mailing list to receive this valuable information directly to your inbox.

For more articles, check out our insights page. Also, don’t forget to follow us on LinkedIn, Twitter, and Facebook.

*American Deposit Management Co. is not an FDIC/NCUA-insured institution. FDIC/NCUA deposit coverage only protects against the failure of an FDIC/NCUA-insured depository institution.