Interest Rate Hikes Continue Amid Banking Turmoil

Following the recent turmoil in the banking sector, many economists predicted the Fed would pause rate hikes at the March meeting. However, the Fed defied these expectations and raised interest rates once again.

The FOMC Raised Rates by 0.25% at the March Meeting

Earlier this week, the FOMC voted to raise the Fed funds rate by 0.25% to a new target range of 4.75 – 5.00%. In their statement following the announcement, committee members highlighted several factors that influenced this decision – persistently high inflation, low unemployment, and signs of a resilient economy.

The Impact of Bank Failures on the FOMC’s Decision

In the two weeks preceding the March FOMC meeting, Silicon Valley Bank and Signature Bank failed. In addition, Credit Suisse was forced to sell to UBS and First Republic was saved by an influx of deposits from the nation’s largest financial institutions. The stress in the banking sector was the culmination of several factors, but one of the major contributors was a failure by bank leadership to prepare for a rising interest rate environment.

As the bank failures unfolded, the FDIC, Fed, and Treasury took decisive action to fully protect deposits from the failed institutions – even those above the traditional FDIC limit. In addition, the Fed and Treasury created the Bank Term Funding Program which allows struggling banks to borrow the funds they need to remain liquid. During the press conference following the interest rate announcement, Fed Chair Jerome Powell noted, “[t]hese actions demonstrate that all depositors’ savings and the banking system are safe.”

Chair Powell also stated that recent unrest in the banking sector has further tightened credit conditions. In essence, the banking turmoil produced a result similar to what would have been expected from a rate hike.

While the FOMC did not forgo a rate hike at the March meeting in response to unrest in the banking sector, they did alter some of the language used to describe the future of monetary policy. In the statement accompanying February’s rate hike, the FOMC said, “the committee anticipates that ongoing increases in the target range will be appropriate.” In March, that language was changed to, “the committee anticipates that some additional policy firming may be appropriate.” The newer phrasing suggests a weaker commitment to further rate hikes, which was supported by both Powell’s comments and the FOMC’s latest projections.

The Current State of Inflation

The pace of inflation has been a driving factor for the FOMC’s decisions over the past year. While interest rate hikes have been successful in reducing the pace of inflation, both consumer and business costs continue to rise quicker than the Fed’s target. The Consumer Price Index [CPI] registered a 6.0% annual increase in February, compared to a peak of 9.1% last June. Similarly, the Producer Price Index [PPI] grew at an annual rate of 4.6% in February, much lower than last June’s reading of 11.3%.

The Fed’s preferred gauge of inflation – Personal Consumption Expenditure [PCE] inflation – rose 5.4% from January 2022 to January 2023. This reading remains significantly above the Fed’s target of 2% inflation. As Chair Powell noted in his press conference, price increases for goods have slowed, while prices for non-housing services continue to escalate, prompting the need for an additional interest rate increase.

Unemployment Remains Historically Low

The Fed’s dual mandate is to keep prices stable while promoting full employment. In the most recent data from the Bureau of Labor Statistics, the U.S. added 311,000 jobs in February and the unemployment rate increased to 3.6%. As rates have risen, employment in certain sectors, like tech, has declined, but the overall unemployment rate has remained in a narrow band between 3.4% and 3.6%.

Economic Growth Has Slowed, But Remains Positive

As the FOMC noted, spending and production increased in the latest data. Personal consumption expenditures rose 1.8% in January while industrial production was unchanged in the latest monthly report following a 0.3% increase in January.

Inflation remains stubbornly high despite tighter credit conditions, slower spending and production, and slightly higher unemployment. The stickiness of inflation, and the resiliency of the economy, were among the factors that influenced the FOMC’s interest rate decision and their updated projections for the future of monetary policy.

The Future of the Economy and Interest Rates

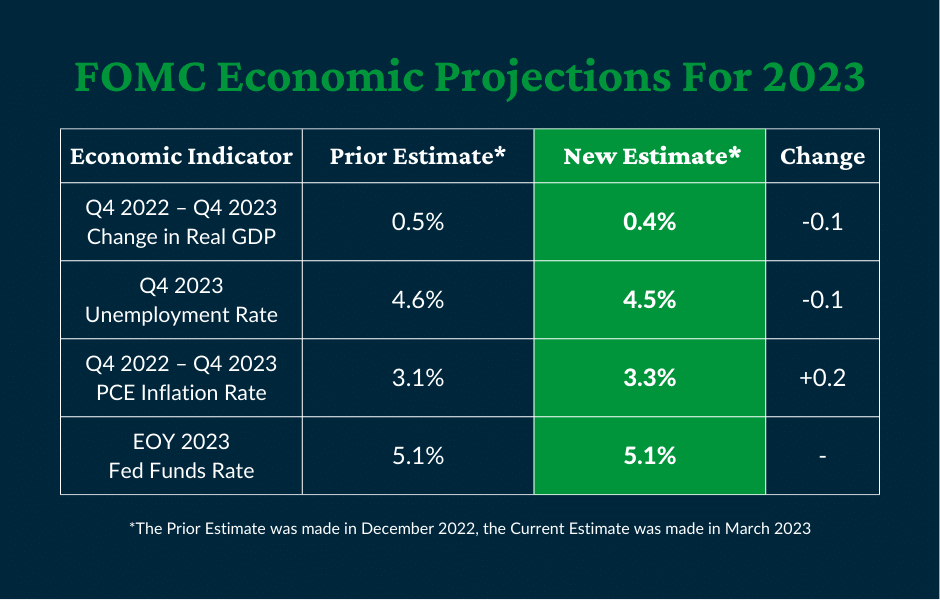

At the March meeting, FOMC members updated their economic projections for the first time since December 2022. Though much has happened in the economy since December, the FOMC’s projections were little changed.

Expectations for The Economy and Interest Rates in 2023

In the most recent projections, FOMC members modestly reduced their economic estimates for the remainder of the year. Committee members now project that Real GDP will expand by 0.4% from the fourth quarter of 2022 to the fourth quarter of 2023. This estimate was revised down by 0.1% from the prior projection last December. Expectations for the labor market also remained relatively stable, with the anticipated unemployment rate in the fourth quarter slightly reduced to 4.5%. Additionally, inflation is projected to fall from its current level to a 3.3% annual pace in the fourth quarter. This estimate was increased by 0.2% from the previous projection.

The FOMC’s projections for interest rates at the end of 2023 held steady at 5.1%. This suggests that rates could rise again this year. However, future rate increases will depend on the economy and the cumulative effects of the Fed’s actions.

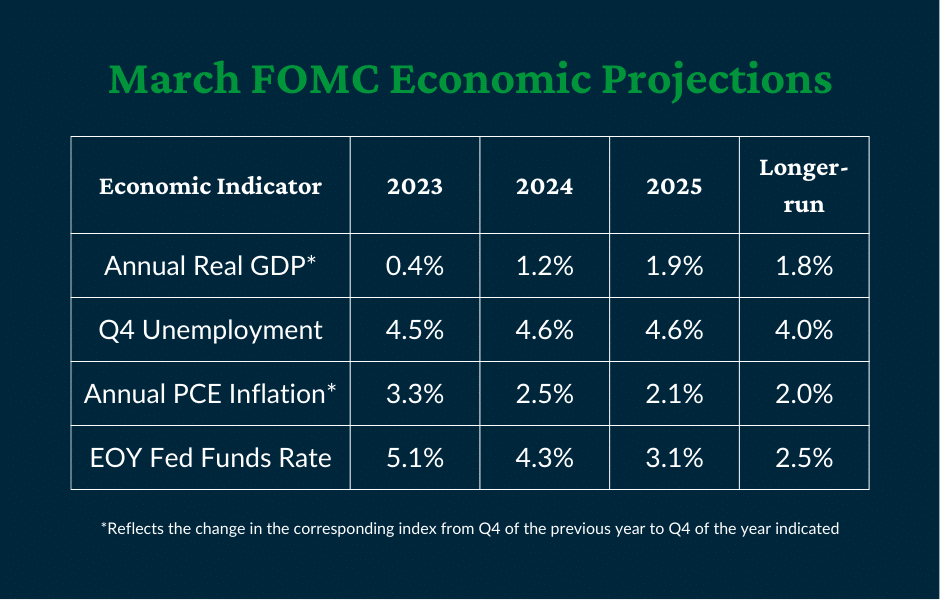

Long-term Expectations for The Economy and Interest Rates

The FOMC’s long-term expectations for the economy and interest rates were also little changed from the December estimates. Real GDP is expected to grow in 2024 and 2025 before settling at a long-run average of 1.8%. Additionally, unemployment is projected to be moderately elevated over the next two years before returning to the long-run estimate of 4.0%.

The FOMC anticipates that interest rate hikes will be effective in curtailing price increases and the inflation rate is projected to fall over the next two years before returning to the 2.0% target in the long run. Similarly, the Fed funds rate is projected to decline in both 2024 and 2025 before settling near 2.5%.

Based on the FOMC’s language and the current economic data, the U.S. could be nearing the end of the current tightening cycle. However, the Fed has continuously stated that the future of interest rates will depend on how prices respond to tighter credit markets.

Don’t miss our interest rate and Federal Reserve updates.

At the American Deposit Management Co. [ADM], we provide valuable insights through our weekly articles and analysis of FOMC meetings. With our timely updates, businesses can stay abreast of recent developments and adapt quickly to changing market conditions.

For the latest in monetary policy, the economy, and business cash management, sign up for our mailing list and receive our weekly article. Also, don’t forget to follow us on Twitter, Facebook, and LinkedIn.

How Did the Gramm-Leach-Bliley Act Facilitate Bank Consolidation?

The Gramm-Leach-Bliley Act passed in 1999 and ushered in a new era of consolidated, one-stop shop banking that perseveres today.

An Overview of Regulations Governing the Management of Public Funds

Public entities like school districts and municipalities are held to specific regulations that govern the ways funds are invested.

Business Escrow in 2026

Business escrow services are not a new concept, but modern solutions should offer far more than companies could expect in the past.