Earn More For Your Business

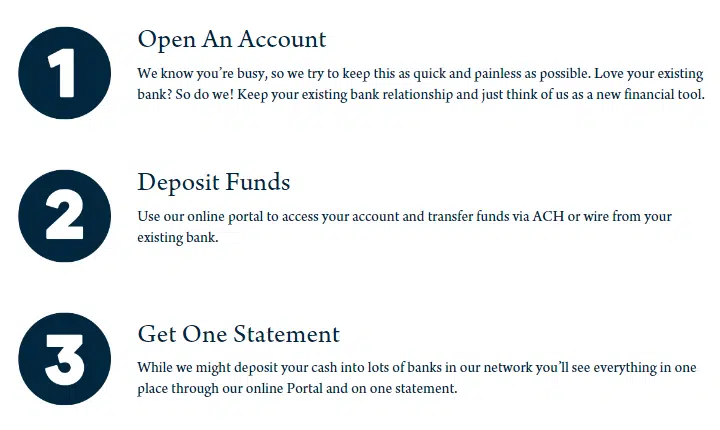

At ADM we realized you do not have the time to shop around for competitive interest rates, or manage multiple financial institutional relationships to receive full FDIC/NCUA protection on your cash. By partnering with us, you will gain access to Marketplace Banking™ – 500+ bank and credit union partners, rates from across the country, unlimited deposit protections, one monthly statement, and one 1099-INT.

Equipment Dealers Frequently Asked Questions

Earn more interest on your cash by partnering with ADM. Download this FAQ PDF to answer some of the most common questions.

Have Additional Questions?

*The list above does not show all rates and terms available. Please contact our client services team to learn about other options. 1Actual ADM network bank rates as of 05/05/2023. Clients’ ability to obtain highest rates may be subject to restrictions and limitations. Rates and availability subject to change. Maximum deposit of $245,000 per placement. Exclusions may apply. Gross rates do not reflect CD placement fee.

You may be subject to an early withdrawal penalty assessed by the financial institution. If the financial institution consents to the request for withdrawal, you agree to pay the penalty determined by the financial institution. You also acknowledge that the penalty is separate from any fees charged by ADM in connection with the placement of the CD and the penalty may decrease your principal balance depending on the terms and conditions of the account.

Money market accounts and Certificates of Deposit satisfy the Federal Deposit Insurance Corporation’s (FDIC)’s and National Credit Union Association’s (NCUA) requirements for agency pass-through deposit insurance coverage. Program and custodial banks are not affiliated with ADM and are not responsible for, and do not guarantee the products, services or performance of third-party providers. ADM is not a member of the FDIC or NCUA, but the banks and credit unions where your money is deposited are FDIC and NCUA members.