What Happens to Business Deposits When a Bank Fails?

Banks are such an essential presence in the economy that their security may seem guaranteed. However, recent events have highlighted the fact that not all banks are financially sound.

When Silicon Valley Bank [SVB] collapsed on March 10, the FDIC stepped in to protect insured deposits. The bank held over $175 billion in deposits at the end of 2022, and depositors with balances above the FDIC limit were in jeopardy. In this special circumstance, the FDIC, Treasury, and Federal Reserve decided to take unique action to preserve all deposits, even those above the FDIC limit. However, this is not typically how bank failures are handled.

FDIC-Insured Deposits Are Returned to Customers After a Bank Fails

The FDIC is a government agency created in the wake of the Great Depression to insure deposits against bank failure. The agency is backed by the full faith and credit of the United States government and proudly states “Since the start of FDIC insurance on January 1, 1934, no depositor has lost a penny of insured funds as a result of a failure.” But the FDIC does not protect all assets in every bank.

Which assets are covered by the FDIC?

The FDIC insures deposits up to $250,000 per ownership category at each of the 4,706 FDIC insured banks – if the cash is held in a covered account. The types of accounts covered by FDIC insurance include checking accounts, savings accounts, Money Market Deposit Accounts, and Certificates of Deposit [CDs].

What happens to FDIC-insured assets after a bank fails?

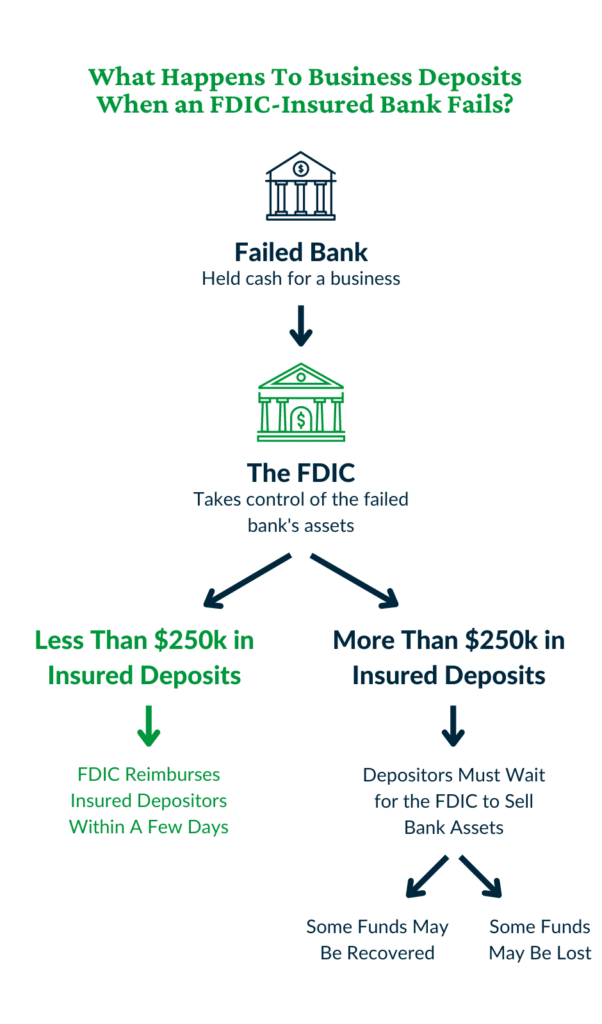

Following a bank failure, depositors whose insured balances are below the $250k limit are reimbursed in one of two ways. Most commonly, the FDIC facilitates the transfer of a failed bank’s assets to a healthy bank. In this scenario, a business would receive a new account at the healthy bank with a balance equal to their previous account. Alternatively, if a healthy bank cannot be located to assume the assets of the failed institution, a business would receive a check from the FDIC for their full insured balance. In either case, depositors typically recover their insured funds within a few days.

With the FDIC’s quick turnaround and proven track record, businesses can rest easy knowing that covered cash is safe from bank failure. But what about businesses with more than $250k in cash?

Deposits Not Insured by the FDIC Are at Risk When a Bank Fails

If a bank fails, assets that are not FDIC-insured could be at significant risk. Non-FDIC insured assets include deposits held at non-participating banks, securities, and cash balances above the $250k limit.

Deposits held at non-FDIC banks could be lost when a bank fails.

Though rare, some banks do not participate in FDIC insurance. Following a bank failure, the recovery process at these banks will vary depending on the bank’s structure. Some non-FDIC insured banks are guaranteed by another source, like the Bank of North Dakota which is not a member of the FDIC, but is backed by the State of North Dakota. In other cases, deposits at non-FDIC insured banks are not guaranteed by any government entity. In that scenario, recovering lost deposits could be a challenge.

Securities and non-FDIC insured accounts are at risk when a bank fails.

Securities, like stocks, bonds, mutual funds, and money market mutual funds, are not covered by FDIC insurance. However, if these assets are held at a SIPC member institution, they could be recovered following a bank failure. SIPC is not a government agency like the FDIC. Instead, it is a non-profit membership corporation that acts as a court-appointed Trustee. Following the failure of a member financial institution, SIPC seeks to return customer’s securities up to its own limits.

Deposits above the FDIC limit are not guaranteed against bank failure.

After a member bank fails, the FDIC “receives” the failed institution and begins collecting and selling its assets. The proceeds from these sales are then paid to creditors to meet outstanding obligations. Businesses with lost deposits above the FDIC limit are considered one of the bank’s creditors and entitled to a portion of recovered funds. While depositors receive priority over general creditors and stockholders, there is no guarantee that all funds will be recovered.

Like with corporate and personal bankruptcies, it can take several years for a failed banks’ assets to be sold. During this time, a business could receive periodic returns of their deposits in excess of the FDIC limit. However, if the bank did not have enough assets to cover its obligations, depositors may only recover a fraction of their original account balance. Waiting years to recover only a portion of lost deposits could be catastrophic for many companies. That’s why businesses should work to ensure their cash reserves are covered by the FDIC.

Extending FDIC Insurance with Fintech

FDIC limits are per ownership category, per institution. This means a business could open accounts at several insured banks and receive $250k of coverage at each one. However, maintaining multiple banking relationships can be cumbersome. Most businesses also have other needs for their cash like earning a competitive return, convenient access to funds, and easy reconciliations.

Fortunately, advanced financial technology – a.k.a. fintech – has provided a simple solution to business deposit management. With today’s technology, businesses can achieve their deposit needs – including extended government insurance – without the hassle.

Protect Cash Reserves from Bank Failure with AMMA™ By ADM

Our company, the American Deposit Management Co. [ADM], has developed proprietary fintech that simplifies and diversifies business deposit management. With our American Money Market Account™ [AMMA™] businesses can ensure the safety of all their funds with access to full FDIC insurance*.

In addition to extended protection, AMMA™ provides nationally competitive interest rates and next-day liquidity. We accomplish this by spreading business cash across our nationwide network of banks and credit unions that compete for deposits.

To learn more about AMMA™ and get started today, contact us.

*Funds in an AMMA™ can be deposited with traditional banks or Credit Unions. When funds are deposited at a credit union, NCUA insurance will be available in lieu of FDIC insurance and is functionally equivalent.

An Overview of Regulations Governing the Management of Public Funds

Public entities like school districts and municipalities are held to specific regulations that govern the ways funds are invested.

Business Escrow in 2026

Business escrow services are not a new concept, but modern solutions should offer far more than companies could expect in the past.

FOMC Meets in January Amid Continued Inflation and Softening Employment

The FOMC met for the first time in 2026 on January 27th and 28th. At that meeting, they voted to hold the Fed Funds Rate steady.