How Do Rising Wages Impact Business?

Many businesses build annual wage increases into their budgets. However, since the pandemic, labor costs have skyrocketed – far outpacing what many firms have budgeted. This rapid increase in labor costs is putting pressure on businesses’ bottom lines and challenging leaders to develop new strategies for managing these costs.

An important first step in mitigating the impact of rising labor costs is to understand the factors that have led to the rising wage environment. Then business leaders can learn from the strategies other firms are implementing and create a plan for managing labor costs while maintaining a high level of customer satisfaction.

What Causes a Rapid Increase in Wages?

The first step in managing the impact of rising wages is understanding the root cause. Two of the most common factors that can lead to rising employment costs are inflation and a tight labor market.

Inflation Leads to Higher Employment Costs

As prices across the economy rise, employees demand higher wages to compensate for the increased cost of buying goods and services. For this reason, inflation is one of the key drivers of wage growth.

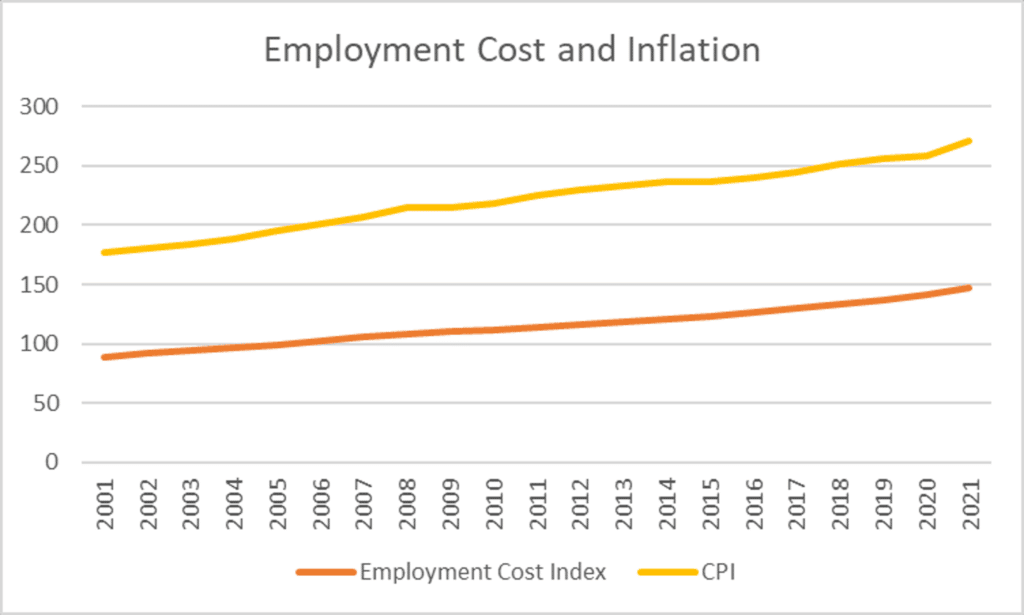

As the chart below illustrates, both wages and inflation have increased steadily over the past twenty years, and nearly in tandem.

From May 2021 to May 2022, consumer prices rose by 8.6%. This rapid pace of inflation has led businesses to raise wages more quickly than in previous periods when inflation was not so prevalent. Wages rose 4.7% from Q1 2021 – Q1 2022, far outpacing wage growth over the past 20 years which has averaged about 2.6% per year.

A Tight Labor Market Leads to Higher Wages

Another factor that can influence wages is the labor market. When there are fewer workers and plenty of jobs the labor market is considered tight. In a tight labor market workers have more bargaining power so they can demand higher wages and better benefits to accept new jobs or stay with their current employer.

Currently, the U.S. is experiencing a tight labor market. In June, unemployment was 3.6%, a historically low rate. Additionally, the labor force remains depressed after the pandemic. The labor force participation rate is currently 62.2%, or 1.0% below its February 2020 level. This figure measures the number of people working or actively looking for work compared to the total population. In other words, there are fewer people working or looking for work than there were before the pandemic.

In addition to a reduced labor force, there are currently more job openings than there were prior to the pandemic. In Feb 2020, there were 6.9 million job openings. In April 2022, this figure had grown to 11.4 million. With fewer workers, and more job openings, businesses are having a hard time finding and keeping qualified workers. In response, many firms have raised the wages they pay to attract and keep talent.

Wage Growth Is Higher in Some Sectors

Inflation’s impact on wages has resulted in a larger impact in certain sectors. Sectors with high employee turnover, like the retail and hospitality industries, are more sensitive to the current tight labor market.

From January 2020 – January 2022, quit rates in the retail sector increased from 3.8% to 4.6%. In the leisure and hospitality industry the impacts were even more severe as quit rates rose from 4.5% to 5.6%. These rates have translated to high job vacancy rates. For retail, the job vacancy rate has risen to 6.3% and for leisure and hospitality is has skyrocketed to 9.90%.

Employers in the retail and hospitality industries have been forced to raise wages significantly to attract and keep talent. From February 2020 – February 2022, wages in the retail sector grew by 13.4% and in leisure and hospitality they rose by 14.7%, far outpacing the overall wage growth seen during this time period of 10.7%.

How Businesses are Responding to Higher Employment Costs

Rising wages can have a significant impact on business profitability. For this reason, many businesses are working to minimize labor costs without sacrificing employee satisfaction or productivity. It is a difficult balancing act, and businesses have used the following methods for achieving it:

1. Increasing Automation and Technology

In some industries, the right technology can reduce dependence on labor. In the past, investing in this technology has not proven cost effective because labor was less expensive than the technology. However, as the cost of labor rises, the technology becomes more attractive, and many businesses can now make the case for buying machines that replace human workers.

2. Working to Keep Current Talent

Employee turnover can be expensive. According to research by Gallup, the cost of replacing an employee can range from one-half to two times the employee’s annual salary, depending on the company and position.

However, employee turnover is a fixable problem. In fact, 52% of employees who voluntarily leave their job say their manager or organization could have done something to prevent them from leaving. With this idea in mind, employers are working to find ways to keep their current talent and avoid the added cost of recruiting and training new workers.

Employers are working to keep their current talent by offering a better work-life balance, increasing investment in the benefits that employees value most, and creating a culture that employees appreciate. One of the most important things a business can do to reduce employee turnover is to listen to their employees and understand their wants and needs. With this information, businesses can put a plan in place for keeping employees happy and productive.

3. Raising Their Prices

When employers have no other option, they must increase their prices. This is often a last resort because increasing prices can have a detrimental effect on sales and can even drive potential customers to competitors with lower prices. In addition, raising prices can add to inflation, exacerbating the problem and pushing wages higher in the future.

4. Absorbing Higher Employment Costs

As inflation has persisted, the Fed has acted aggressively to tame the rampant price increases by raising interest rates. One common byproduct of higher rates is a weaker labor market. As the Fed continues to raise rates to cool inflation, both causes of higher employment costs could lessen – inflation could moderate, and the labor market could weaken. So, the rapid increase in wages could slow in the coming months.

Because wage growth is expected to slow when inflation and the labor market return to more normal levels, many businesses are hesitant to make decisions that could impact the long term, like raising their prices. Instead, businesses with sufficient cash reserves can absorb some of the increased employment costs in the short term and delay longer term decisions.

By absorbing some cost increases using cash reserves, businesses can keep their prices below their competitors and therefore retain customers and attract new ones. One way that businesses can employ this strategy successfully is to effectively manage their cash reserves in such a way that provides the ultimate safety and return.

Earn More, Risk Less® with ADM

Our company, the American Deposit Management Co. [ADM] helps businesses manage their cash reserves to achieve safety and competitive returns. Our American Money Market Account [AMMA™] provides the highest level of protection for business cash reserves – FDIC or NCUA insurance. Typically, this insurance is limited to $250k per account ownership category at each insured bank, but with AMMA™ businesses can receive access to extended FDIC / NCUA protection for all of their funds.

In addition, AMMA™ helps businesses secure competitive interest rates available for their cash reserves. We accomplish this through our proprietary fintech which connects our nationwide network of financial institutions seeking deposits with businesses looking to secure competitive rates. So, if your business needs the extended safety and competitive returns for cash reserves, contact us today.

Navigating the Economic Tides: Monetary and Fiscal Policy’s Impact on Banking and Corporate Finance

Prudent financial stewardship requires an understanding of monetary and fiscal policy as well as strategies for adapting to change.

FOMC Holds Interest Rates Steady at June Meeting

The FOMC maintained interest rates at the current level and released updated economic projections at the June meeting.

Community Financial Institutions Face 2 Common Problems in 2025. ADM Is the Solution.

Banks and credit unions face two key problems in 2025. Fortunately, our company offers solutions to attract and retain depositors.