How Interest Rates Have Fared in Past Election Years

Elections impact more than the trajectory of the country’s leadership. In fact, evidence shows that they also influence the economy, businesses, and stock markets. However, the question remains – is The Federal Reserve [The Fed] susceptible to election fever?

The Fed is designed to operate independently of the President with a dual mandate to promote full employment and stable prices. Despite the separation of duties, the President’s actions have the potential to impact the Fed’s goals, and vice versa. For this reason, the relationship between elections and monetary policy decisions is more nuanced than it appears on the surface.

Monetary Policy Decisions in Past Presidential Election Years

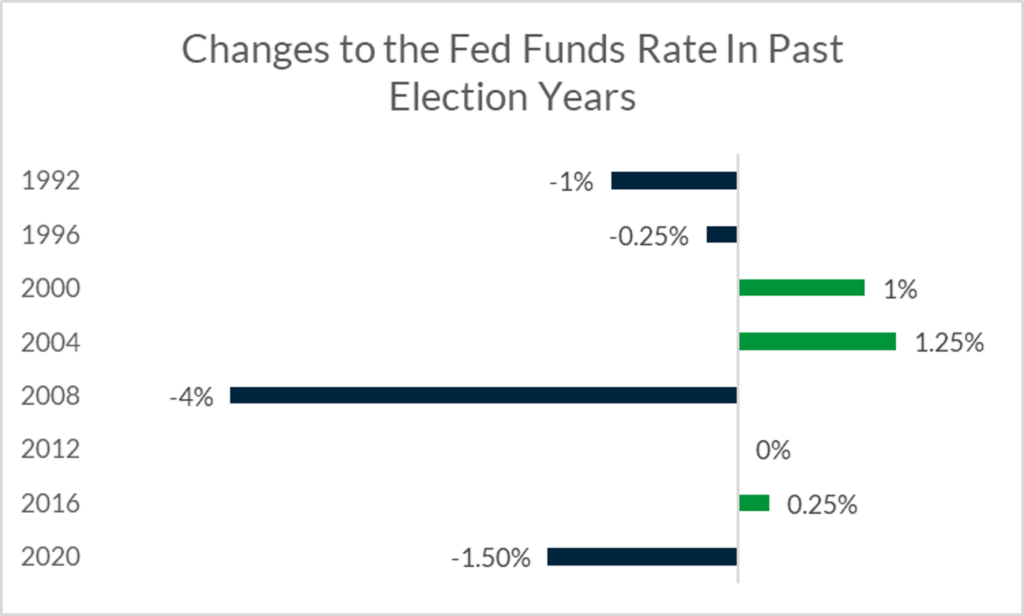

In the past two decades, the political and economic situations have experienced drastic changes. Both Democrats and Republicans have held the Oval Office, and the country has faced deep recessions and record-breaking expansion. As such, the Fed’s actions during election years have also varied widely – including years with multiple rate hikes, sharp rate cuts, and those with no change at all.

Consider the following summary of monetary policy decisions in election years since 1990.

- 1992 – The Fed was in the middle of a massive interest rate easing cycle. From the beginning of 1990 through the end of 1992, they cut interest rates by an astounding 5.00%. The election year at the end of this cycle followed the trend of the previous two years and included three interest rate cuts totaling 1.00%.

- 1996 – In the mid-1990s, the Fed made several small adjustments to interest rates in response to economic shifts, including a 0.25% decrease in January 1996.

- 2000 – The Fed increased interest rates by 1.00% in 2000 as the Dot Com Bubble reached its peak. The economy was overheating during this time and the interest rate hikes are generally considered an attempt to slow that rapid growth.

- 2004 – The Fed cut interest rates by 5.50% in the two years following the bursting of the Dot Com Bubble and began reversing those changes in election year 2004. Throughout the year, they raised interest rates four times for a total of 1.00%.

- 2008 – In an attempt to stave off the worst effects of the Great Recession, the Fed dropped interest rates 7 times during 2008 from 4.25% to the lower bound – a target range of 0 to 0.25%.

- 2012 – The Fed left interest rates unchanged at the lower bound from 2009 to 2015, including election year 2012.

- 2016 – With the lingering effects of the Great Recession having passed, the Fed began very gradually raising interest rates in 2015 and election year 2016. During that year, they implemented one 0.25% interest rate hike.

- 2020 – Similar to past economic crises, the Fed reduced interest rates rapidly following the COVID-19 pandemic in election year 2020. Rates were still low, and they were only able to reduce them by 1.50% to the lower bound.

The graph below provides a visual representation of Fed actions during election years from 1990 – 2020.

The Fed’s decisions in each of these years were in-line with the economic situation at the time and supportive of their long-term goals. In fact, there is little evidence to show that an election year has had any influence on monetary policy decisions.

The Intersection Between Monetary Policy and Presidential Elections

While there is no clear data to show that a presidential election impacts the Fed’s decisions, the opposite can be true in certain cases. This impact is nuanced and difficult to measure, but it stems from the Fed’s significant influence over the economy and the President’s role as the face of the nation.

When citizens are unhappy with the current economic situation, they may decide to vote against the party currently holding office. Similarly, when they are happy with the economic situation, they may be more likely to keep the current party in power. Since the Fed has an outsized influence on the direction of the economy, its actions can indirectly impact elections.

For example, Pew Research Center reported that Americans’ top policy priority for 2024 was “strengthening the economy.” However, the Fed has maintained interest rates at a restrictive level so far this year. These high interest rates are intended to reduce inflation by slowing the economy – putting the goals of the Fed and the citizens at odds. For this reason, incumbents’ success or failure in winning votes through a stronger economy is largely in the Fed’s hands.

Further adding to the complexity of the current election year, independent and Fed analysts predict an interest rate cut later this year. As past monetary policy decisions have shown, the timing of that cut will most likely be influenced by economic data and the Fed’s own goals, rather than the election. However, politicians on both sides of the fence will be carefully watching the timing and potential economic impact of the Fed’s actions and how they could influence the election.

Take Advantage of Elevated Interest Rates with Deposit Management Services from ADM

At the American Deposit Management Co. [ADM], we can help your company take advantage of elevated interest rates. Our term deposit solutions allow you to access competitive returns for cash reserves from our nationwide network of financial institutions and lock in those yields for years to come.

We also offer deposit management services with next-day liquidity and customizable solutions to meet your liquidity and return needs. In addition to these great benefits, you’ll have access to full government protection for your cash – above and beyond the traditional FDIC limit.

To learn more about our services, contact a member of our team today.

*American Deposit Management is not an FDIC/NCUA-insured institution. FDIC/NCUA deposit coverage only protects against the failure of an FDIC/NCUA-insured depository institution.

FOMC Lowers Interest Rates at Final 2024 Meeting

At the last FOMC meeting of 2024, committee members voted to reduce the Fed Funds Rate and released updated economic projections.

History of Economic Turmoil in the U.S. Part 2 of 3 – Mid-20th Century

Part two of this three-part series explores the catalysts and resolutions of the worst recessions in the mid-20th century.

A Brief History of U.S. Bank Failures

Devastating bank failures occur frequently in U.S. history, but government action has significantly reduced the risk of losses.