The FOMC met for the first time in 2023 on January 31 and February 1. At the meeting, committee members reaffirmed their commitment to bringing down inflation through tighter monetary policy. As a part of this goal, they voted to raise the Fed funds rate for the eighth time since the onset of the COVID-19 pandemic. However, the latest rate increase was smaller than the previous hikes, leading some to believe that rates could peak in the coming months.

February’s Rate Hike

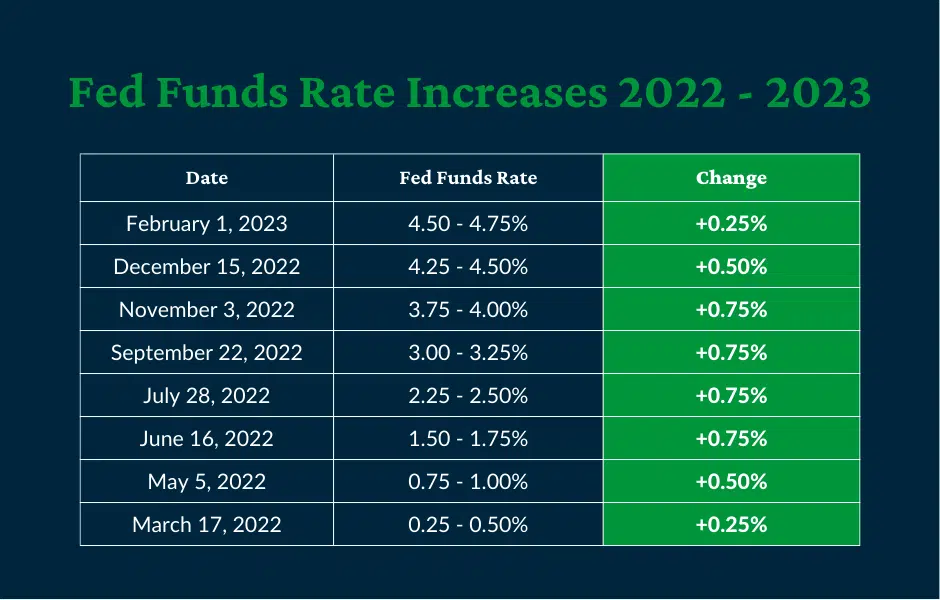

At the most recent meeting, FOMC members voted to increase the Fed funds rate by 0.25%, bringing the target range to 4.50 – 4.75%. This is the eighth consecutive meeting with an interest rate increase.

The Fed began tightening policy in March of 2022. Since that time, they have acted aggressively, raising rates from 0.00 – 0.25% to 4.50 – 4.75% in less than a year.

The Data Behind the Decision

The FOMC pointed to several factors that influenced their decision to raise rates by 0.25% at the latest meeting. Among these were moderate growth in spending and production, low unemployment, and easing inflation.

Spending and Production

According to the Bureau of Economic Analysis, personal consumption expenditures fell by 0.2% in December, following a 0.1% decline in November. However, spending rose throughout the majority of 2022. Similarly, industrial production trailed off toward the end of the year but experienced annual growth of 1.6%.

Unemployment

The labor market remained strong throughout 2022. In fact, the unemployment rate fell from 4.0% in January 2022 to 3.5% by December, despite the Fed’s tightening.

Inflation

PCE inflation – the Fed’s preferred gauge – rose 5.0% from December 2021 to December 2022. This is an improvement from the prior year’s rate of 5.8%, but still much higher than the Fed’s target of 2.0% annual inflation.

A more common measure of inflation is the Consumer Price Index [CPI]. It too has shown improvement but remains elevated by historical standards. For the 12 months ending in December, CPI rose 6.5%. This is down from 7.0% the previous December, and far below June’s peak of 9.1%.

The Fed’s actions thus far have served their dual mandate to regulate inflation while maintaining full employment. While the interest rate increases have led to a slight moderation in inflation, the effects of rate hikes often lag their implementation. Therefore, the cumulative effects of past rate hikes are not likely to be seen immediately in either inflation or employment.

Where are interest rates headed?

In the statement accompanying the interest rate announcement, FOMC members said, “[t]he Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.” Pundits have noted the use of the plural ‘increases,’ which signals more than one additional rate hike in the future. This belief is in line with the FOMC’s December projections, which showed an anticipated Fed funds rate of 5.1% by the end of 2023.

Despite the Fed’s hawkish language, Fed funds futures traders have a more optimistic outlook for interest rate increases this year. Currently, futures traders predict another 0.25% increase at March’s meeting with 85% probability. Throughout the rest of the year, they foresee a high probability of rates remaining steady, or even falling in the fourth quarter.

The current economy, with a tight labor market and high inflation driven by supply chain disruptions and geopolitical turmoil, is unique. Therefore, it is difficult to predict how the Fed’s previous rate hikes will impact these factors. The FOMC has repeatedly stated that they will make their decisions, meeting-by-meeting, based on the state of the economy, inflation, and the labor market.

Don’t miss our interest rate and Federal Reserve updates.

At the American Deposit Management Co. [ADM], we provide valuable insights through our weekly articles and analysis of FOMC meetings. These insights can help businesses adapt quickly to changing market conditions.

To stay abreast of developments in monetary policy, the business landscape, and the economy, sign up for our mailing list to receive our weekly article and follow us on Twitter, Facebook, and LinkedIn.

*American Deposit Management Co. is not an FDIC/NCUA-insured institution. FDIC/NCUA deposit coverage only protects against the failure of an FDIC/NCUA-insured depository institution.