How Businesses Plan to Adapt to Inflation

The rapid pace of inflation is a key risk for businesses in 2022. Higher input prices can threaten profitability, while firms who raise prices can lose customers. In short, it is a tough balancing act for businesses to adapt to higher costs without crippling demand for their products.

Companies across the country are grappling with inflation in different ways. Leaders who understand these differing methods for combatting inflation can gain a better knowledge of their competition’s plans and use this information to maintain a competitive edge.

How Finance Leaders Plan to Combat Inflation

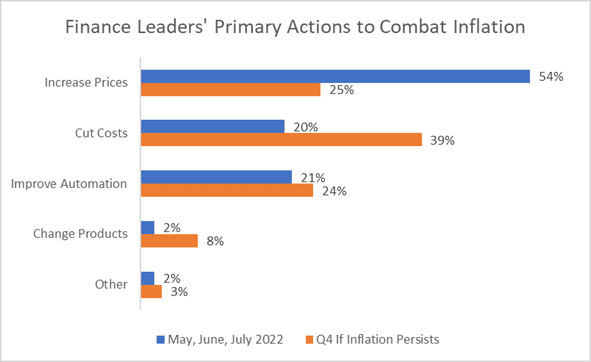

A new survey shows how businesses plan to adapt to inflation in the short term and if prices continue to climb in the future. The chart below shows the primary action that CFOs are using presently to combat inflation and the action they plan to take in 6 months if inflation persists.

Some Businesses Plan to Increase Prices in Response to Inflation

When surveyed, 54% of businesses indicated that raising prices was their primary tool for weathering the current inflationary environment. However, these price increases may not be sustainable for the long term. Only a quarter of companies plan to rely on price hikes if inflation persists into the fourth quarter.

If fewer businesses rely on price increases in the future, it could be good news for the inflation rate. When businesses raise prices in response to higher costs, it contributes to a vicious inflationary cycle. However, if firms keep their prices level, or at least raise their prices more slowly, inflation could slow as well.

Firms Plan to Cut Costs if Inflation Persists

Another popular method that businesses are using to combat inflation is cost cutting. At present, 20% of businesses indicated that reducing expenses was their main instrument for reacting to inflation.

A cost minimization strategy could become increasingly important in the coming months. If inflation persists into the fourth quarter, 39% of firms plan to reduce expenses as their principal tool for adapting to inflation, nearly double those that are currently relying on this method.

Businesses Plan to Increase Automation in Response to Rising Costs

Automation can help businesses reduce reliance on human labor and can increase productivity for current workers. As such, businesses have begun increasing their investment in automation as labor costs have risen. Finance leaders indicate that the current inflationary environment could continue to propel investment in this area.

Currently, 21% of CFOs indicated that their companies are using automation as their primary tool for battling inflation. If prices continue to climb, more businesses plan to invest in this technology. Per the survey, 24% of firms are planning to improve automation if prices continue rising into the fourth quarter.

A Few Businesses Plan to Change Products in Response to Inflation

Just 2% of CFOs from the survey indicated that their businesses are changing their products in response to inflation. However, if inflation persists, 8% of companies plan to make changes to their products.

A new term has arisen recently to describe some of these product changes – shrinkflation. This is the tactic of selling smaller portions of products at the same price to reduce costs. While this strategy can prove effective, it has not been popular with consumers.

Cash Reserves Can Help Businesses Weather Inflation

In addition to the methods mentioned in the survey, businesses often work to increase their cash reserves in response to inflation. Cash reserves can help businesses survive a high inflation, rising rate environment while maintaining their market share.

Businesses with ample cash reserves have more options to combat inflationary pressures. For example, a firm could use their cash reserves to fund an investment in automation that could improve profitability for years to come. In addition, cash reserves can help businesses meet short term needs without dramatically raising their prices or cutting hard-to-replace employees.

With the advent of fintech, cash reserves can also earn a competitive return. This income can help supplement revenue and ease the strain of higher expenses. For all these reasons, effective cash management is essential to helping businesses adapt to inflation.

With AMMA™ from ADM, Businesses Can Get Safety and Nationally Competitive Rates for their Cash Reserves

Sufficient cash reserves can help businesses maintain their market share in a high inflation environment. However, holding excessive cash in an unprotected account can create additional risk. Our company, the American Deposit Management Co. [ADM] has solved this problem.

With our American Money Market Account™ [AMMA™], businesses can achieve the ultimate protection for their cash reserves – FDIC / NCUA insurance. In addition, our proprietary fintech allows us to spread business deposits across our nationwide network of financial institutions that compete for deposits, ensuring that our customers always receive nationally competitive rates.

To learn more or get started, contact us today.

Q4 Banking Trends: Strong Net Income, Rising Deposits, Lower Unrealized Losses

American banks reported strong net income and lower unrealized losses alongside higher loan balances and deposit levels in Q4 2025.

How Did the Gramm-Leach-Bliley Act Facilitate Bank Consolidation?

The Gramm-Leach-Bliley Act passed in 1999 and ushered in a new era of consolidated, one-stop shop banking that perseveres today.

An Overview of Regulations Governing the Management of Public Funds

Public entities like school districts and municipalities are held to specific regulations that govern the ways funds are invested.