History and Timeline of Changes to FDIC Coverage Limits

Since the inception of the FDIC in 1933, there have been numerous bank failures but no depositor has lost a penny of insured funds. This fact alone has provided stability and confidence in the U.S. banking system that did not exist before the FDIC was established.

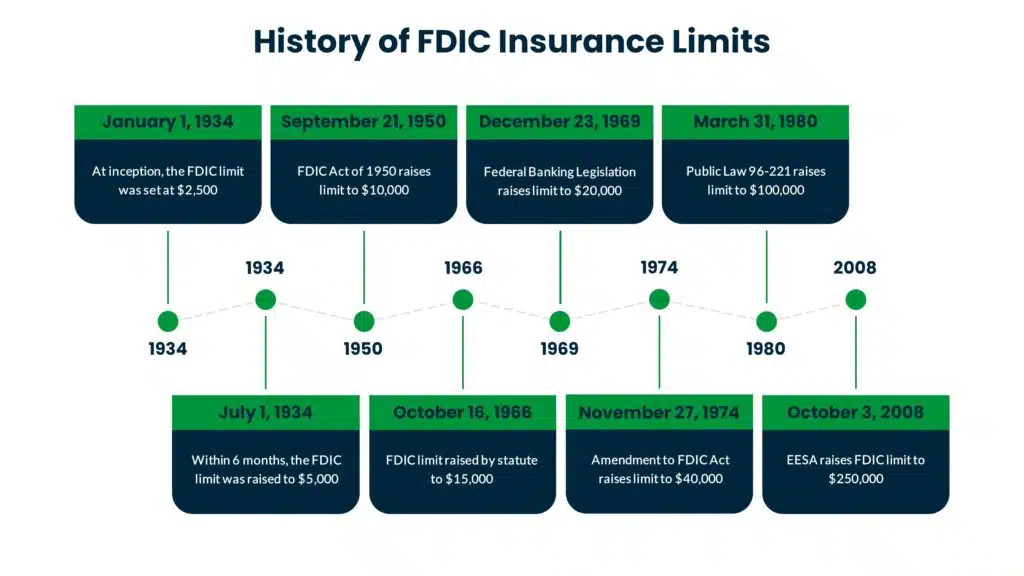

Although the FDIC has provided a strong backstop to prevent lost deposits, that doesn’t mean that all funds are protected. FDIC coverage has always had limitations for individuals and businesses. These limits have changed several times throughout the history of the FDIC due to various crises, inflation, and other factors. The limit currently stands at $250,000 per depositor, per institution, but how has it evolved over time?

A History of FDIC Insurance Coverage Changes

Since FDIC coverage became effective on Jan 1, 1934, the FDIC has adjusted the maximum coverage available to depositors seven times:

July 1934

Only six months after the creation of the FDIC, government leaders realized the initial $2,500 limit was not enough to effectively support the banking system. So, on July 1, 1934, the FDIC limit was doubled to $5,000.

September 1950

On September 21, 1950, congress passed the FDIC Act of 1950 which revised and consolidated FDIC legislation into a single act. This act gave the FDIC authority to evaluate and lend to insured banks in danger of closing. It also impacted FDIC coverage by raising the coverage limit to $10,000.

October 1966

On October 16, 1966, the FDIC coverage limit was increased to $15,000 by statute. This was in response to a survey of deposits that indicated a higher maximum coverage amount would have protected almost 99% of depositors from recent bank failures.

December 1969

On December 23, 1969, just 3 years after the last increase, Public Law 91-151 was passed by congress “to lower interest rates and fight inflation; to help housing, small business, and employment; to increase the availability of mortgage credit; and for other purposes.” This act also amended the Federal Deposit Insurance Act to increase the FDIC coverage limit to $20,000.

November 1974

Effective November 27, 1974, the Federal Deposit Insurance Act was amended to raise the FDIC coverage limits for individuals and businesses to $40,000. During the 1970’s, inflation was nearing historic highs, and this was an important factor in raising this limit – just 5 years after the last increase. This doubling of coverage was the largest increase in FDIC coverage limits in history.

March 1980

On March 31, 1980, following the historically high inflation of the 1970’s, another increase in FDIC coverage was implemented through the passing of Public Law 96-221. This time the increase in coverage was dramatic. The FDIC coverage limit more than doubled to $100,000, which was again the largest increase in history. This was a level it would maintain for almost 3 decades.

October 2008

During the height of panic brought on by the Great Recession, the Emergency Economic Stabilization Act [EESA] was passed which temporarily raised the FDIC coverage limit to $250,000. For the third consecutive time, this increase was the largest in history. On July 21, 2010 this increase was made permanent by the Dodd-Frank Wall Street Reform and Consumer Protection Act. The FDIC has maintained this level of insurance coverage since that time.

When will the FDIC increase coverage limits again?

As you can see from history, changes to FDIC coverage have been somewhat sporadic. In general, during times of high inflation or times of crisis, we can look for the FDIC to adjust their coverage when they deem it necessary.

Between 2011 and 2022, 214 banks collapsed. However, these were small institutions and the total assets of all failed banks during this timeframe was only $71 billion. As such, there was not much discussion surrounding the FDIC limit. Then in 2023, three bank failures rattled the financial world.

Combined, the failures of Signature Bank, Silicon Valley Bank, and First Republic Bank represented nearly $550 billion in assets. Many large depositors were at significant risk of losing their uninsured funds. The FDIC and the Treasury took unprecedented action to guarantee all funds at Signature and Silicon Valley Banks, even those above the FDIC limit. This action is credited with helping to slow the panic surrounding the bank failures. It also raised the question once again – should the FDIC limit be higher?

Following the early 2023 bank failures, the FDIC attempted to tackle this question. In a report released May 1, the FDIC proposed three options for the future of deposit insurance.

- Limited Coverage. The current structure of FDIC insurance where both businesses and individuals are covered up to a particular limit would be maintained.

- Unlimited Coverage. All deposits, both individual and business, would be protected.

- Targeted Coverage. A significantly higher limit would apply to business deposits compared to individual deposits.

The result of the FDIC’s analysis was a recommendation to implement targeted coverage. This was based on the fact that 99% of all deposit accounts are under the FDIC limit but the 1% of large accounts make up nearly half of U.S. deposits. Many of these large accounts belong to businesses. An overhaul of the FDIC program would require Congressional action. As of the writing of this article, the discussion continues but no action has been taken.

Is it possible to get FDIC coverage in excess of the $250,000 limit?

Yes, it is possible for businesses to access extended FDIC protection. That’s because FDIC limits are “per depositor, per institution.” This means that you can get more coverage by having accounts at multiple FDIC insured banks.

As you can imagine, the more cash you need protected, the more banking relationships you will need to maintain. In the past, this created a great deal of additional work to monitor, manage, and reconcile these accounts. Now, with the help of advanced financial technology – a.k.a. fintech – the days of managing multiple banking relationships to achieve full FDIC protection are over.

Earn More, Risk Less® with Marketplace Banking™ by ADM

Our company, the American Deposit Management Co. [ADM], has leveraged our proprietary fintech and vast network of banks to simplify the process of protecting business cash. We call this concept Marketplace Banking™ and it allows business to achieve virtually unlimited FDIC / NCUA protection with a single deposit, a single relationship, and a single consolidated statement.

If this sounds like a program that could help your business manage and protect its cash, don’t hesitate to reach out to a member of our team. As you will learn, our team is our secret sauce, and they are standing by to answer your questions and streamline the onboarding of your company.

To stay abreast of interest rate changes, banking industry insights, and other valuable financial information, be sure to check out our Insights page and follow us on LinkedIn, Twitter and Facebook.

*American Deposit Management is not an FDIC/NCUA-insured institution. FDIC/NCUA deposit coverage only protects against the failure of an FDIC/NCUA-insured depository institution.

Business Escrow for Intellectual Property Transfers

Business escrow services help to mitigate risk during large and lengthy transactions like intellectual property transfers.

2025 Business Economic Outlook

Several factors that helped to shape the 2024 economic landscape are expected to continue impacting business in the new year.

FOMC Lowers Rates at The November Meeting

FOMC members voted to reduce the Fed Funds Rate for the second consecutive time at the meeting on November 6th and 7th.