While leverage can provide many cash flow benefits, interest on long-term debt can also impede cash flow objectives – especially when rates for that debt rise. In particular, rising mortgage rates can be a significant hurdle for businesses with adjustable-rate loans and those who plan to refinance or acquire new properties.

Rates for business mortgages change often and can be influenced by many factors, including monetary policy. For this reason, decision makers should understand the relationship between the Fed’s actions and mortgage rates, so they can forecast where rates are headed and plan their real estate strategy accordingly.

Demand Plays a Role in Mortgage Rates

Among other factors, mortgage rates are impacted by the law of supply and demand. In the same way that banks pay different rates on similar accounts, individual lenders can offer different rates for mortgages. When a particular lender is seeing heavy demand, they tend to raise the rates they charge to increase returns while slowing demand for their services. Conversely, when there is little demand for a lender’s products, they can reduce rates to attract more business.

The law of supply and demand can also impact mortgage rates on a national scale. If there is significant demand for mortgages, rates could rise across the sector. On the other hand, when demand weakens, lenders must compete for the available business and rates tend to decline as competition for fewer loans intensifies.

Monetary Policy Impacts Mortgage Rates

The actions of the Federal Reserve can influence demand for credit and shape the country’s interest rates, including the rates that businesses pay for mortgages. The Fed’s primary tools are adjusting the Fed funds rate and varying the size of their balance sheet. Changes in either of these can influence credit markets and, in turn, mortgage rates.

The Fed Funds Rate Can Influence Mortgage Rates

The Fed funds rate sets the tone for the country’s economic outlook and is the basis for many other interest rates. As the Fed funds rate rises, interest rates, including mortgage rates, tend to follow.

Often, credit markets react before the Fed intervenes. When futures markets foresee lower interest rates, mortgage rates tend to decline in anticipation – even if the Fed has not yet cut rates. Similarly, when markets forecast higher rates ahead, mortgage rates often rise in response.

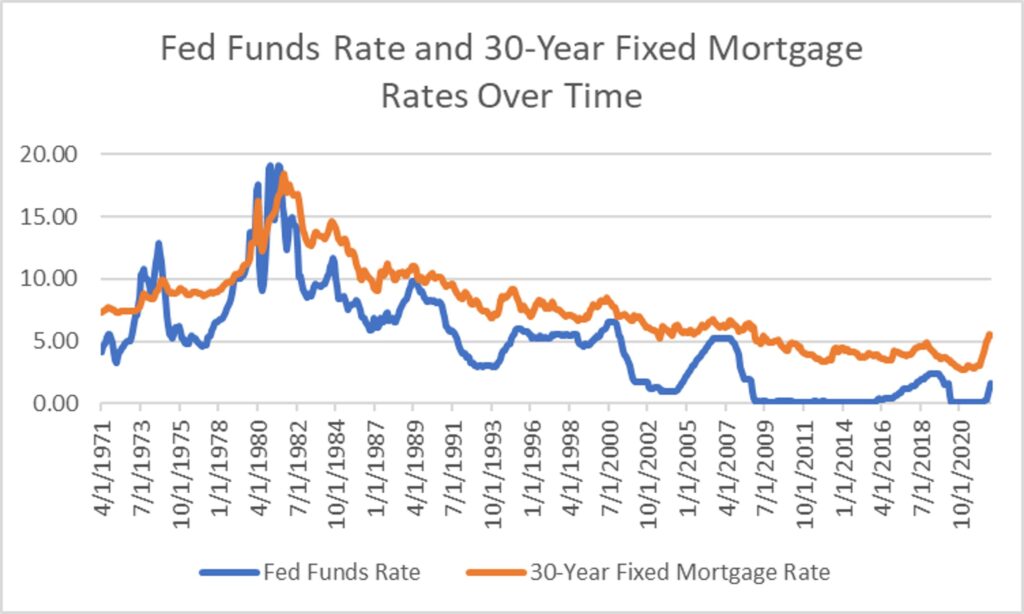

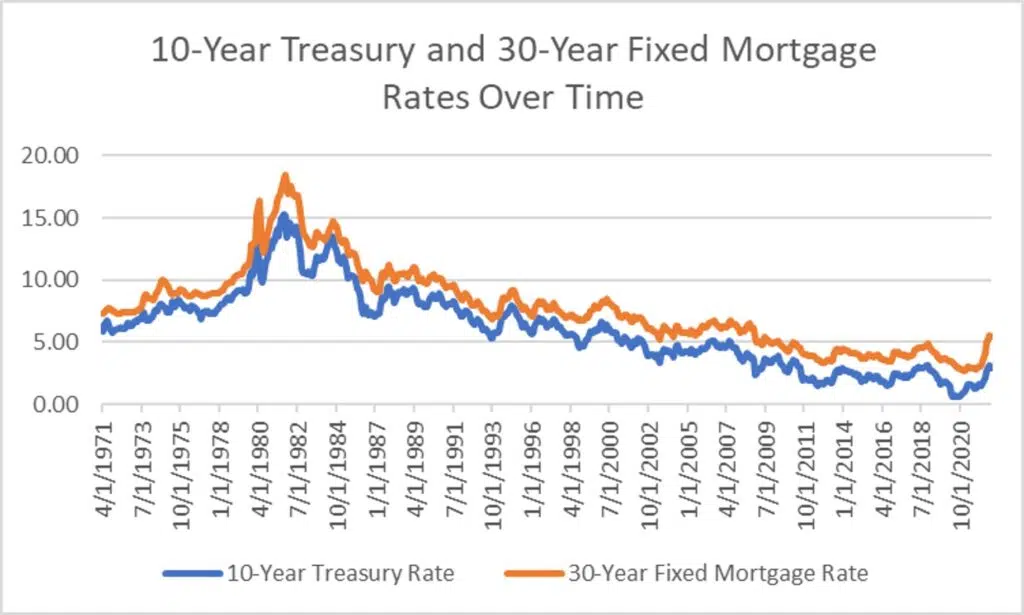

In addition to directly influencing the cost of credit, the Fed funds rate can also indirectly influence rates through demand. As rates rise and credit becomes more expensive, demand tends to decline. As such, a higher Fed funds rate can reduce demand for mortgages if fewer consumers can afford to borrow at the new, higher rates. This could counteract some of the impact of a higher Fed fund’s rate by forcing lenders to compete for the remaining business. That is the main reason why mortgage rates and the Fed Funds rate don’t move in lockstep. When the Fed funds rate changes, it tends to have an immediate impact on shorter-term products like credit cards and home equity lines of credit. On the other hand, mortgages are longer-term debt and are more closely tied to other longer-term securities like the 10-year Treasury yield. As the charts below illustrate, mortgage rates tend to move in the same general direction as the Fed funds rate, but their movements more closely resemble those of the 10-year Treasury yield.

Quantitative Easing Can Impact Mortgage Rates

In addition to the Fed funds rate, the Fed has another tool for attaining economic equilibrium – adjusting the size of their balance sheet. The Fed expands the size of the balance sheet through a process called Quantitative Easing [QE]. With this strategy, the Fed buys assets on the open markets, thereby increasing liquidity for those assets. This makes the assets less risky since the Fed is acting as a “backstop”, or a reliable buyer to counteract a selloff. This method can expand the availability of credit and push interest rates, including mortgage rates, lower.

When the Fed reduces the size of the balance sheet, it does so through Quantitative Tightening [QT]. This is the process of selling securities accumulated through QE. Quantitative Tightening can reduce the availability of credit and cause interest rates to rise, propelling mortgage rates higher.

The actions of the Fed, either through interest rate policy or the size of the balance sheet, can have significant ramifications for credit markets including shaping mortgage rates. As such, real estate investors must stay attuned to Fed actions that could impact the rates they pay for mortgages.

Stay Up to Date on Monetary Policy with Insights by ADM

The Fed’s decisions can shape the economic outlook, influence consumer demand, and alter the cost of credit. Therefore, business leaders must stay attuned to monetary policy decisions. Our company, the American Deposit Management Co. [ADM] provides valuable insights for leaders in all industries, including analysis of monetary policy changes. To stay up to date on all of our insights, follow us on Twitter, Facebook, and LinkedIn.

In addition to our valuable insights, ADM helps businesses with all their cash management needs. Our American Money Market Account™ [AMMA™] helps businesses achieve safety and nationally competitive rates for their cash reserves.

Contact us to learn more.

*American Deposit Management Co. is not an FDIC/NCUA-insured institution. FDIC/NCUA deposit coverage only protects against the failure of an FDIC/NCUA-insured depository institution.