Insights

How Interest Rates Have Fared in Past Election Years

July 26, 2024

Presidential elections impact many aspects of the American economy, but do they influence the Fed’s monetary policy decisions?

READ MORE

Insights

The True Cost of Paper Checks

July 23, 2024

Paper checks cost more than many cash managers believe when considering time spent, interest forfeited, and the risk of fraud.

READ MORE

Insights

Comparing Money Market Accounts and Money Market Mutual Funds

July 12, 2024

Both Money Market Accounts and Mutual Funds preserve liquidity for business cash, but the protection they offer differs.

READ MORE

Insights

FDIC Insurance for Business – A Resource Guide

July 10, 2024

This guide provides an overview of FDIC insurance for business and resources to answer common questions about deposit protection.

READ MORE

Insights

Is Your Business Leaving Interest Income on The Table?

June 26, 2024

Deposit management services from ADM help businesses optimize returns on cash reserves without sacrificing safety or liquidity.

READ MORE

Insights

History and Evolution of the Fed’s Inflation Target

June 19, 2024

Price stability is one of the top priorities for the Fed today, but the level of inflation they deem acceptable has changed over time.

READ MORE

Insights

FOMC Holds Interest Rates Steady, Projects Longer Recovery

June 13, 2024

The FOMC held interest rates steady in June and released updated economic projections that signal a longer recovery ahead.

READ MORE

Insights

Escrow Accounts for Business Transactions

June 5, 2024

Escrow services for business are critical for large, lengthy, and complicated transactions, but not all agents are created equal.

READ MORE

Insights

Types of FDIC Insured Accounts

May 29, 2024

The Federal Deposit Insurance Corporation [FDIC] insures business cash invested in covered account types at member banks.

READ MORE

Insights

Republic First Failure Reignites Fears of Banking Turmoil

May 22, 2024

The collapse of Republic First Bank revived many of the concerns that plagued the banking industry in 2023.

READ MORE

Insights

How is the FDIC Funded?

May 15, 2024

Unlike other types of insurance, businesses don’t pay premiums to have their deposits protected by the FDIC.

READ MORE

Insights

Comparing CDs and Treasuries

May 9, 2024

Organizations should understand the key differences between CDs and Treasuries before committing to a long-term investment.

READ MORE

Insights

FOMC Leaves Fed Funds Rate Unchanged at the May Meeting

May 2, 2024

At the April 30th – May 1st meeting, the FOMC voted to hold the Fed Funds Rate steady and slow the pace of balance sheet runoff.

READ MORE

Insights

Are CDs FDIC Insured?

April 24, 2024

CDs often offer higher returns and less liquidity than traditional deposit accounts, but how does their safety compare?

READ MORE

Insights

Business Escrow for Commercial Real Estate Transactions

April 17, 2024

Business escrow services reduce risk in large, lengthy, and complex transactions like commercial real estate purchases and sales.

READ MORE

Insights

Why Was the FDIC Established?

April 11, 2024

The FDIC has been integral to protecting funds in American banks, but why was federal deposit insurance necessary?

READ MORE

Insights

What Banking Leaders Need to Know About the BOI Database

April 4, 2024

The new FinCEN ‘beneficial ownership information’ database will help financial institutions complete comprehensive due diligence.

READ MORE

Insights

How to Open an Escrow Account for Business

March 27, 2024

Business leaders know they need escrow during risky transactions, but often don’t know where to begin with opening an account.

READ MORE

Insights

FOMC Maintains Interest Rates in March

March 21, 2024

At the March FOMC meeting, participants held interest rates steady and released updated projections for the future of the economy.

READ MORE

Insights

The Debate Surrounding Bank Held-to-Maturity Rules

March 13, 2024

Last year’s banking turmoil reignited a debate about how unrealized losses at banks are reported to investors and depositors.

READ MORE

Insights

FDIC Insurance for Business Accounts

March 7, 2024

FDIC insurance covers deposits for individuals up to $250k per ownership category, but how does it protect business accounts?

READ MORE

Insights

The Fed’s Bank Term Funding Program Expires Soon

March 5, 2024

The Federal Reserve recently announced that they will stop granting new loans under the Bank Term Funding Program on March 11.

READ MORE

Insights

Is It Time to Lock in Higher Rates for Business Cash?

February 28, 2024

With interest rates slated to fall this year, it’s a good time for cash managers to consider locking in high yields for cash.

READ MORE

Insights

ADM Helps School Districts Manage Bond Referendum Proceeds

February 22, 2024

The American Deposit Management Co. helps school districts achieve safety for bond proceeds along with a host of other benefits.

READ MORE

Insights

Resource Guide for Property Managers

February 14, 2024

Even experienced property managers can gain a competitive edge with these resources and the latest technology.

READ MORE

Insights

5 Ways Nonprofits Can Combat Declining Donations

February 7, 2024

Nonprofit organizations can use these five strategies to continue funding their mission even when donations are declining.

READ MORE

Insights

FOMC Holds Interest Rates Steady at January Meeting

February 2, 2024

FOMC members voted to hold the Fed Funds Rate steady in January and provided new insight into the timing of rate adjustments.

READ MORE

Insights

Why Banks Pay Different Rates on Similar Accounts

January 24, 2024

Deposit rates at banks can vary widely across the U.S. Businesses that understand why can achieve above average returns on cash.

READ MORE

Insights

Business Escrow in 2024

January 17, 2024

Business escrow is not a new concept, but modern fintech has disrupted the industry and enhanced traditional escrow methods.

READ MORE

Insights

When Will Interest Rates Go Down? A Historical Look at Fed Policy

January 10, 2024

Studying the Fed’s actions during past interest rate tightening cycles can help predict when interest rates will fall this time.

READ MORE

Insights

FDIC Insurance Limits in 2024

January 3, 2024

Businesses with more than $250k in a single bank are taking unnecessary risk, but there is an easy way to protect all deposits.

READ MORE

Insights

The Evolution of Fintech

December 27, 2023

Fintech is short for financial technology. This industry has a longer – and more interesting – history than many people know.

READ MORE

Insights

Deposit Rates Could Continue to Rise in 2024

December 21, 2023

Deposit yields have risen rapidly over the past two years and businesses could continue to see additional income in 2024.

READ MORE

Insights

FOMC Meeting and Projections Summary for December 2023

December 14, 2023

FOMC members voted on the future of monetary policy at the December meeting and released updated forecasts for the economy.

READ MORE

Insights

An Update on the Banking Industry

December 6, 2023

Bank failures in 2023 reignited the conversation about bank safety and left many companies wondering when the danger would pass.

READ MORE

Insights

Year End Economic Review for Business Leaders

November 29, 2023

To remain successful, business leaders must tailor their strategy to account for developments in the economy and interest rates.

READ MORE

Insights

Advantages of Business Escrow Services

November 22, 2023

Escrow services allow for an unbiased third party to protect businesses conducting large, lengthy, or complex transactions.

READ MORE

Insights

ADM Simplifies Tax Revenue Management

November 16, 2023

Municipalities no longer have to choose between earning a competitive return and maintaining easy access to tax revenue.

READ MORE

Insights

How ADM Helps Equipment Dealers

November 9, 2023

The American Deposit Management Co. helps equipment dealers manage their cash and secure protection during risky transactions.

READ MORE

Insights

November FOMC Meeting Summary

November 2, 2023

The FOMC met on October 31st and November 1st to discuss the state of the economy and determine the future of monetary policy.

READ MORE

Insights

Optimizing Business Cash Returns

October 26, 2023

Business cash yields vary based on many factors. Certain dynamics also make it possible for firms to earn above-average returns.

READ MORE

Insights

FDIC Launches Campaign to Educate Consumers and Businesses

October 18, 2023

The FDIC launched a campaign called ‘Know Your Risk. Protect Your Money.’ to increase public awareness of deposit insurance.

READ MORE

Insights

5 Property Management Challenges and How to Overcome Them

October 11, 2023

These solutions to common property management challenges can help your firm improve customer service and drive profitability.

READ MORE

Insights

Are Credit Unions as Safe as Banks for Business Cash?

October 4, 2023

Deposits at both credit unions and banks are insured by government agencies – the FDIC for banks and the NCUA for credit unions.

READ MORE

Insights

Smart Business Cash Strategies for Year End

September 27, 2023

The end of the year is a good time to review your company’s cash management plan and implement strategies to improve it.

READ MORE

Insights

FOMC Holds Interest Rates Steady at September Meeting

September 21, 2023

The FOMC met this week to discuss the future of interest rates. Committee members also released updated economic projections.

READ MORE

Insights

Quantitative Tightening: What it Means for Business

September 13, 2023

As the Fed continues to implement a quantitative tightening program, businesses should understand the possible implications.

READ MORE

Insights

What Does “Fiduciary Duty” Mean to Labor Unions?

September 6, 2023

Union officers have a fiduciary duty to protect the organization’s assets and make financial decisions that benefit members.

READ MORE

Insights

How Does FDIC Insurance Work for Business?

August 30, 2023

FDIC insurance provides a level of protection for business cash, but how does it work and what are the limitations?

READ MORE

Insights

What Do Lower Bank Deposit Levels Mean for Businesses?

August 23, 2023

Bank deposit levels have fallen for 4 straight quarters which could signal increased bank needs and higher returns for businesses.

READ MORE

Insights

7 Common Cash Flow Management Mistakes – And How to Avoid Them

August 18, 2023

Effective cash flow management is critical to business success, so be sure your organization avoids these 7 common mistakes.

READ MORE

Insights

How Does the Fed Funds Rate Impact CD Yields?

August 10, 2023

The Fed funds rate impacts most of the country’s interest rates including loans, bonds, and, indirectly, bank CD yields.

READ MORE

Insights

Comparing the Liquidity of Common FDIC Insured Investments

August 2, 2023

For a successful cash management plan, businesses need safety in the form of FDIC insurance and liquidity to match their needs.

READ MORE

Insights

FOMC Raised the Fed Funds Rate to the Highest Level Since 2001

July 27, 2023

At the July meeting, FOMC members voted to raise the Fed funds rate once again – bringing it to the highest level since 2001.

READ MORE

Insights

Is Your Clients’ Cash Safe?

July 21, 2023

With high-net-worth clients holding more cash, RIAs are leveraging ADM’s fintech to achieve simplicity, safety, and returns.

READ MORE

Insights

The Importance of Business Cash Flow Management

July 12, 2023

Effective cash flow management helps businesses survive during economic turmoil and thrive during periods of prosperity.

READ MORE

Insights

History and Timeline of Changes to FDIC Coverage Limits

June 21, 2023

The FDIC was established in 1933 following the Great Depression. Since then, FDIC coverage limits have been adjusted several times.

READ MORE

Insights

The FOMC Holds the Fed Funds Rate Steady at June’s Meeting

June 16, 2023

The FOMC chose not to raise the Fed funds rate at June’s meeting, but updated projections signal additional policy firming ahead.

READ MORE

Insights

Are Money Market Accounts FDIC Insured?

June 7, 2023

Money market accounts can help businesses earn higher returns than checking accounts without sacrificing FDIC insurance.

READ MORE

Insights

Protecting Business Deposits from Bank Failure

May 24, 2023

Periodic turmoil in the banking sector highlights the need for businesses to protect their deposits from bank failure.

READ MORE

Insights

Could Certificates of Deposit be an Asset to Your Company?

May 17, 2023

Certificates of deposit allow businesses to earn higher rates of return for their cash in exchange for structured liquidity.

READ MORE

Insights

Business Escrow for Mergers and Acquisitions

May 10, 2023

In a merger or acquisition, business escrow services help protect both parties, ensure contract terms are met, and reduce risk.

READ MORE

Insights

FOMC Raises Rates at May Meeting

May 5, 2023

At the meeting held May 2nd and 3rd, FOMC members voted to raise the Fed funds rate for the 10th time since the pandemic.

READ MORE

Insights

A Brief History of U.S. Bank Failures

May 3, 2023

Bank failures are not uncommon during times of economic stress, but government action has significantly reduced associated risk.

READ MORE

Insights

The Importance of Liquidity Management

April 27, 2023

Liquidity management ensures a company has cash available to meet short-term obligations while optimizing long-term returns.

READ MORE

Insights

Interest Rate Expectations

April 19, 2023

Both FOMC members and market pundits indicate that the Fed may be nearing the end of the current tightening cycle.

READ MORE

Insights

How Businesses Can Benefit from Reinvesting Existing CDs

April 4, 2023

In today’s economic environment, many businesses can benefit by reinvesting funds from existing CDs into those with higher rates.

READ MORE

Insights

Interest Rate Hikes Continue Amid Banking Turmoil

March 24, 2023

FOMC members voted to increase the Fed Funds Rate target once again, as turmoil in the banking sector continues.

READ MORE

Insights

What Happens to Business Deposits When a Bank Fails?

March 13, 2023

When a bank fails, the FDIC steps in to make depositors whole. But businesses with more than the FDIC limit could be at risk.

READ MORE

Insights

The History and Evolution of Banking

March 8, 2023

Banks have been mainstays of successful economies for thousands of years, but modern innovations have expanded their role.

READ MORE

Insights

AI’s Expanded Role in the Economy

March 1, 2023

AI can improve company profitability by reducing the effort and expense required to create, market, and distribute products.

READ MORE

Insights

6 Ways Fintech Helps Businesses Succeed

February 23, 2023

Learn six common ways advanced financial technology – a.k.a fintech – helps firms improve profitability and customer satisfaction.

READ MORE

Insights

A Brief History of Digital Banking

February 15, 2023

As the adoption of digital banking continues to rise, now is a good time to revisit the history and evolution of this technology.

READ MORE

Insights

FOMC Slows Rate Hikes at February Meeting

February 3, 2023

The FOMC held its first meeting of 2023 on January 31 and February 1. At the meeting, committee members slowed rate increases.

READ MORE

Insights

What is Marketplace Banking™ and How Could It Help Businesses?

January 27, 2023

Marketplace Banking™ by ADM helps businesses access extended deposit protection, liquidity, and nationally competitive returns.

READ MORE

Insights

Labor Unions Thrive When They Partner With ADM

January 25, 2023

Through a partnership with the American Deposit Management Co., labor unions can streamline their cash management strategy.

READ MORE

Insights

A Brief History of Money Market Investments

January 18, 2023

Money market investments have solved problems facing investors for more than fifty years. Now, a new type of money market exists.

READ MORE

Insights

Economic Challenges for Business Could Persist into 2023

January 13, 2023

The economy and business outlook changed dramatically in 2022. This year, many of those challenges are expected to continue.

READ MORE

Insights

3 Important Reasons to Diversify Your Company’s Deposits

December 21, 2022

Companies and municipalities need to diversify their deposits to protect their funds, build relationships, and prevent fraud

READ MORE

Insights

December 2022 FOMC Meeting Summary

December 15, 2022

At this week’s meeting, the FOMC once again raised interest rates and updated their projections for the future of the economy. This continues the committee’s aggressive work toward combatting inflation by raising rates and unwinding the quantitative easing program implemented during the COVID-19 pandemic. The FOMC Raised Rates at December’s Meeting The FOMC raised the… Read more »

READ MORE

ADM News

American Deposit Management Joins Bankers Helping Bankers (BHB) BaaS Association

December 5, 2022

PRESS RELEASE December 1, 2022 Pewaukee, Wisconsin – The American Deposit Management Co. [ADM], a nationally recognized, award-winning, treasury management and financial services company, announced today that it has joined the newly launched Bankers Helping Bankers (BHB) Banking as a Service (BaaS) Association, aimed at serving the unique needs of BaaS banks. The BHB BaaS… Read more »

READ MORE

Insights

Financial Institutions Need Deposits, Fintech Can Help

December 1, 2022

Corporate deposits are declining, but banks and credit unions can supplement their liquidity by partnering with a fintech provider.

READ MORE

Insights

The Bond Referendum Passed, Now What?

November 10, 2022

After a bond referendum, leaders must ensure that those funds are secure, managed efficiently, and earning a competitive return.

READ MORE

Insights

FOMC Meeting Summary – November 2022

November 3, 2022

At November’s meeting, the FOMC met to discuss interest rates as rising prices continue to plague consumers.

READ MORE

Insights

Municipalities Should Review Their Cash Management Strategy

October 26, 2022

Municipalities should review their cash management strategy to ensure they achieve safety, liquidity, and competitive returns.

READ MORE

Insights

How the Inflation Reduction Act Could Impact Businesses

October 19, 2022

The Inflation Reduction Act could raise taxes for large corporations, but manufacturers and small firms could see some benefits.

READ MORE

![What is Banking as a Service [BaaS]?](https://americandeposits.com/wp-content/uploads/2022-10-12-square.jpg)

Insights

What is Banking as a Service [BaaS]?

October 12, 2022

Banking as a Service – BaaS – can help businesses gain new customers, improve profitability, and enhance marketing efforts.

READ MORE

Insights

How Businesses Plan to Adapt to Inflation

September 28, 2022

A recent survey analyzes how companies are adapting to inflation currently and how their plans could change if inflation persists.

READ MORE

Insights

September FOMC Meeting Recap

September 22, 2022

The September FOMC meeting resulted in another significant rate increase, and the board released updated economic projections.

READ MORE

Insights

The Relationship Between Mortgage Rates and the Fed Funds Rate

September 15, 2022

The Fed’s actions help shape the credit markets, including influencing the rates that real estate investors pay for mortgages.

READ MORE

Insights

Cryptocurrency and the Modern-Day Bank Run

September 7, 2022

In 2022, cryptocurrency exchanges experienced turmoil reminiscent of early American bank runs that led many to lose their savings.

READ MORE

Insights

What is a Yield Curve Inversion and Why Does it Matter?

August 31, 2022

Historically, an inverted yield curve has proven to be a fairly accurate indicator that the economy is headed for recession.

READ MORE

Insights

Escrow for the Purchase or Sale of a Business

August 17, 2022

Escrow services can reduce risk for both parties during the sale of a business, but escrow agents are not all created equal.

READ MORE

Insights

Challenges to Globalization and the Rise of Deglobalization

August 10, 2022

In recent years, weaknesses in the global economy and supply chains have been revealed, leading to call for deglobalization.

READ MORE

Insights

A Brief History of Globalization

August 5, 2022

Global trade is a staple of the modern economy, but the history of globalization is much older and more complex than many realize.

READ MORE

Insights

Fed Continues to Battle Inflation with Higher Rates

July 29, 2022

Inflation hit a fresh multidecade high and the Fed responded with another significant interest rate hike at July’s meeting.

READ MORE

Insights

How Could Rising Rates Impact Commercial Real Estate?

July 21, 2022

Rising interest rates can dampen demand for commercial properties, leading to lower sale prices and higher vacancy rates.

READ MORE

Insights

How Do Rising Wages Impact Business?

July 13, 2022

Employment costs are rising rapidly, putting pressure on businesses’ bottom line and forcing them to reevaluate their strategies.

READ MORE

Insights

How the Digitization of Finance is Changing the Way Consumers Bank

June 29, 2022

In a post-pandemic world, banks are responding to customers’ desire for a blend of digital convenience and human expertise.

READ MORE

Insights

Declining Bank Deposits Could Impact Deposit Rates

June 22, 2022

Forecasts show that 2022 will be the first year since WWII that total bank deposits will decline. This could impact deposit rates.

READ MORE

Insights

Fed Takes Historic Action to Tame Inflation

June 16, 2022

In response to rampant inflation, the Fed raised rates significantly. In addition, FOMC members updated their forecasts.

READ MORE

Insights

Who is Responsible for Financial Oversight in Religious Organizations?

June 1, 2022

Financial oversight is critical in any organization. But many church administrators are unsure who should handle these activities.

READ MORE

Insights

Case Study: How Deposit Rates React to Changes in the Fed Funds Rate

May 16, 2022

Discover how changes in the Fed funds rate have impacted deposit rates over the years and where deposit rates could be headed.

READ MORE

Insights

Fed Continues Its Battle with Inflation

May 9, 2022

Inflation remains an issue of concern, so the Fed raised rates by 50 basis points at May’s meeting.

READ MORE

Insights

Business Escrow Accounts: Everything You Need to Know

April 27, 2022

Business escrow accounts are often needed for large, complex or risky transactions. Here’s what you should know before you enlist a business escrow company.

READ MORE

Insights

How ADM Helps Municipalities Manage Referendum Funds

April 20, 2022

Managing bond proceeds can be tedious and risky for municipalities. ADM can reduce effort and risk while growing purchasing power.

READ MORE

Insights

How the Fed Funds Rate Impacts Earnings on Business Cash Reserves

April 13, 2022

Businesses could earn more on their deposits as rates rise. However, the link between the Fed funds rate and deposit rates is nuanced.

READ MORE

Insights

How Can Businesses Prepare for a Rising Interest Rate Environment?

April 6, 2022

The Fed has signaled several rate increases in 2022. Businesses should prepare for these rate hikes by considering these suggestions.

READ MORE

Insights

Are Supply Chain Disruptions Easing?

March 23, 2022

Businesses have struggled to meet consumer demand due to supply constraints and logistical delays. These disruptions could ease in 2022.

READ MORE

Insights

Interest Rates are on the Rise

March 17, 2022

FOMC members began raising rates at this week’s meeting. Additionally, members submitted updated projections for the future.

READ MORE

Insights

2022 Interest Rate Outlook for Business Leaders

March 2, 2022

Business leaders can prepare for rising rates by forecasting when hikes will occur and how they might impact operations.

READ MORE

Insights

Preparing for Fed Rate Changes in 2022

February 25, 2022

Regardless if rates are on the rise or on the decline, you have peace of mind knowing that your funds are fully protected with ADM.

READ MORE

Insights

A History of Blockchain and How It Enables DeFi

February 23, 2022

Understanding blockchain can help leaders predict how DeFi will evolve and impact the way they save and invest.

READ MORE

Insights

Fintech and Financial Inclusion

February 16, 2022

Fintech can help close the banking gap and create a more inclusive financial system.

READ MORE

Insights

Banks are Going Green

February 9, 2022

Banks are joining the fight to preserve the environment by reducing their carbon footprint and shifting their portfolios.

READ MORE

Insights

What is DeFi and How is it Impacting Banking?

February 2, 2022

DeFi promises a decentralized, digital financial system which is open to all. This could disrupt the current banking industry.

READ MORE

ADM News

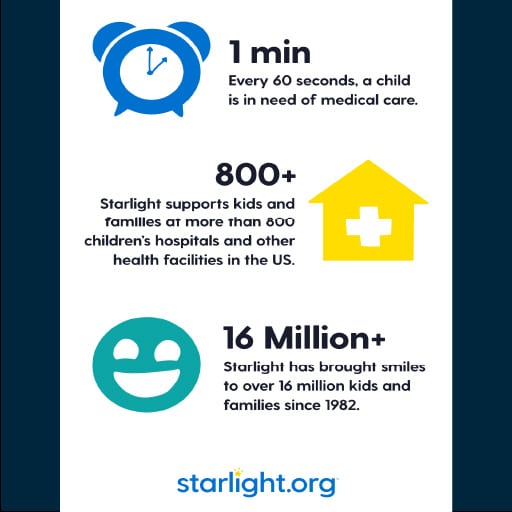

ADM is Raising Money for Starlight Children’s Foundation to Benefit Children’s Hospital of Wisconsin

January 26, 2022

Hospital stays can be frightening and long, especially for children who are chronically or severely ill. In these cases, children can be stuck in a hospital for weeks or months while they receive treatment. Starlight Children’s Foundation provides resources that can bring moments of happiness to children receiving treatment or recovering in hospitals. In Milwaukee,… Read more »

READ MORE

Insights

Expectations for the U.S. Economy in 2022

January 21, 2022

The U.S. economy is recovering from supply chain disruptions, unemployment, and high inflation. Find out what’s in store for 2022.

READ MORE

Insights

When Will Interest Rates Go Up?

January 5, 2022

As prices rise at the fastest pace in more than three decades, many business leaders are anticipating interest rate increases.

READ MORE

Insights

How Will Tapering of the QE Program Impact Rates and the Economy?

December 28, 2021

The FOMC announced tapering of the most recent quantitative easing program which could impact markets and the economy.

READ MORE

Insights

History of Quantitative Easing in the U.S.

December 22, 2021

The Fed has implemented quantitative easing programs several times in the US over the past twenty years with varying results.

READ MORE

Insights

FDIC Initiatives to Promote MDIs and Mission Driven Banks

December 17, 2021

Recently, the FDIC has strengthened their collaboration MDIs and mission-driven banks to help better serve their communities.

READ MORE

Insights

Traditional Money Market vs. AMMA™

November 24, 2021

Money markets are popular investment vehicles for business cash reserves. With fintech, businesses may have a better option.

READ MORE

Insights

Managing Risk When Working with a New Vendor

November 8, 2021

When working with a new supplier, businesses have additional risk. Some of this risk can be mitigated with business escrow.

READ MORE

Insights

The Number One Reason Businesses Fail

October 27, 2021

Almost 400,000 businesses are opened each year. Half of those will fail in their first five years of operation.

READ MORE

Insights

History of Economic Turmoil in the U.S. Part 3 – The Modern Economy

October 13, 2021

Recessions are challenging for business. Explore the catalysts of the worst recessions in the U.S. in Part 3 of 3 in this series.

READ MORE

Insights

Fed Updates Inflation and Interest Rate Projections

October 6, 2021

Fed Chair Jerome Powell gives an update on the US economy. FOMC members submit their projections for inflation and interest rates.

READ MORE

Insights

History of Economic Turmoil in the U.S. Part 2 of 3 – Mid-20th Century

September 22, 2021

Recessions are challenging for business. Explore the catalysts of the worst recessions in the U.S. in part 2 of this 3-part series.

READ MORE

Insights

Interest Rate Update: September 2021

September 17, 2021

As the economy recovers from the COVID-19 related shutdown, the Fed considers steps to tighten monetary policy.

READ MORE

Insights

History of Economic Turmoil in the U.S. Part 1 of 3 – The Early Years

September 15, 2021

The U. S. economy is the largest in the world, but its history is filled with turmoil. Part 1 of this series explores the early years.

READ MORE

Insights

Insured Cash Sweep (ICS) vs AMMA™

August 18, 2021

What is insured cash sweep [ICS], and how does it work? ICS offers a way to achieve FDIC coverage for large sums of cash, but there are some limitations.

READ MORE

Insights

How Escrow Compliments Enterprise Risk Management

August 10, 2021

Large transactions create risk for both buyers and sellers. Using escrow can mitigate risk and ensure that contract terms are met.

READ MORE

Insights

Enhanced Business Banking with AMMA™️

August 3, 2021

ADM’s fintech allows businesses to achieve the most protection and the most return for their cash without leaving their current bank.

READ MORE

Insights

Fintech: Once a Disruptor, Now Critical Business Technology

July 13, 2021

Despite pandemic-related budget cuts, fintech investment and adoption continue to increase in both consumer and B2B sectors.

READ MORE

Insights

Inflation Surges – Will Interest Rates Follow?

June 28, 2021

The FOMC has increased its inflation projections, and some see interest rate hikes coming sooner than previously predicted.

READ MORE

Insights

Yield Curve Analysis

May 19, 2021

Long-term treasury yields are climbing with the economic and inflationary outlook, but the Fed still has short-term rates locked near zero.

READ MORE

Insights

Banks are Flush with Cash – ADM Can Help

May 14, 2021

The pandemic and resulting fiscal stimulus have left banks flush with cash. These banks are turning to ADM for help.

READ MORE

Insights

Stimulus Impact on State and Local Government

May 11, 2021

Both the CARES Act and the ARP provided funding to state and local governments. A strong economic impact is expected.

READ MORE

Insights

How Will the Proposed Infrastructure Bill Impact the Economy?

April 28, 2021

Infrastructure is the next big focus of the Biden administration, and this plan could impact the economy in several ways.

READ MORE

Insights

The American Rescue Plan: Impact on Business

April 21, 2021

With the recently passed fiscal stimulus, focus shifted toward the consumer, but what will be the impact on the business community?

READ MORE

Insights

Fintech Leads the Way for Alternative Investments

April 14, 2021

Alternative investments have risen in popularity in the current low-rate environment, and fintech is making them more accessible.

READ MORE

Podcasts

Outsource Your Interest Rate Management

April 8, 2021

If you have a huge amount of excess cash sitting in your bank account but don’t have enough time for interest rate planning – outsource it.

Otherwise, it’ll keep losing value due to inflation!

READ MORE

Insights

Interest Rate Update: Analysis and Expectations

April 6, 2021

The Fed projects that interest rates will stay low for years, will recent developments threaten that stance?

READ MORE

Insights

Settlement Fund Administration Made Simple

March 24, 2021

Distribution of settlement funds can be an arduous task, especially with very large sums. ADM makes this process simple.

READ MORE

Insights

Extended FDIC Insurance for Business Deposits

February 26, 2021

While FDIC insurance is typically enough for individual depositors, some businesses with lots of cash on hand may be taking on unnecessary risk.

READ MORE

Insights

Fintech is Changing the Way RIAs Invest Cash

February 22, 2021

Next Day Liquidity. Extended FDIC Protection. The MOST competitive return on cash. AMMA™ is a “win-win-win” for RIAs.

READ MORE

ADM News

ADM Honored in Best and Brightest Companies in America

February 2, 2021

ADM is proud to receive this national recognition! We are truly honored to be one of the “Best

and Brightest Companies in America.”

READ MORE

ADM News

ADM In The News

January 21, 2021

American Deposits Management CEO, Kelly Brown, discusses with Fox6 News how to ensure your stimulus money is safe.

READ MORE

Insights

Fintech is Filling in Gaps Created by the Pandemic

January 19, 2021

The pandemic disrupted the economy, creating gaps in many traditional business processes. Fintech has been filling those gaps.

READ MORE

Insights

Making the Most of a Low Interest Rate Environment

December 31, 2020

The Fed seems to have committed to their ultra-low interest future, so how can you best position your company for this environment?

READ MORE

Insights

The Unconventional Holiday Season is Underway

December 15, 2020

This year has been unconventional in many ways, but it’s almost complete. Please accept a message of thanks from our team at ADM!

READ MORE

Insights

What to Expect for Interest Rates in 2021?

November 13, 2020

While interest rates are likely to stay low for a while, there are a few key metrics to watch as the economy slugs through the pandemic.

READ MORE

Insights

ADM Honored as One of Milwaukee’s Best Places to Work

November 4, 2020

The Milwaukee Business Journal has honored The American Deposit Management Co. as one of Milwaukee’s Best Places to Work in 2020.

READ MORE

Insights

Avoiding Fraud: Corporate Phishing Attacks

October 26, 2020

Phishing is a technique used by hackers to gain unauthorized access to corporate data. Educate your team, so they can identify these attacks.

READ MORE

Insights

What Does Inflation Mean for Business Cash Reserves?

September 18, 2020

The Fed recently changed course to allow for inflation above 2%, but how does a weaker dollar impact business cash reserves?

READ MORE

Insights

3 Industries That Benefit from Business Escrow During a Pandemic

August 26, 2020

COVID-19 is shaking up business activity and increasing uncertainty everywhere. Businesses can leverage escrow to mitigate risk created by the pandemic.

READ MORE

Insights

Investing Excess Business Cash

August 20, 2020

In today’s economic climate, cash reserves are a must. But how can a company make sure those returns are safe, liquid and earning a competitive return?

READ MORE

Insights

Interest Rate Update – July 2020

August 5, 2020

The Fed released minutes from their June meeting. These notes provided insights into how the board views the direction of the economy and interest rates.

READ MORE

Insights

How Banks Benefit from Partnering with ADM

July 22, 2020

When banks partner with ADM, there are many advantages, including access to additional deposits at lower costs, made possible by our proprietary fintech.

READ MORE

Podcasts

Credit Ecosystem To Go

July 6, 2020

While banks may now be “depositors” with excess PPP Funds and savings at an all-time high, it’s a temporary scenario. Kelly Brown, a national expert on cash management and bank liquidity, stops by Credit “Eco” to Go to discuss ways banks and companies can manage their money in these times of uncertainty and “fear of the unknown”. Kelly describes it like a dating game, but hear how to she connects banks with one another to solve their liquidity issues.

READ MORE

Insights

Poor COVID-19 Support Leads Companies to Change Banks

July 1, 2020

Financial stress struck many companies swiftly and without warning due to COVID-19. Those banks who were not responsive may soon feel the repercussions.

READ MORE

Insights

How Businesses Are Responding to COVID-19

June 17, 2020

The COVID-19 Pandemic has created a “new normal” for many businesses. What changes are companies implementing to adjust to this uncertain economic climate?

READ MORE

Insights

Benefits of Extending FDIC Limits with Marketplace Banking™

June 10, 2020

When your business has more than $250k to protect, don’t rule out the FDIC. The FDIC has limits, but fintech has simplified extending those limits.

READ MORE

Insights

June 2020 FOMC and Interest Rates Update

June 4, 2020

The Fed is exhausting all possible options to prop up a socially distant economy. Rates are already at historic lows, so what should we expect this month?

READ MORE

Podcasts

Ensure Your Deposits Are Protected

May 28, 2020

Our Chairman and CEO, Kelly A. Brown, talks with Jeff Kowal of Kowal Investment Group on WISN The Retirement Clinic about how to be proactive with your retirement plans, savings accounts, investments, and personal accounts during this uncertain time. Listen to learn more about extended FDIC coverage and why creating a strong bank relationship is important to protect your hard earned dollars.

READ MORE

Insights

What is CDARS

May 19, 2020

CDARS is short for Certificate of Deposit Account Registry Service. It can help you achieve FDIC coverage above standard limits, but there are drawbacks.

READ MORE

Insights

How Fintech is Changing Church Management

April 10, 2020

Churches have finite cash and limited resources, but no shortage of good things to accomplish. Fintech can help your church do more with those resources.

READ MORE

Insights

What is a CD Ladder?

March 25, 2020

CD ladders take advantage of higher interest rates of long-term CD’s while maintaining the liquidity of shorter-term investments.

READ MORE

ADM News

An Open Letter to Our Clients from Our CEO

March 18, 2020

My thoughts and prayers are with you and your loved ones during these uncertain times. We continue to monitor this situation closely.

READ MORE

Insights

Federal Reserve Drops Rates to Zero

Fed officials dropped interest rates to zero and pledged to purchase at least $700 million in securities. What more can they do to support the economy?

READ MORE

Insights

March FOMC Meeting and Coronavirus (COVID-19) Impact on Interest Rates

March 11, 2020

Following an emergency rate cut to combat the impact of Coronavirus (COVID-19), markets predict the Fed will slice rates further. Will they follow through?

READ MORE

ADM News

For the 6th Straight Year, ADM Named in Milwaukee’s “Best and Brightest Companies to Work For”

February 24, 2020

ADM wins this award for the 6th straight year! We are truly honored to be one of “Milwaukee’s Best and Brightest Companies to Work For.”

READ MORE

Insights

January Fed Meeting: Reaction, Expectations

January 31, 2020

An uncharacteristically normal FOMC meeting took place last week. Although interest rates remained unchanged, their policy statement did not.

READ MORE

Insights

What to expect from the Fed later this week?

January 29, 2020

Manufacturing and inflation remain low as the Fed works to determine the course of monetary policy following a pause to rate cuts last meeting.

READ MORE

ADM News

ADM is bringing you the MOST in 2020

January 17, 2020

It’s a new year and the beginning of a new decade. Here’s a few things we hope to accomplish for our team and our clients in 2020 and beyond.

READ MORE

Insights

2020 Interest Rate and Economic Outlook

January 6, 2020

Last year brought us a strong stock market, falling interest rates and growing economic uncertainty. What can you expect the U.S. economy in 2020?

READ MORE

Insights

December Fed Meeting: What’s next?

December 13, 2019

The Fed met investors expectations and left interest rates unchanged, but what will it take for them to move again?

READ MORE

Insights

What to Expect on Interest Rates at the December Fed Meeting?

December 6, 2019

After three straight interest rate cuts it seems likely that the Federal Reserve is hitting the brakes on further easing. But what can you expect next?

READ MORE

ADM News

Thanksgiving 2019 is in the books!

November 29, 2019

The 2019 edition of the Thanksgiving Holiday is in the books, and it was a great one. As is tradition, we saw parades, enjoyed some incredible food, and witnessed some insanity on the gridiron. For some of you, today might mean battling for a deal at your local department store or enjoying those leftover turkey… Read more »

READ MORE

Insights

Idle Cash Equals Lost Profits for Property Managers

November 25, 2019

Property managers with idle reserve funds are missing out on profits. Learn how deposit management can maximize the value of your reserve cash.

READ MORE

Insights

Property Managers: How to Get Better Returns on Your Reserves

November 18, 2019

It’s critical to maintain cash reserves in case of an emergency at one of your properties. But, are you getting the most competitive returns on your reserves?

READ MORE

Insights

The Fed Cuts Rates. What’s Next?

November 4, 2019

The past week delivered a great deal of news on the U.S. economy. Many important economic indicators were released, and The Fed cut interest rates.

READ MORE

Insights

What to Expect at the October FOMC Meeting?

October 25, 2019

The Federal Reserve has begun its quiet period prior to the October FOMC meeting. There is a split within the committee on whether they should cut interest rates further.

READ MORE

Insights

How To Manage Your Business’s Excess Cash & Liquidity

October 10, 2019

Managing excess cash and liquidity in your business can be a full-time job, especially if you are working to get the most competitive return on your cash. A poll of 3,000 companies at the end of 2018 reported that these organizations had approximately $2.7 trillion in cash on hand. That is an astronomical number, especially… Read more »

READ MORE

Insights

Federal Reserve Cuts Rates as Expected at September Meeting

September 25, 2019

As anticipated, the Federal Reserve Board cut rates at the September meeting by 25 basis points to a new target range of 1.75-2.00%.

READ MORE

ADM News

ADM Honored as One of the ‘Fastest 5’ by COSBE

September 24, 2019

The American Deposit Management Co. is part of the “Fastest Five” which are the top 5 highest growth companies out of the Future 50 presented by COSBE.

READ MORE

Insights

September Fed Meeting: What should you expect?

September 18, 2019

The Federal Reserve is meeting to make their policy rate decision. In today’s article, we discuss expectations for the direction of interest rates.

READ MORE

Insights

Will the Fed Cut Interest Rates at the Next Meeting?

September 3, 2019

Fed Chairman Powell speaks at Jackson Hole at the Federal Reserve’s annual symposium. Did we get an indication of where rates are heading?

READ MORE

Events

ADM Sponsors WBA Golf Outing with Former Packer Mark Tauscher

August 26, 2019

The Wisconsin Bankers Association Golf Outing was held on August 15th. ADM sponsored the guest speaker, Former Packer Mark Tauscher, and the event was a success!

READ MORE

Insights

How To Effectively Manage Church Funds

August 19, 2019

Gathering donations is only half of the equation when it comes to managing your congregation’s giving. To take the next step, consider deposit management.

READ MORE

Insights

Federal Reserve Board Cuts Rates, Creates Uncertainty

August 5, 2019

The Fed’s decision to cut rates was far from unexpected, but there were still some surprises in Chairman Jerome Powell’s remarks.

READ MORE

Insights

Church Management Software Often Ignores Deposit Management

August 2, 2019

Church Management Software is critical to operating a successful congregation, but these systems routinely ignore deposit management.

READ MORE

Events

Future 50 Award Luncheon

July 23, 2019

ADM has been named a 2019 Future 50 company by the Metropolitan Milwaukee Association of Commerce’s Council of Small Business Executives (COSBE).

READ MORE

Insights

Analysis: How Would Declining Interest Rates Impact Your Business?

June 26, 2019

Many experts believe that interest rates have plateaued for the time being, and some are expecting that rates may soon drop. Why is this happening, and how will it impact your business?

READ MORE

Events

Bankers, Beer & Bags – June 27, 2019

June 19, 2019

Spend an afternoon networking, sampling great craft beer, eating great food and throwing bags at the ADM Headquarters on June 27th from 4-8 p.m. Bring your CEO, CFO, Treasury Professionals & Commercial Lenders! RSVP to info@americandeposits.com and we hope to see you there!

READ MORE

Insights

Fintech Can Help Your Church Prevent Fraud

May 24, 2019

Church funds can be particularly vulnerable to fraud and theft. But there are ways to protect your church from both, with deposit management and vendor payment processing.

READ MORE

Insights

How to Grow Your Church’s Fund through Deposit Management

May 20, 2019

There is a way to grow your church’s excess funds without raising extra cash. The solution is deposit management.

READ MORE

Insights

Idle Funds are Costing Religious Organizations Big Money

April 26, 2019

Here’s how unused funds could affect your church and what you can do to maximize your ministry’s financial strength through deposit management.

READ MORE

Insights

What do rising interest rates mean for your business?

April 16, 2019

Rising interest rates present both challenges and opportunities for businesses of all sizes. Here’s what you need to know to make the most of higher rates.

READ MORE

Insights

Corporate Fraud: How to Identify, Address and Prevent

April 12, 2019

Fraud is a very real problem in today’s corporate environment. We tend to hear about it only when it impacts the end user — when customer accounts are hacked, for example, or valuable personal data is stolen. But internal fraud can be crippling to a business. Some estimates suggest it costs large corporations in the… Read more »

READ MORE

Insights

How to Spot an Internal Thief

April 8, 2019

Internal theft can deal a crushing blow to any business. Here’s how to recognize it, stop it and take steps to prevent it from happening in the future.

READ MORE

Insights

Why don’t banks pay the highest rates?

April 5, 2019

Why don’t banks pay the highest rates? In short, it’s complicated. The good news? There is a way to find competitive rates while keeping your money safe.

READ MORE

Insights

Fintech is Changing How We Make Payments: Here’s How…

March 15, 2019

Financial technology is changing payments as we know them. Here’s how to make your business payments more efficient — and keep your money secure in the process.

READ MORE

Insights

Unhappy with your bank’s business deposit rates? We have a solution.

March 1, 2019

Thinking about switching banks? Hold that thought. There’s a way to maintain your existing bank relationship while earning more competitive returns. Here’s how.

READ MORE

Insights

Is my corporate cash safe?

February 15, 2019

Your business has extra cash on hand. Good. That means you’re prepared for whatever might come your way. Now the question is, how do you keep that cash safe?

READ MORE

Insights

The Physics Problem Plaguing the World of Finance

February 13, 2019

Earlier this month, the Wall Street Journal’s “Intelligent Investor” columnist introduced a vexing problem in the world of finance: inertia.

READ MORE

ADM News

ADM named one of Milwaukee’s ‘Best and Brightest Companies to Work for’

February 8, 2019

There are a lot of awards in the world of business, but for us, this one is particularly powerful. ADM wins the award for the 5th straight year.

READ MORE

Insights

Your company is repatriating money. Now what?

Looking to bring your foreign profits home? Here’s how your company can put that repatriated cash to good use.

READ MORE

Insights

How to Put Your Corporation’s Tax Funds to Work

February 1, 2019

Your business has saved diligently for taxes. Here’s how to keep those funds working for you before they head out the door for good?

READ MORE

Podcasts

Five Ways Community Banks Can Increase Deposits

January 26, 2019

In this brief episode we cut through the politically correct language and talk directly to bankers that really want to make serious changes in how they gather deposits.

READ MORE

Insights

Why Companies Shouldn’t Delay Repatriation of Foreign Profits

January 25, 2019

U.S. companies have historically stored billions of dollars abroad to avoid high taxes. But, now is the perfect time to repatriate those funds. Here’s why.

READ MORE

Insights

Five Ways Community Banks Can Find New Depositors

January 18, 2019

ADM provides a simple way for community banks to find new deposits by leveraging technology and a vast network of businesses leaders. In this article, we’ve detailed a total of 5 ways community banks can land more deposits.

READ MORE

Podcasts

Three Tips for Tax Deposits

January 13, 2019

Today we discuss three great tips for public and private entities that earmark funds for taxes.

READ MORE

Podcasts

Smarter Cash #001

January 12, 2019

A discussion on bond proceeds and how to maximize your returns.

READ MORE

Insights

Referendum Funds: How to Maximize and Protect

January 11, 2019

Do you have the manpower necessary to manage your newly acquired referendum funds? In this article we explore the challenges with managing bond proceeds.

READ MORE

Insights

Community Banks Need To Go Digital. Here’s Why.

November 9, 2018

Community banks that don’t go digital will struggle in the new digital economy. Here’s why.

READ MORE

Insights

How Will the GDPR Affect Your Bank?

September 24, 2018

Europe’s new data privacy law, commonly known as the GDPR will have an effect on US banks. Here’s what you need to know.

READ MORE

Insights

Why Community Banks Should Bank Beyond Their Backyard

September 10, 2018

With technological advances, banking is changing and community banks need to look beyond their backyard to protect their business.

READ MORE

ADM News

Thanks to Our Summer 2018 Interns

August 9, 2018

We as a firm are thankful for our wonderful summer interns. Today’s interns, tomorrow’s leaders.

READ MORE

Insights

What You Need To Know About A Rising Rate Environment

May 31, 2018

In a rising interest rate economy, company and municipal depositors need to take action to protect their investments. Here are a few things to think about when planning your deposits in the current interest rate environment.

READ MORE

Insights

Fintech is Changing Banking. Here’s What Banks Need to Know

Disruptive fintech startups are changing the way we bank and shaking up the banking industry. Here are some things that banks need to do to stay competitive.

READ MORE

Insights

What You Need To Know About AI’s Role In The Economy

May 4, 2018

Like it or not, AI is now deeply embedded in the economy. That means really big changes are sweeping how financial institutions handle everything from data to products to investments.

READ MORE

ADM News

The Nuts & Bolts of What We Do

March 20, 2018

CFOs and Chief Investment Officers are faced with finding places to safely manage their cash portfolio and get a great return in that investment. What our firm does is take large deposits and we invest that into a network of FDIC insured banks so that the money is all FDIC insured.

READ MORE